Chuanglian Holdings Limited (HKG:2371) shares have had a really impressive month, gaining 32% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 39%.

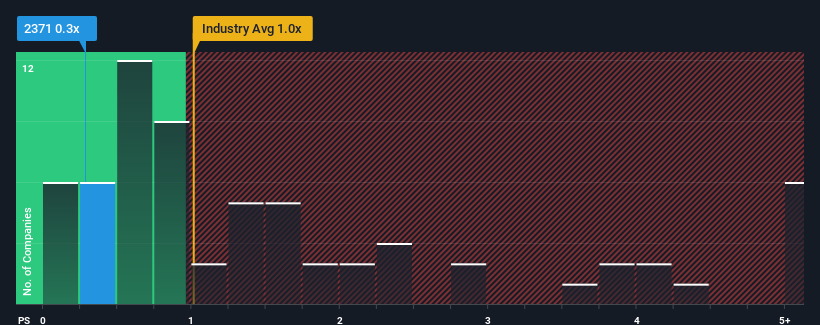

In spite of the firm bounce in price, given about half the companies operating in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Chuanglian Holdings as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Chuanglian Holdings

What Does Chuanglian Holdings' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Chuanglian Holdings has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chuanglian Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Chuanglian Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chuanglian Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. Pleasingly, revenue has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Chuanglian Holdings' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Chuanglian Holdings' P/S Mean For Investors?

Despite Chuanglian Holdings' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Chuanglian Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Chuanglian Holdings (1 is a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.