As global markets experience a surge in optimism driven by hopes for softer tariffs and enthusiasm around artificial intelligence, major indices such as the S&P 500 have reached new record highs. Despite large-cap stocks outperforming their smaller counterparts, the current economic landscape presents unique opportunities for small-cap companies that can capitalize on manufacturing rebounds and AI advancements. In this context, identifying promising stocks involves looking at those with solid fundamentals and growth potential that align with these emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Simply Wall St Value Rating: ★★★★★★

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company involved in the research, development, manufacture, and commercialization of interventional medical devices globally, with a market cap of HK$5.89 billion.

Operations: LEPU ScienTech generates revenue primarily from its interventional medical devices. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

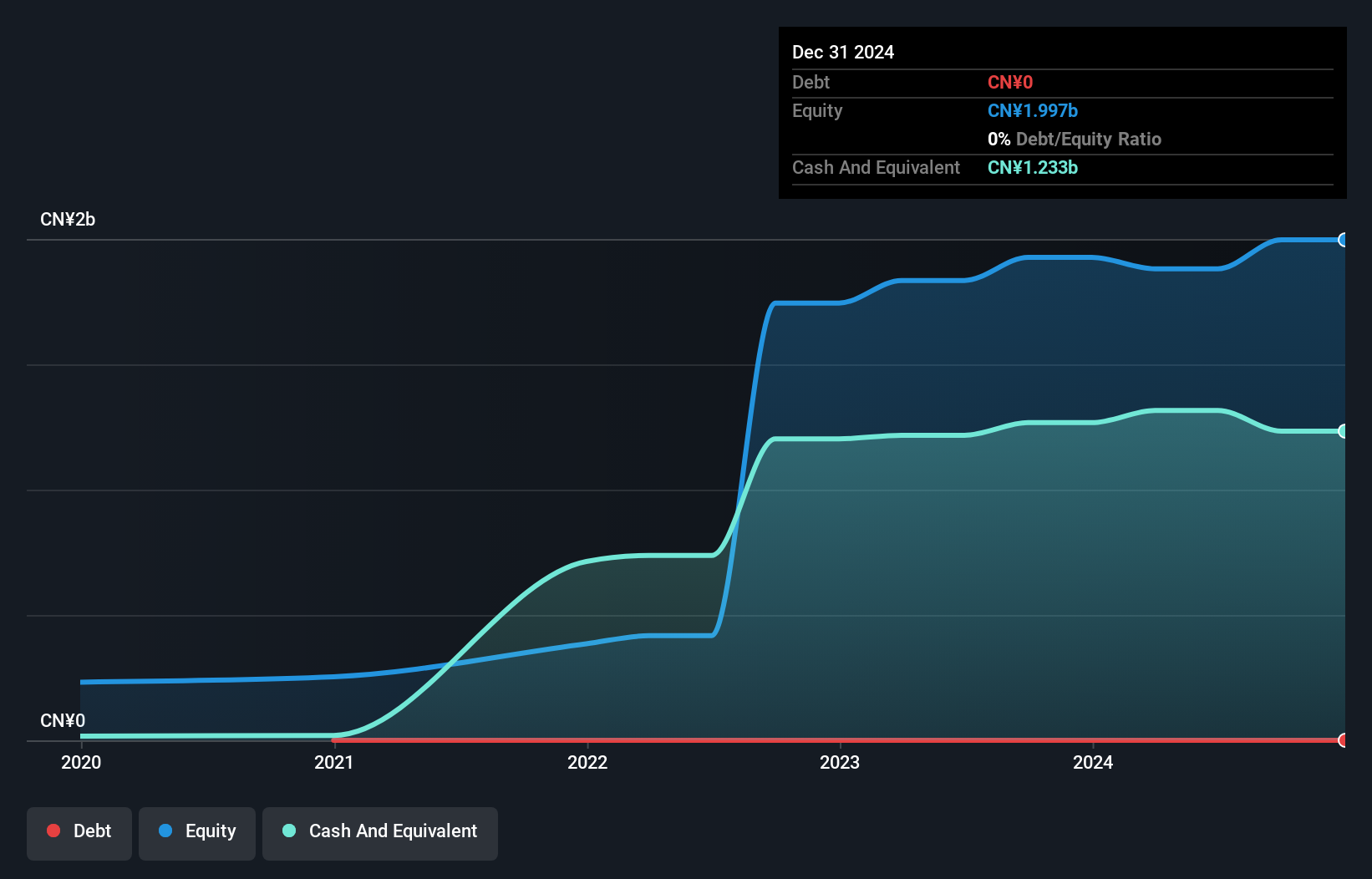

LEPU ScienTech Medical Technology, a promising player in the medical technology sector, has shown remarkable earnings growth of 586% over the past year, outpacing its industry peers. The company is currently trading at 31.5% below its estimated fair value, suggesting potential undervaluation. With no debt on its books for five years and high-quality earnings, it stands on solid financial ground. Recent executive changes include Mr. Zhu's appointment as a non-executive director, bringing extensive experience from Lepu Medical and other pharmaceutical giants like Merck and Sanofi to bolster their strategic direction.

Billion Industrial Holdings (SEHK:2299)

Simply Wall St Value Rating: ★★★★★☆

