As global markets navigate through tariff uncertainties and a cooling labor market, small-cap stocks are drawing increased attention from investors seeking opportunities amidst volatility. Despite broader market fluctuations, the resilience of certain sectors and companies presents unique investment prospects for those willing to explore beyond the mainstream indices. Identifying a good stock often involves looking for strong fundamentals and growth potential that can withstand economic shifts, making them appealing choices in today's dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Shanghai Haohai Biological Technology (SEHK:6826)

Simply Wall St Value Rating: ★★★★★☆

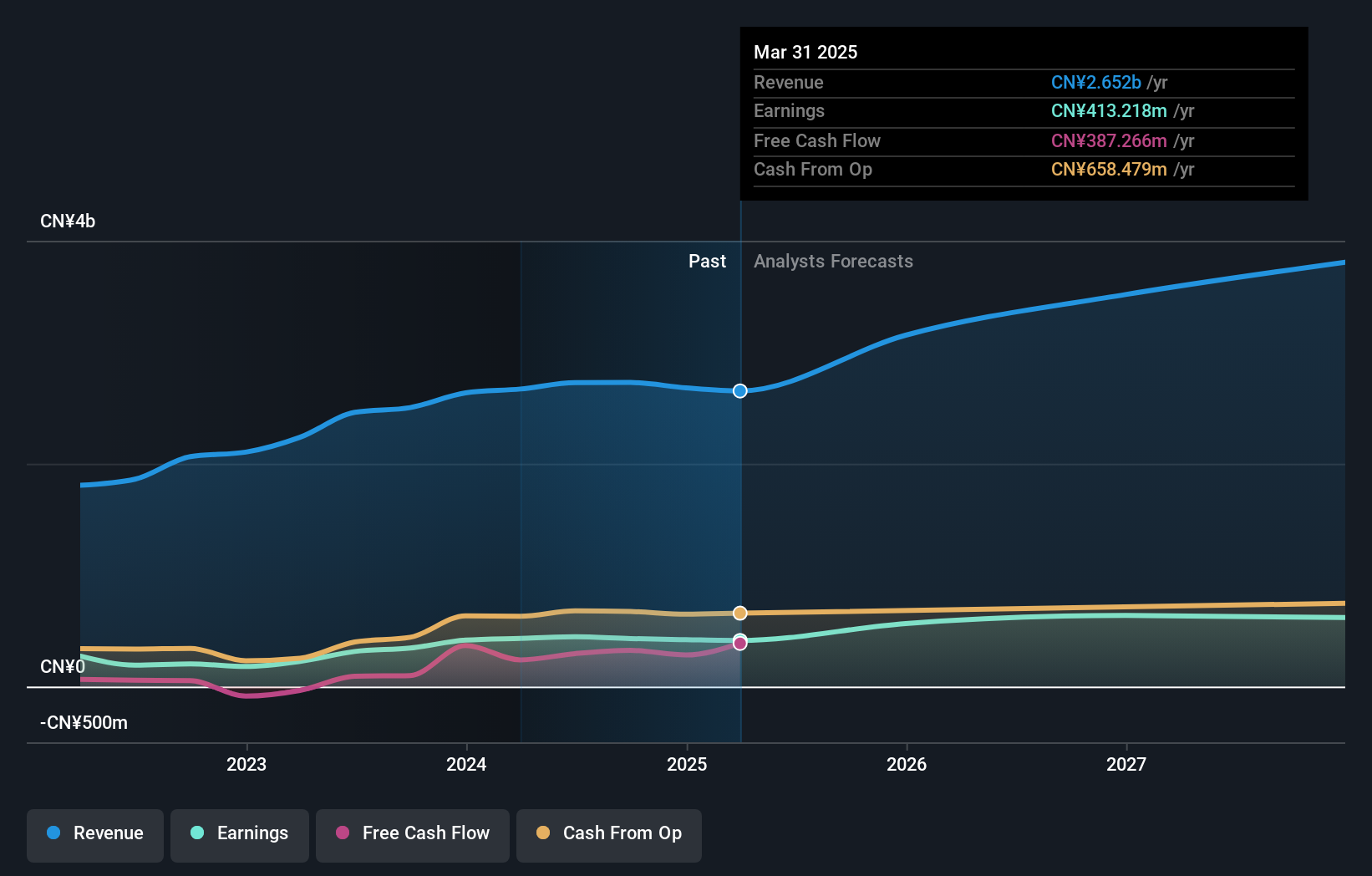

Overview: Shanghai Haohai Biological Technology Co., Ltd. specializes in the production and sale of biologics, focusing on medical hyaluronic acid products, with a market capitalization of HK$13.18 billion.

