As global markets continue to react positively to political developments and economic indicators, U.S. stocks have reached record highs amid optimism around tariffs and AI investments. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area for those seeking potential growth opportunities. While the term may seem outdated, these stocks can still offer significant value when backed by strong financials and a clear path to growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.71 | HK$42.65B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$139.45M | ★★★★☆☆ |

Click here to see the full list of 5,726 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Scholar Education Group (SEHK:1769)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scholar Education Group is an investment holding company that offers K-12 after-school education services in the People's Republic of China, with a market cap of HK$2.29 billion.

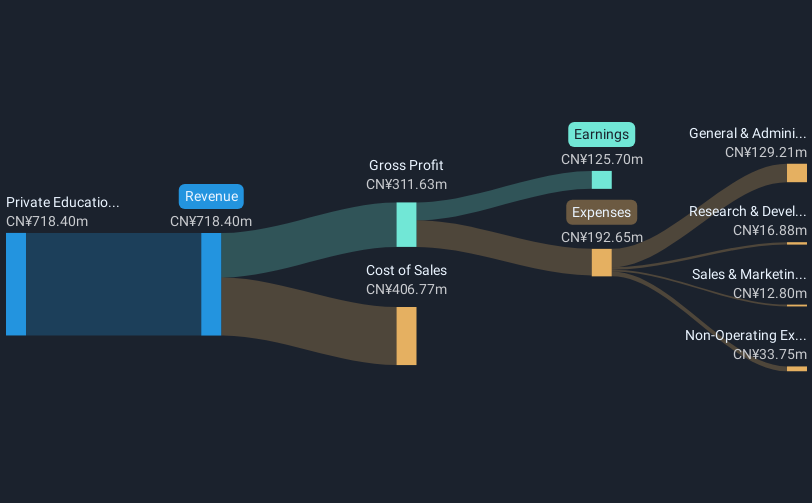

Operations: The company generates revenue primarily from its private education services, totaling CN¥718.40 million.

Market Cap: HK$2.29B

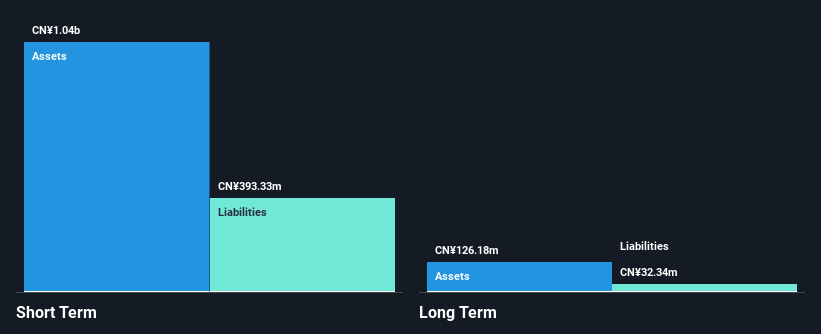

Scholar Education Group, with a market cap of HK$2.29 billion, primarily generates revenue from its private education services totaling CN¥718.40 million. Despite negative earnings growth over the past year and declining net profit margins (currently 17.5% from last year's 28%), the company maintains strong financial health with short-term assets exceeding both long-term and short-term liabilities. Its debt is well-covered by operating cash flow (848.3%), and it has more cash than total debt, indicating prudent financial management. Additionally, Scholar Education's board and management team are seasoned, enhancing governance stability for investors in this volatile sector.

- Navigate through the intricacies of Scholar Education Group with our comprehensive balance sheet health report here.

- Gain insights into Scholar Education Group's outlook and expected performance with our report on the company's earnings estimates.

UNQ Holdings (SEHK:2177)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UNQ Holdings Limited is a brand e-commerce service solutions provider in the People's Republic of China, with a market cap of approximately HK$245.52 million.

Operations: The company's revenue is derived from several segments, including B2B General Trade (CN¥503.45 million), B2C General Trade (CN¥418.80 million), Rendering of Service (CN¥12.14 million), B2B Cross-Border E-Commerce (CN¥194.02 million), and B2C Cross-Border E-Commerce (CN¥318.87 million).

Market Cap: HK$245.52M

UNQ Holdings, with a market cap of HK$245.52 million, has achieved profitability in the past year, marking a significant turnaround from negative shareholder equity five years ago. The company shows strong financial health, with short-term assets (CN¥1.0 billion) surpassing both short- and long-term liabilities. Its debt is well-covered by operating cash flow (148.3%), and it holds more cash than total debt. Despite trading at 92.2% below estimated fair value, its return on equity remains low at 0.5%. The board and management teams are experienced, contributing to stability in this volatile sector.

- Take a closer look at UNQ Holdings' potential here in our financial health report.

- Understand UNQ Holdings' track record by examining our performance history report.

LHT Holdings (SGX:BEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LHT Holdings Limited, with a market cap of SGD60.70 million, operates in the manufacturing, import, export, and trading of wooden pallets and timber-related products across Singapore, Malaysia, and internationally.

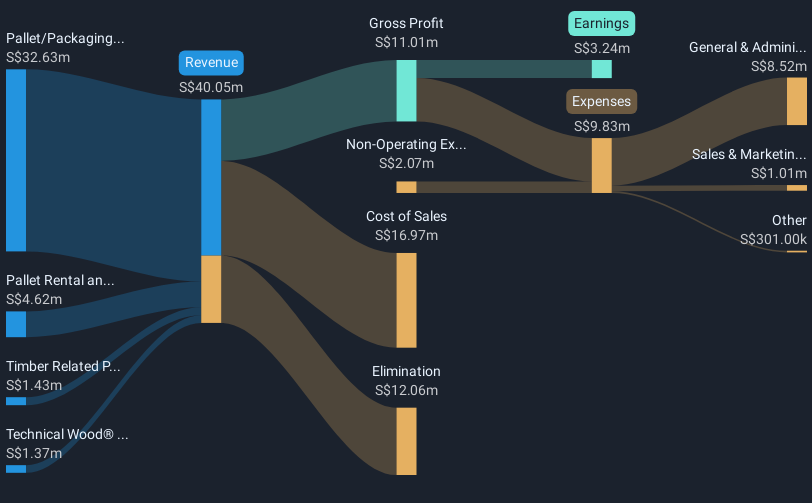

Operations: The company generates revenue primarily from its Pallet/Packaging segment, which accounts for SGD32.63 million, followed by contributions from the Pallet Rental and Others segment at SGD4.62 million, Timber Related Products at SGD1.43 million, and Technical Wood® and Related Products at SGD1.37 million.

Market Cap: SGD60.7M

LHT Holdings Limited, with a market cap of SGD60.70 million, operates primarily in the Pallet/Packaging segment, generating SGD32.63 million in revenue. The company is debt-free and maintains strong financial health with short-term assets of SGD45.2 million exceeding both short- and long-term liabilities. However, recent changes to its board have introduced less experienced directors, averaging three years of tenure. Despite stable weekly volatility over the past year, LHT's earnings growth has been negative at -43.6%, and insider selling has been significant recently, which may concern investors seeking stability in penny stocks.

- Click here to discover the nuances of LHT Holdings with our detailed analytical financial health report.

- Learn about LHT Holdings' historical performance here.

Next Steps

- Get an in-depth perspective on all 5,726 Penny Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com