Global markets have been navigating a complex landscape, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic signals. Despite these challenges, some areas of the market continue to offer intriguing opportunities for investors willing to explore beyond well-known names. Penny stocks, while often associated with smaller or newer companies, remain a relevant investment area due to their potential for significant returns when backed by solid financials. In this article, we explore three penny stocks that demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.53M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £3.83 | £309.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.27 | £161.95M | ★★★★★☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★★

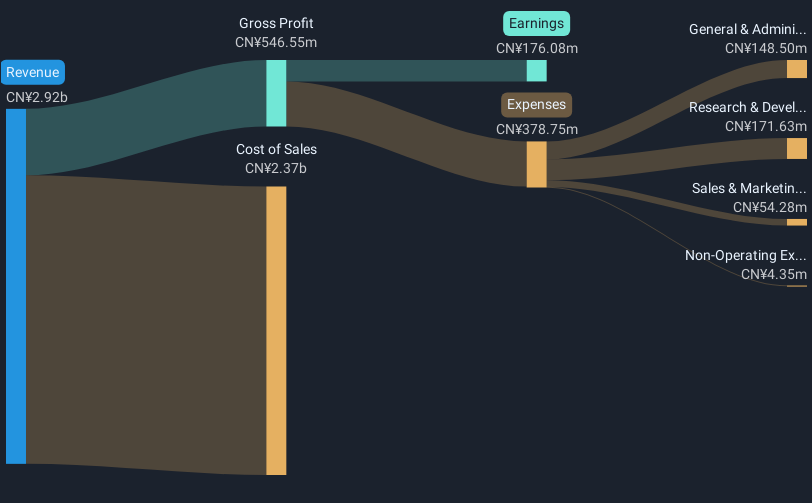

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, is engaged in the research, design, development, production, and sale of automotive steering systems and accessories in the People’s Republic of China, with a market capitalization of approximately HK$9.09 billion.

Operations: There are no specific revenue segments reported for Zhejiang Shibao.

Market Cap: HK$9.09B

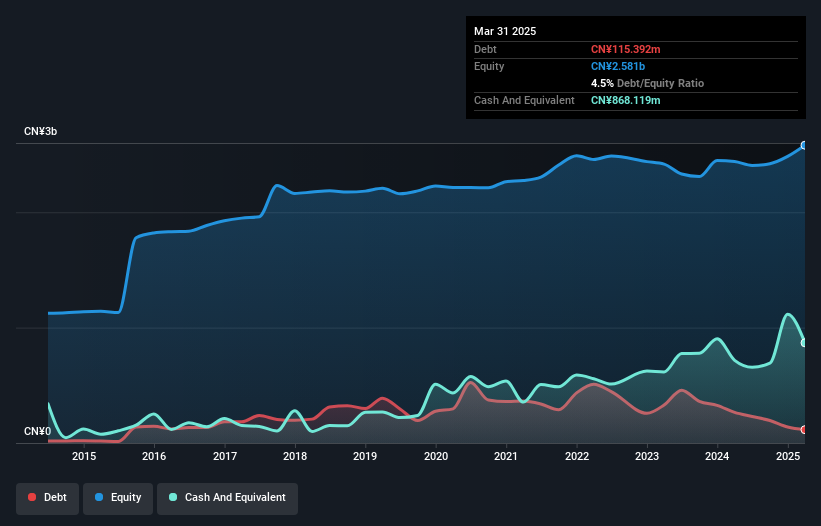

Zhejiang Shibao has demonstrated strong earnings growth, with a significant increase in net profit projected for 2024, driven by the rising demand for electrification and intelligent steering systems. The company’s financial health appears robust, with more cash than debt and sufficient operating cash flow to cover liabilities. Its short-term assets comfortably exceed both short- and long-term liabilities. Despite a low return on equity of 8.9%, Zhejiang Shibao's stable weekly volatility and experienced management team contribute to its stability in the market. Notably, shareholders have not faced dilution over the past year.

- Get an in-depth perspective on Zhejiang Shibao's performance by reading our balance sheet health report here.

- Learn about Zhejiang Shibao's historical performance here.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

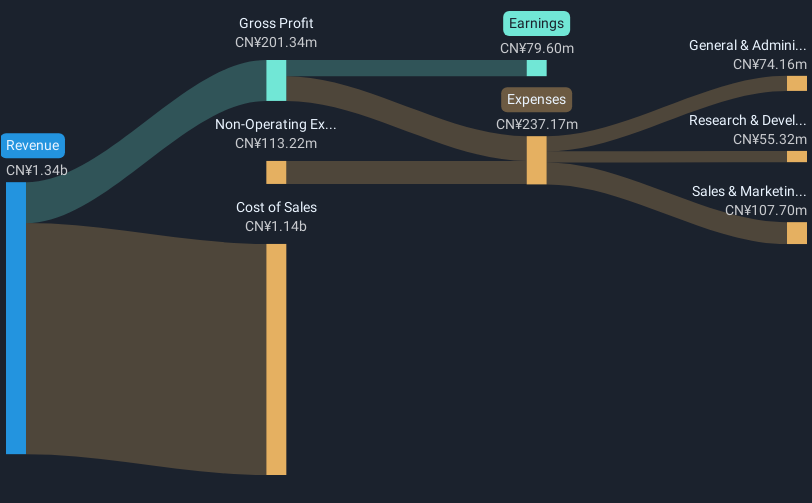

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and sells material handling equipment for the electrolytic aluminum, steel, construction machinery, and non-ferrous industries both in China and internationally, with a market cap of CN¥4.84 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. does not report specific revenue segments, but it operates in the material handling equipment sector, serving industries such as electrolytic aluminum, steel, construction machinery, and non-ferrous metals both domestically and abroad.

Market Cap: CN¥4.84B

Zhuzhou Tianqiao Crane has seen a remarkable earnings growth of 6332.4% over the past year, significantly outpacing the industry's performance. Despite its low return on equity at 2.2%, the company's financial position is solid, with more cash than debt and operating cash flow well covering its obligations. Short-term assets exceed both short- and long-term liabilities, indicating strong liquidity. However, high weekly volatility remains a concern for investors seeking stability. Recent amendments to the articles of association suggest active governance adjustments but also highlight an inexperienced board with an average tenure of 1.8 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhuzhou Tianqiao Crane.

- Explore historical data to track Zhuzhou Tianqiao Crane's performance over time in our past results report.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand, with a market cap of CN¥4.22 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥4.22B

Sanchuan Wisdom Technology, with a market cap of CN¥4.22 billion, has faced challenges such as being dropped from the S&P Global BMI Index. Despite trading at 40.2% below its estimated fair value and having more cash than debt, the company struggles with negative earnings growth and declining profit margins (7.9% from 12% last year). The company's financial stability is supported by short-term assets exceeding both short- and long-term liabilities, while interest coverage remains strong due to high-quality earnings. However, low return on equity (5.6%) and increased debt levels may concern some investors seeking higher returns.

- Take a closer look at Sanchuan Wisdom Technology's potential here in our financial health report.

- Examine Sanchuan Wisdom Technology's past performance report to understand how it has performed in prior years.

Key Takeaways

- Dive into all 5,706 of the Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com