Operations: Haohai Biological Technology generates revenue primarily from the production and sale of biologics, specifically medical hyaluronic acid, amounting to CN¥2.75 billion.

Shanghai Haohai Biological Technology is making waves with its robust 24% earnings growth over the past year, outpacing the biotech industry's 7%. Trading at a significant discount of 77% below estimated fair value, it seems like a bargain. The company's debt to equity ratio has risen from 0.7% to 7% in five years, yet it still holds more cash than total debt. Recent buybacks of nearly half a million shares for CNY 30.58 million suggest confidence in its valuation and future prospects, with earnings projected to grow by about 17% annually.

Deluxe Family (SHSE:600503)

Simply Wall St Value Rating: ★★★★★☆

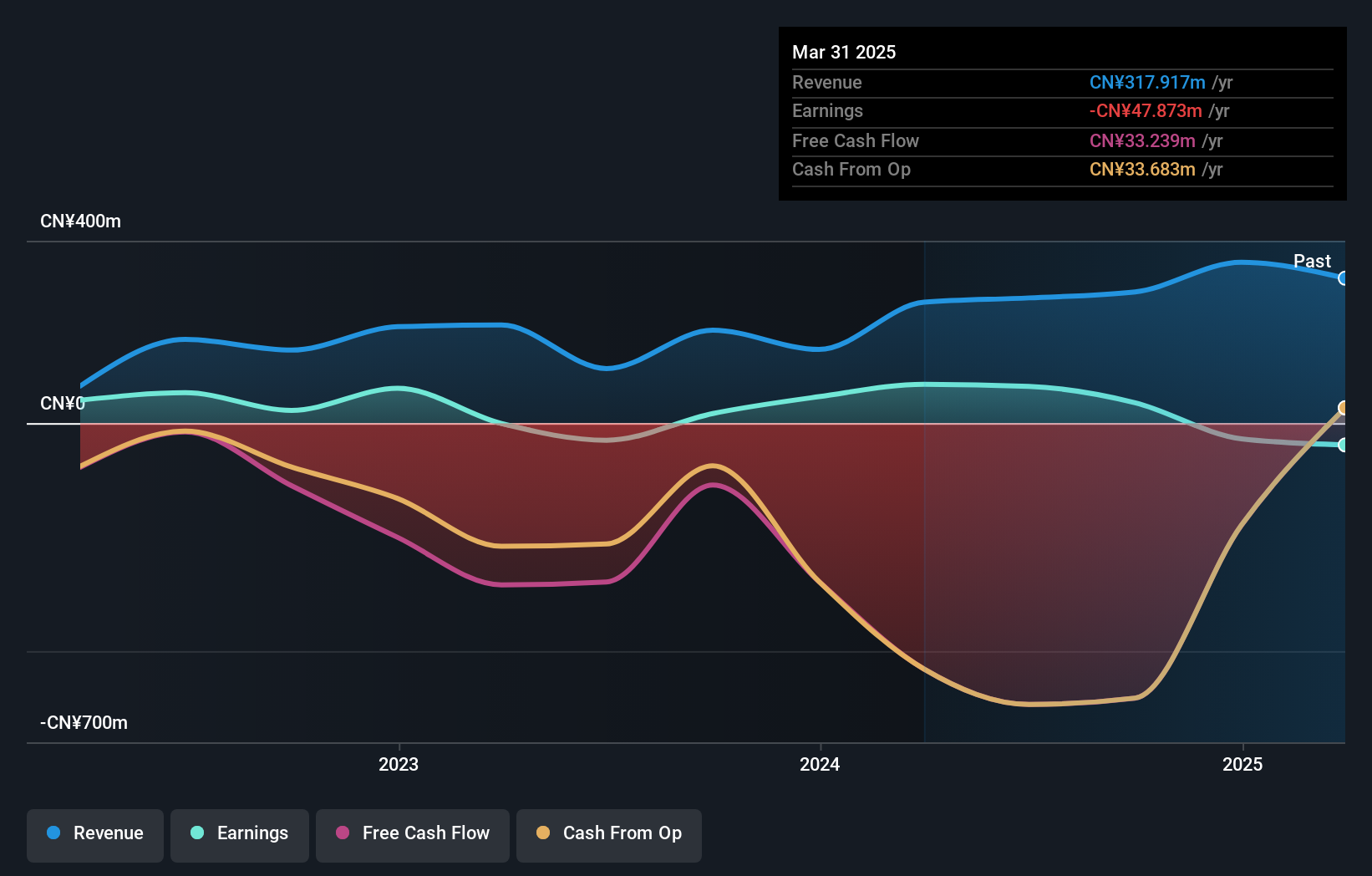

Overview: Deluxe Family Co., Ltd. focuses on the development, management, and sale of real estate properties in China with a market capitalization of CN¥4.21 billion.

Operations: Deluxe Family generates revenue primarily from the development, management, and sale of real estate properties in China. The company's financial performance is highlighted by a net profit margin that has shown significant variability over recent periods.

Deluxe Family, a smaller player in its sector, has shown impressive earnings growth of 112.9% over the past year, outpacing the Real Estate industry's negative trajectory. This growth is supported by a reduced debt to equity ratio from 22.1% to 5.4% in five years, indicating improved financial health. Despite its high level of non-cash earnings suggesting quality past performance, the company faces challenges with free cash flow remaining negative recently at -US$603 million as of September 2024. The company's ability to earn more interest than it pays further highlights robust interest coverage and financial stability amidst market volatility.

