Global markets have been buoyed by optimism surrounding potential trade deals and AI investments, with major indexes like the S&P 500 reaching record highs. In such a climate of growth and innovation, investors often seek opportunities in various market segments, including those traditionally considered more speculative. Penny stocks—often smaller or newer companies—remain an intriguing area for exploration due to their potential for growth at lower price points. Despite being an outdated term, penny stocks still highlight companies that can offer significant value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,721 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

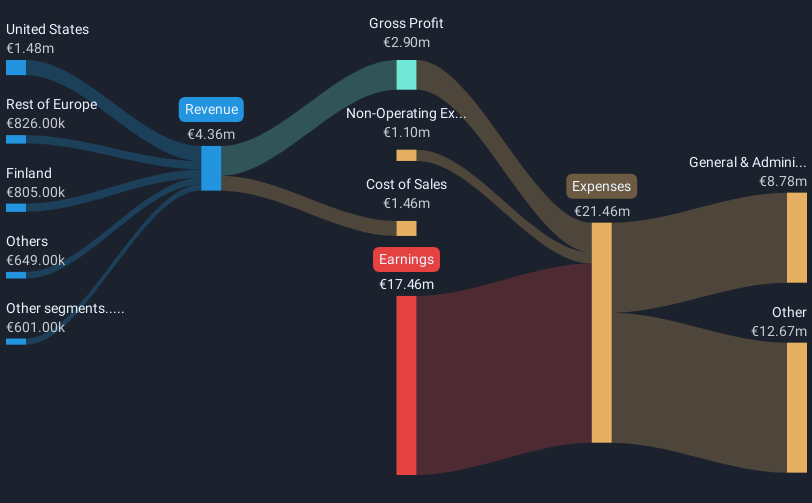

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform to detect disease risks across Finland, the United Kingdom, the rest of Europe, the United States, and internationally, with a market cap of €181.03 million.

Operations: The company's revenue is primarily generated from its Medical Labs & Research segment, which accounts for €4.36 million.

Market Cap: €181.03M

Nightingale Health Oyj, with a market cap of €181.03 million, is navigating the health technology sector by leveraging its innovative blood analysis platform to assess disease risks. Despite being unprofitable and having limited revenue (€4.36 million), the company maintains a strong cash position exceeding its liabilities and has not diluted shareholders recently. Recent strategic moves include partnerships with Enigma Genomics in Saudi Arabia and Boston Heart Diagnostics in the U.S., aiming for broader adoption of its Remote Health Check service. The company's expansion into Singapore further underscores its commitment to global growth despite financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Nightingale Health Oyj.

- Gain insights into Nightingale Health Oyj's outlook and expected performance with our report on the company's earnings estimates.

Honbridge Holdings (SEHK:8137)

Simply Wall St Financial Health Rating: ★★★★★☆

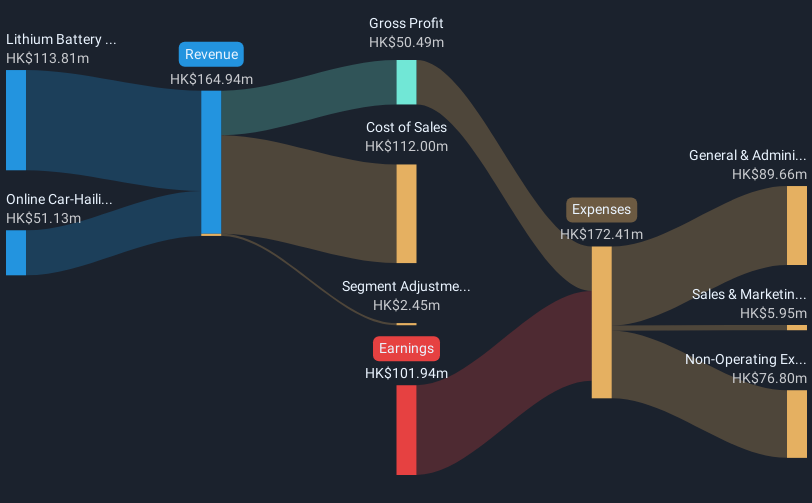

Overview: Honbridge Holdings Limited is an investment holding company involved in the research, development, production, and sale of lithium batteries across China, Hong Kong, Brazil, France, and internationally with a market cap of HK$4.97 billion.

Operations: The company's revenue is derived from two main segments: Lithium Battery Production, contributing HK$113.81 million, and Online Car-Hailing and Related Services, generating HK$51.13 million.

Market Cap: HK$4.97B

Honbridge Holdings Limited, with a market cap of HK$4.97 billion, operates primarily in lithium battery production and online car-hailing services. Despite being unprofitable with increasing losses over the past five years, the company benefits from having more cash than debt and a substantial cash runway exceeding three years if free cash flow growth persists. The company's short-term assets cover its short-term liabilities but fall short against long-term obligations of HK$2.4 billion. Recent developments include plans to issue 4.5 billion new shares at HK$0.08 each, indicating potential capital raising initiatives amidst high share price volatility.

- Dive into the specifics of Honbridge Holdings here with our thorough balance sheet health report.

- Gain insights into Honbridge Holdings' historical outcomes by reviewing our past performance report.