Overview: Billion Industrial Holdings Limited, along with its subsidiaries, is engaged in the development, manufacturing, and sale of polyester filament yarns, polyester products, polyester industrial yarns, and ES fiber products both in China and internationally with a market cap of approximately HK$10.15 billion.

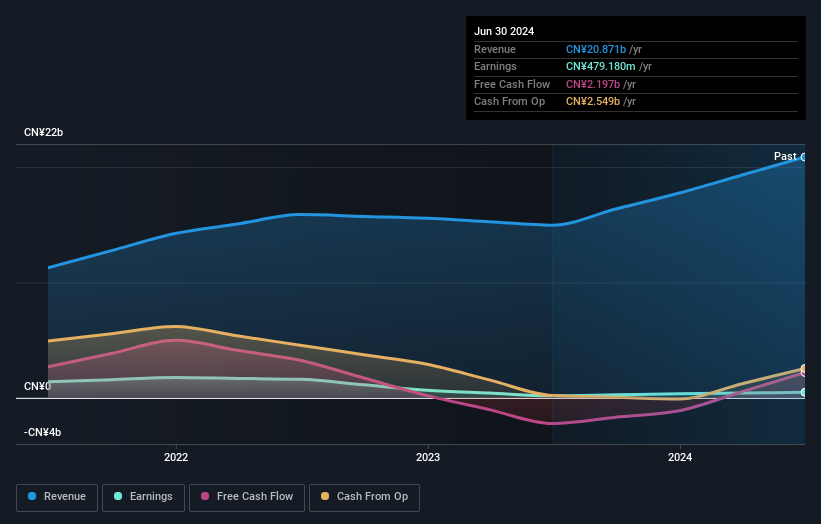

Operations: The primary revenue stream for Billion Industrial Holdings comes from its textile manufacturing segment, generating CN¥20.87 billion. The company's financial performance is characterized by a focus on polyester-related products, with costs primarily associated with production and sales operations in this sector.

Billion Industrial Holdings, a player in the synthetic fiber market, is making strides with a robust investment plan for polyamide production lines. With an expected investment of RMB2.40 billion over three years, the company aims to boost its annual production capacity by 120,000 tons starting in 2026. Earnings guidance suggests a potential profit increase of up to 120% for 2024 compared to the previous year, driven by higher sales volumes of polyester products. The debt-to-equity ratio has impressively decreased from 28% to just 3.6% over five years, highlighting financial prudence and stability in operations.

Lee & Man Chemical (SEHK:746)

Simply Wall St Value Rating: ★★★★★★

Overview: Lee & Man Chemical Company Limited is an investment holding company that manufactures and sells chemical products in the People’s Republic of China, with a market capitalization of HK$3.32 billion.

Operations: The primary revenue stream for Lee & Man Chemical comes from its chemical segment, generating HK$4.01 billion, while the property segment contributes HK$32.71 million.