- Delve into the full analysis health report here for a deeper understanding of Deluxe Family.

Gain insights into Deluxe Family's historical performance by reviewing our past performance report.

Guilin Layn Natural Ingredients (SZSE:002166)

Simply Wall St Value Rating: ★★★★★★

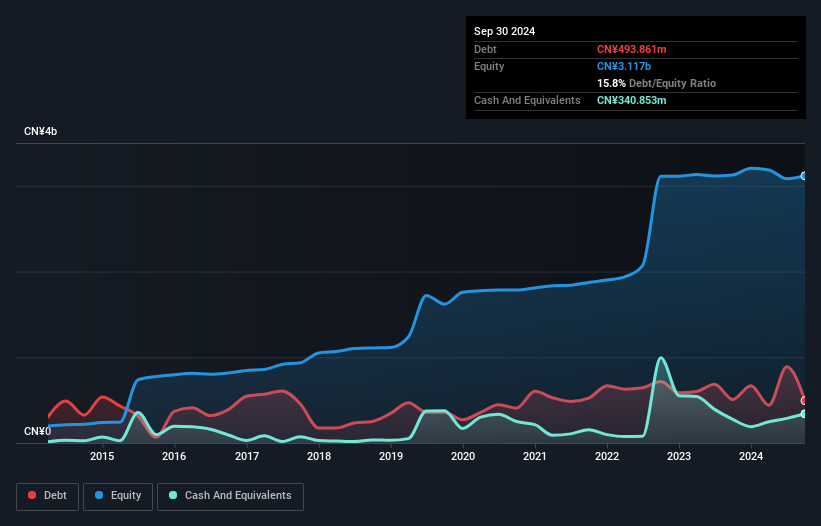

Overview: Guilin Layn Natural Ingredients Corp. is engaged in the production and sale of plant extracts both domestically in China and internationally, with a market cap of CN¥5.88 billion.

Operations: Guilin Layn Natural Ingredients generates revenue primarily from the sale of plant extracts both in China and internationally. The company's financial performance is influenced by its cost structure and market dynamics, impacting its profitability metrics.

Guilin Layn Natural Ingredients, a smaller player in its sector, has demonstrated impressive earnings growth of 226.8% over the past year, significantly outpacing the broader food industry's -6.3%. The company's debt to equity ratio has improved from 22.2% to 15.8% in five years, indicating solid financial management. Interest payments are comfortably covered by EBIT at 5.6 times, showcasing strong profitability metrics despite not being free cash flow positive currently. Recent buybacks saw them repurchase over 15 million shares for CN¥105 million, suggesting confidence in future prospects and commitment to shareholder value enhancement.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4703 more companies for you to explore.Click here to unveil our expertly curated list of 4706 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com