As global markets navigate a landscape marked by volatile corporate earnings and geopolitical uncertainties, small-cap stocks have been particularly impacted, with indices like the S&P 600 reflecting these broader economic currents. Amidst this backdrop, identifying promising small-cap companies can be challenging yet rewarding for investors seeking growth opportunities. In today's market conditions, a good stock often exhibits resilience and adaptability to shifting economic dynamics while maintaining strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

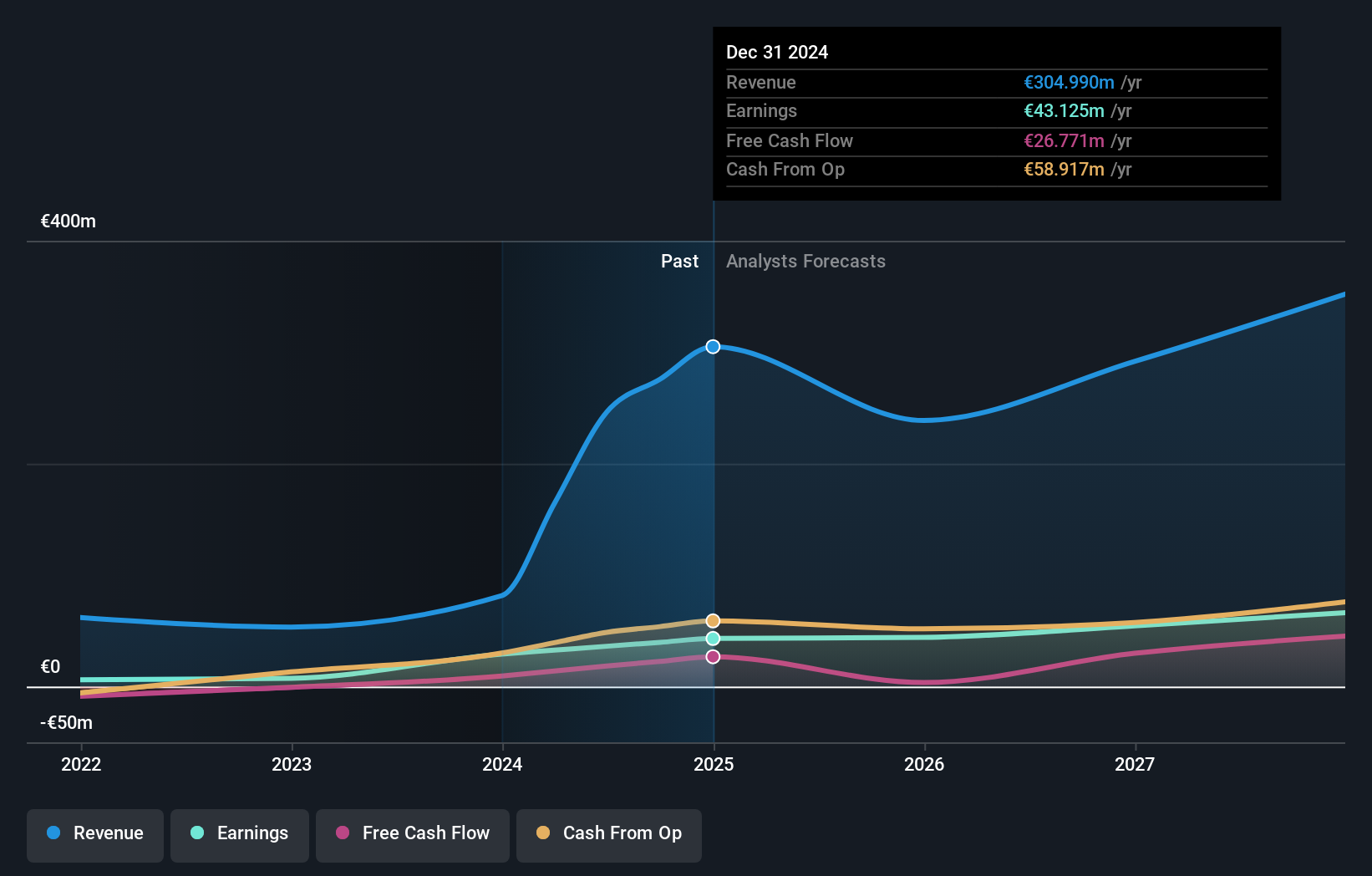

Overview: Next Geosolutions Europe SpA specializes in offering geoscience and engineering services to the energy, infrastructure, and utilities sectors with a market capitalization of €423.84 million.