Zhejiang Hengtong HoldingLtd (SHSE:600226)

Simply Wall St Financial Health Rating: ★★★★☆☆

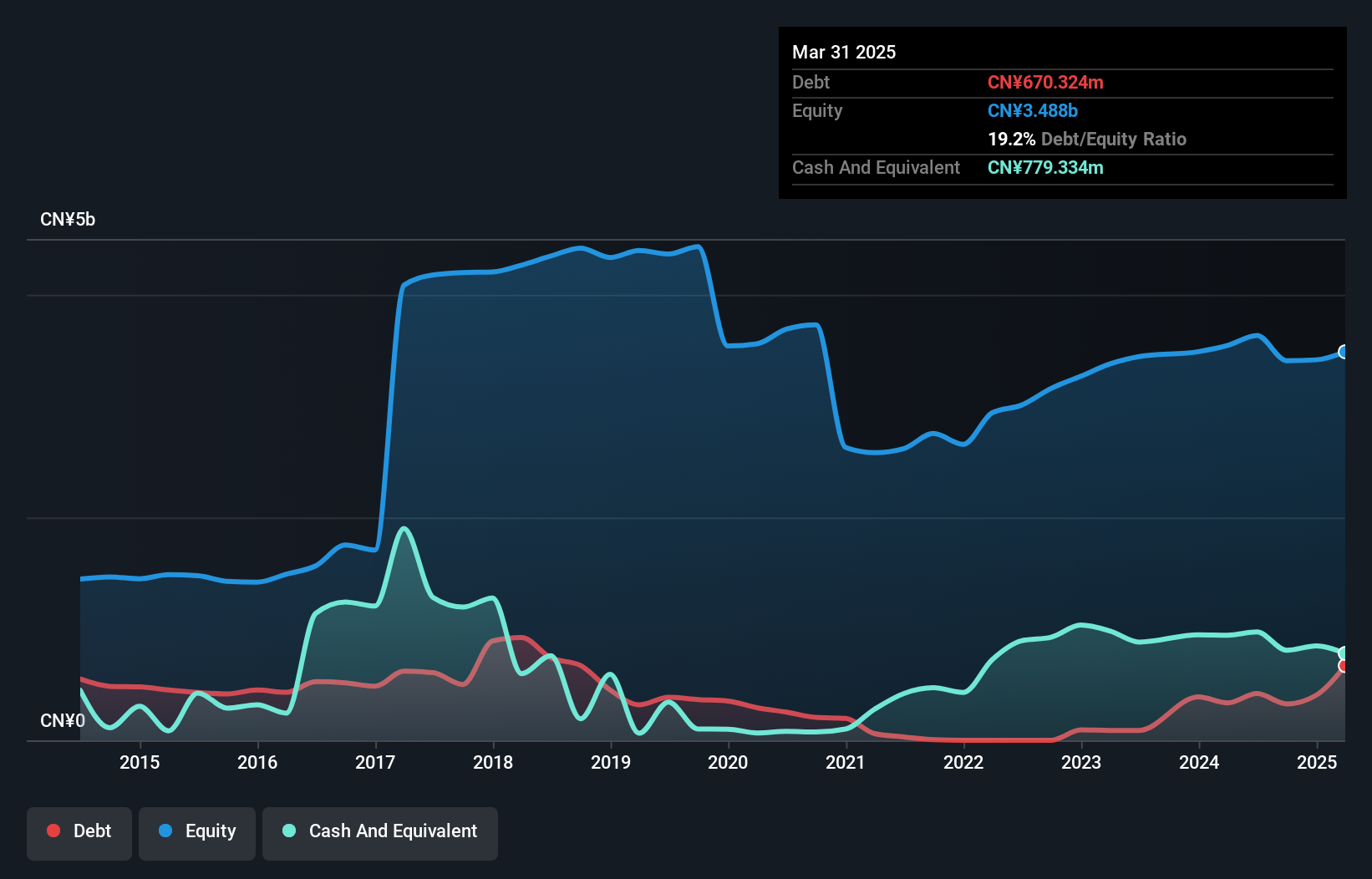

Overview: Zhejiang Hengtong Holding Co., Ltd. engages in the research, development, production, and sale of biological pesticides, veterinary drugs, and animal feed additive products both in China and internationally, with a market capitalization of CN¥8.36 billion.

Operations: No specific revenue segments are reported for Zhejiang Hengtong Holding Co., Ltd.

Market Cap: CN¥8.36B

Zhejiang Hengtong Holding Co., Ltd. boasts a market capitalization of CN¥8.36 billion, with its short-term assets (CN¥1.5 billion) comfortably covering both short-term and long-term liabilities, enhancing financial stability. The company has demonstrated impressive earnings growth of 94.2% over the past year, surpassing industry averages, and maintains high-quality earnings with improved profit margins from last year (17.1% vs 16.1%). However, despite positive interest coverage and cash exceeding debt levels, the board's inexperience may pose governance challenges as they navigate ongoing operational cash flow deficits and a slightly increased debt-to-equity ratio over five years.

- Navigate through the intricacies of Zhejiang Hengtong HoldingLtd with our comprehensive balance sheet health report here.

- Evaluate Zhejiang Hengtong HoldingLtd's historical performance by accessing our past performance report.

Next Steps

- Get an in-depth perspective on all 5,721 Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com