BOE Varitronix Limited (HKG:710) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 50%.

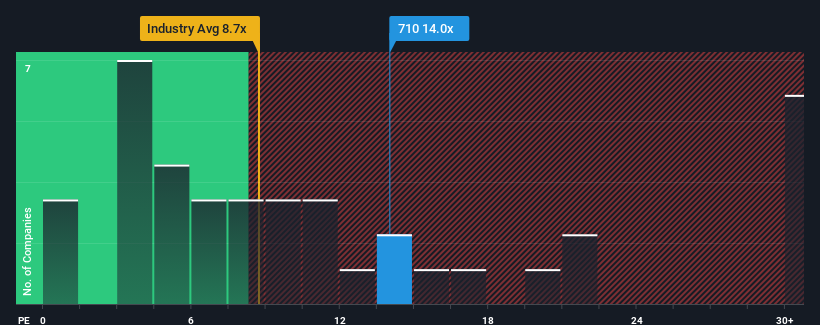

Since its price has surged higher, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider BOE Varitronix as a stock to potentially avoid with its 14x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

BOE Varitronix hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for BOE Varitronix

Is There Enough Growth For BOE Varitronix?

In order to justify its P/E ratio, BOE Varitronix would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 18%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 184% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 13% each year growth forecast for the broader market.

With this information, we can see why BOE Varitronix is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in BOE Varitronix's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of BOE Varitronix's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for BOE Varitronix with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of BOE Varitronix's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.