Operations: Next Geosolutions Europe generates revenue primarily from engineering services, amounting to €246.37 million. The company has a market capitalization of €423.84 million.

Earnings for Next Geosolutions Europe have surged by 98.9% over the past year, outpacing the construction industry's growth of 39.5%. Despite a dip in profit margins from 27% to 14.7%, the company remains profitable with a solid cash runway and free cash flow standing at US$18.45 million as of June 2024. NXT trades at an attractive valuation, being priced at roughly 62% below estimated fair value, while its interest payments are comfortably covered by EBIT with a coverage ratio of 28.8x, indicating robust financial health despite high levels of non-cash earnings.

China Chunlai Education Group (SEHK:1969)

Simply Wall St Value Rating: ★★★★★☆

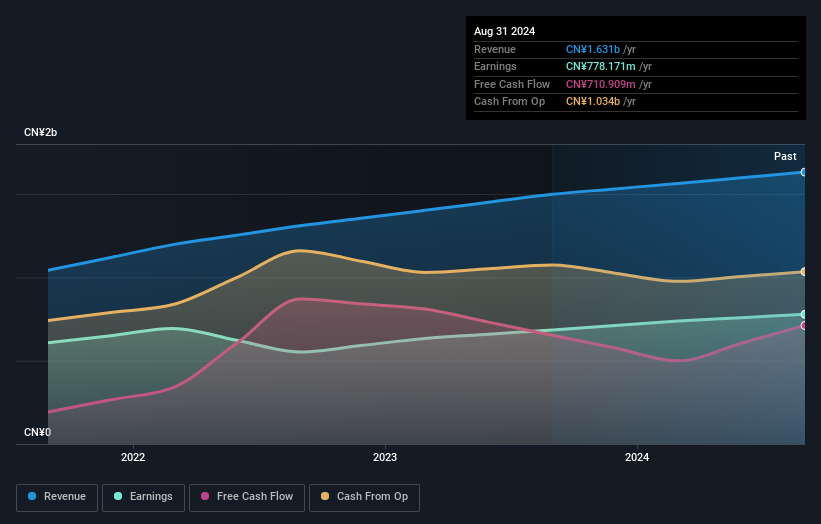

Overview: China Chunlai Education Group Co., Ltd., along with its subsidiaries, offers private higher education services in the People’s Republic of China and has a market capitalization of HK$5.14 billion.

Operations: The primary revenue stream for China Chunlai Education Group is the operation of private higher education institutions, generating CN¥1.63 billion. The company's financial performance can be analyzed through its net profit margin, which provides insights into profitability trends over time.

Chunlai Education has been making waves with its earnings growth of 13.7% over the past year, outpacing the Consumer Services industry average of 5.5%. The company trades at a significant discount, around 50.6% below its estimated fair value, presenting an intriguing opportunity for investors. Over five years, Chunlai's debt to equity ratio impressively decreased from 118.1% to 57.9%, demonstrating effective financial management. Recent results show net income rising to CNY 778 million from CNY 684 million last year, with basic earnings per share increasing to CNY 0.65 from CNY 0.57, reflecting strong operational performance and potential for future growth.

- Click to explore a detailed breakdown of our findings in China Chunlai Education Group's health report.

Gain insights into China Chunlai Education Group's past trends and performance with our Past report.

Azorim-Investment Development & Construction (TASE:AZRM)