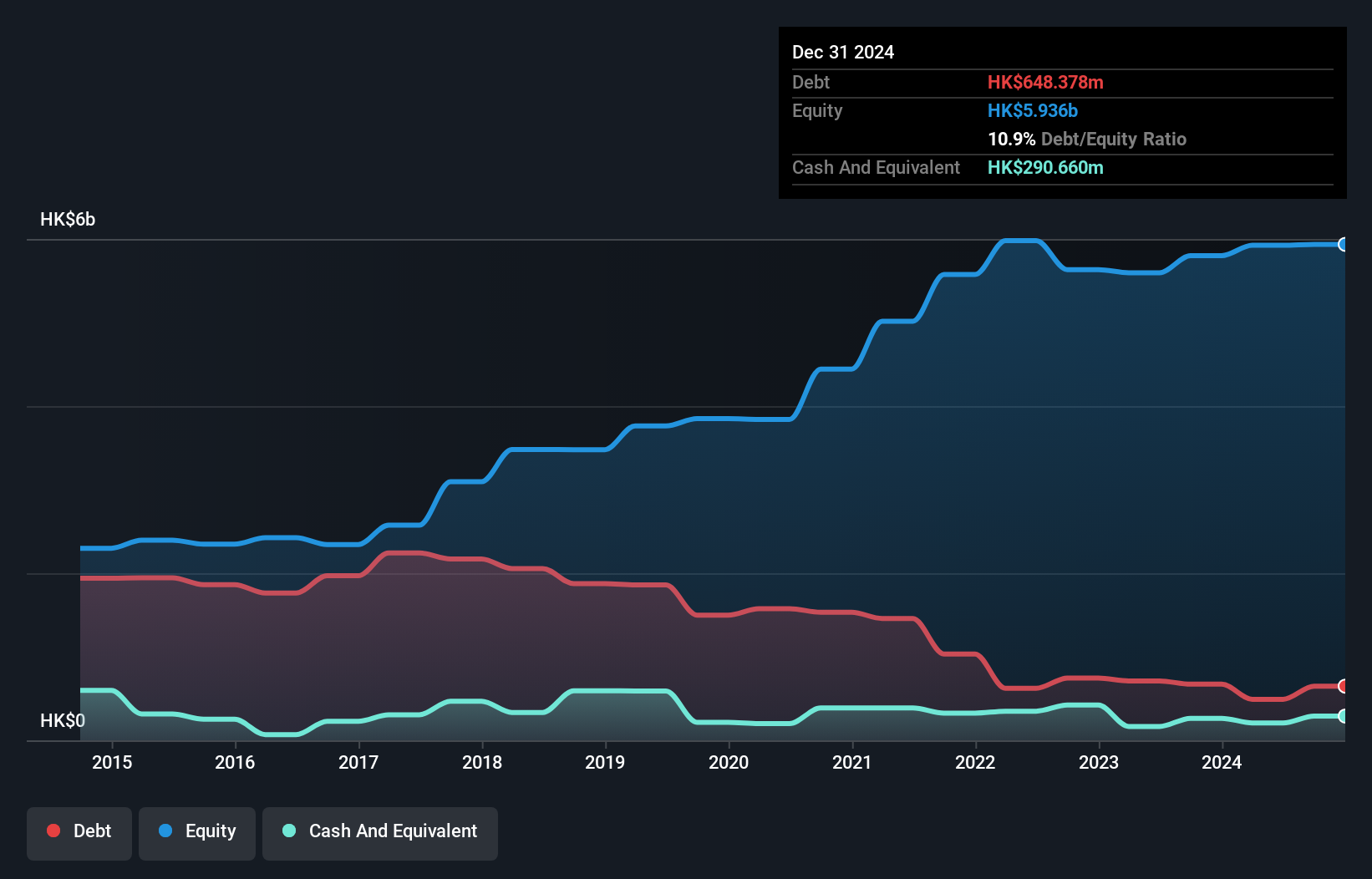

Lee & Man Chemical, a nimble player in the chemicals sector, is trading at a significant 49.9% discount to its estimated fair value. The company has demonstrated robust financial health with a net debt to equity ratio of 4.8%, which is deemed satisfactory. Over the past year, earnings surged by 44.9%, outpacing the industry average of -21.5%. This growth aligns with its high-quality earnings and free cash flow positivity, suggesting solid operational efficiency. Additionally, interest payments are comfortably covered by EBIT at 24 times coverage, reinforcing financial stability and providing room for strategic maneuvers within its market space.

- Navigate through the intricacies of Lee & Man Chemical with our comprehensive health report here.

Gain insights into Lee & Man Chemical's past trends and performance with our Past report.

Key Takeaways

- Click through to start exploring the rest of the 4667 Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com