Simply Wall St Value Rating: ★★★★☆☆

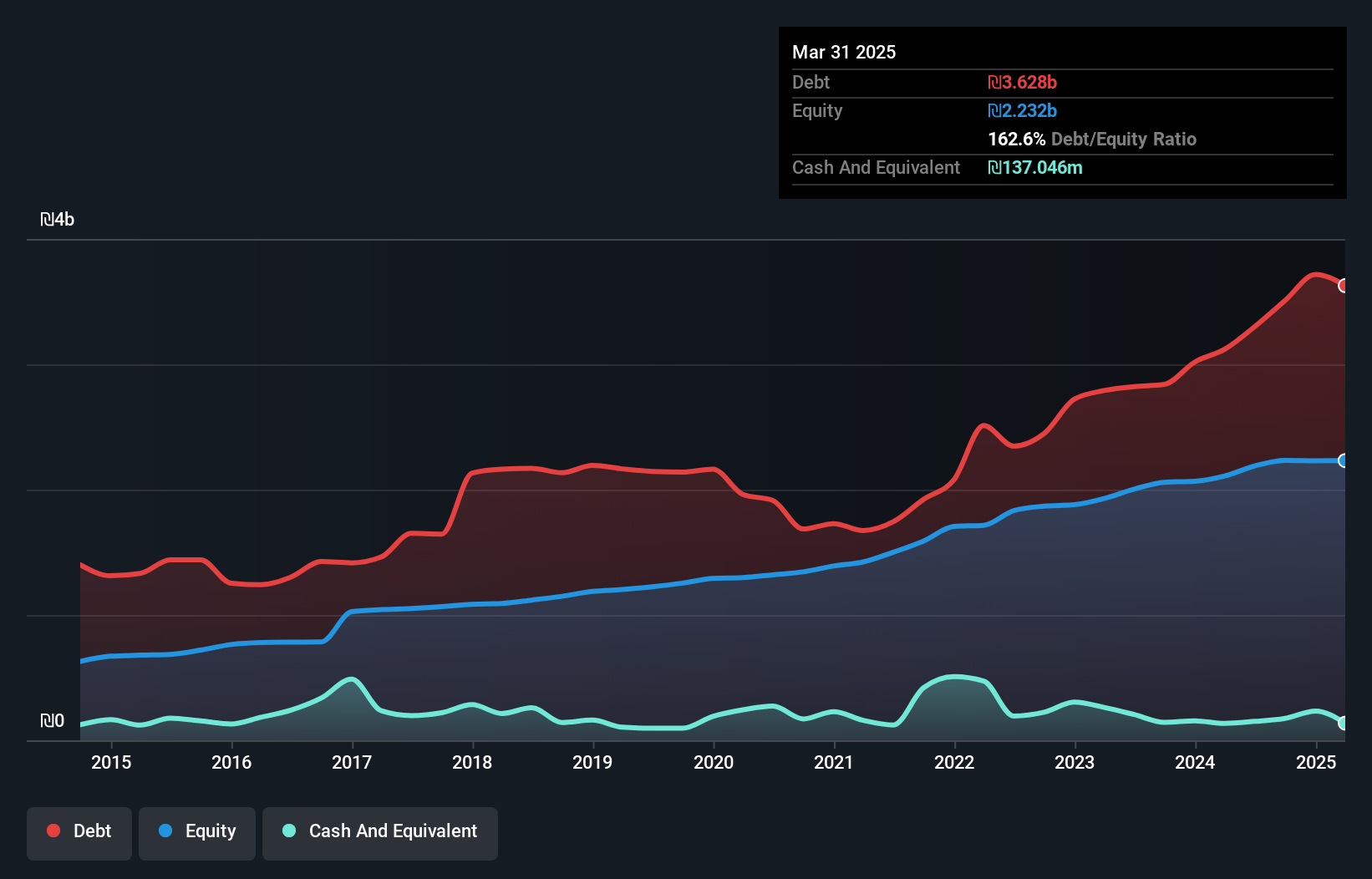

Overview: Azorim-Investment Development & Construction Co. engages in real estate development and construction, focusing on residential projects in Israel, with a market cap of ₪4.56 billion.

Operations: Azorim generates revenue primarily from residential construction in Israel, amounting to ₪1.43 billion, and also earns from residences for rent and income-producing assets within the country. The net profit margin shows a notable trend at 10%, reflecting the company's profitability dynamics in its core operations.

Azorim-Investment Development & Construction, a relatively small player in its field, has shown impressive earnings growth of 22.6% over the past year, outpacing the Consumer Durables industry's 9.1%. The company's Q3 2024 revenue reached ₪504.71 million, up from ₪455.02 million the previous year, with net income climbing to ₪50.34 million from ₪38.44 million. However, despite this growth and strong EBIT coverage of interest payments at 3.2 times, Azorim's financial health is challenged by a high net debt to equity ratio of 149.4%, indicating significant leverage concerns that may impact future stability or expansion efforts.

Make It Happen

- Reveal the 4666 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com