As global markets experience a resurgence, driven by easing U.S. inflation and robust bank earnings, small-cap stocks are capturing attention with the S&P MidCap 400 Index surging 3.81% for the week. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking growth potential beyond the well-trodden paths of large-cap equities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Pryce (PSE:PPC)

Simply Wall St Value Rating: ★★★★★☆

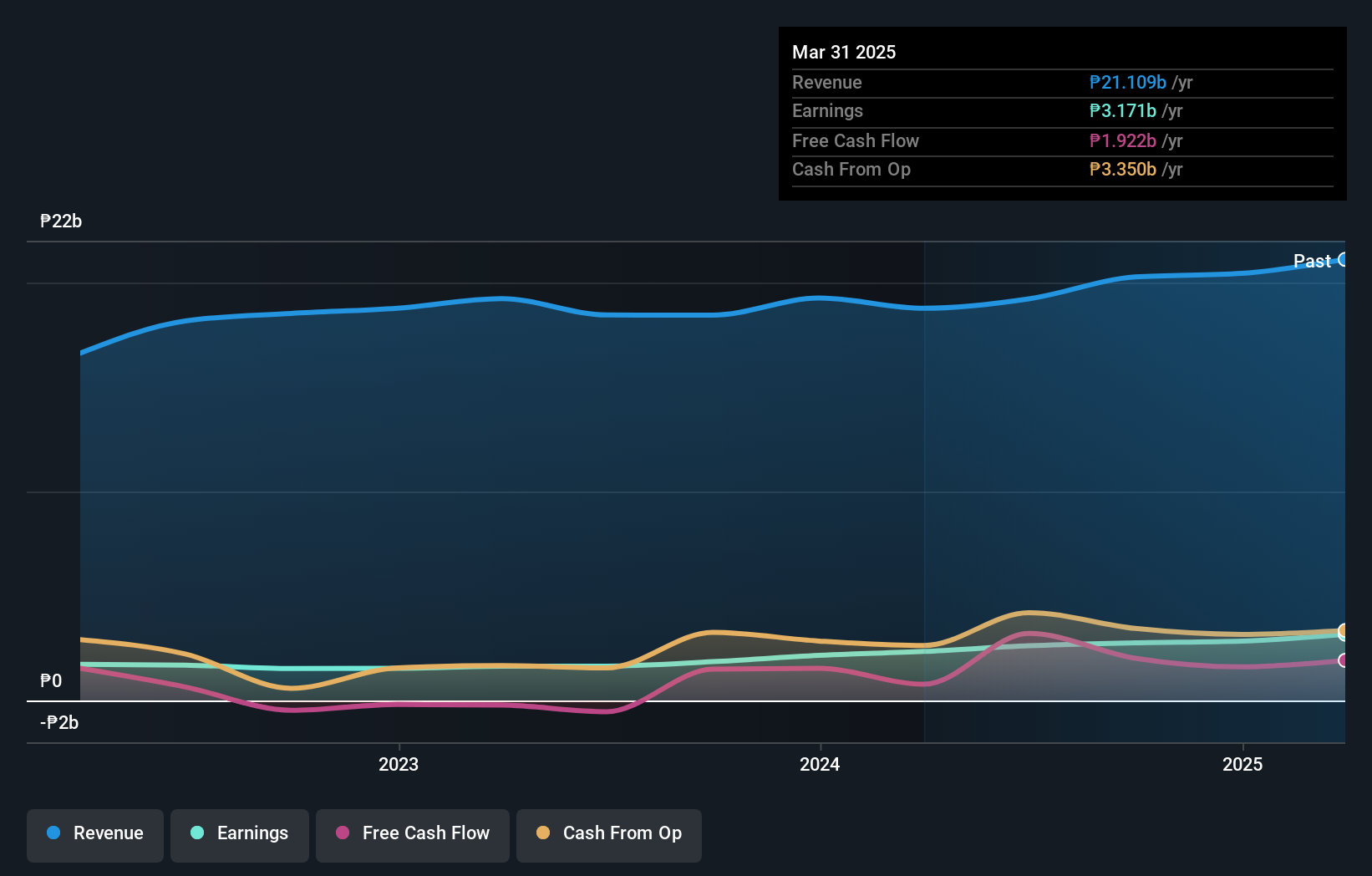

Overview: Pryce Corporation, along with its subsidiaries, operates in the import and distribution of liquefied petroleum gas (LPG) under the PryceGas brand name in the Philippines, with a market capitalization of ₱20.61 billion.

Operations: Pryce Corporation generates significant revenue from its liquefied petroleum and industrial gases segment, amounting to ₱19.88 billion, with additional contributions from real estate at ₱342.85 million and pharmaceutical products at ₱46.57 million.

Pryce, a smaller player in its sector, is showing promising signs with earnings growing by 48% over the past year, outpacing the broader oil and gas industry. The company appears to be trading at an attractive valuation, 22% below estimated fair value. Its financial health seems robust with high-quality earnings and free cash flow positivity. Recent results highlight strong performance, as third-quarter sales reached PHP 5.46 billion compared to PHP 4.41 billion last year, while net income rose to PHP 831 million from PHP 692 million. Additionally, dividends were increased to PHP 0.20 per share for early next year payouts.

- Dive into the specifics of Pryce here with our thorough health report.

Gain insights into Pryce's historical performance by reviewing our past performance report.

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Value Rating: ★★★★★★

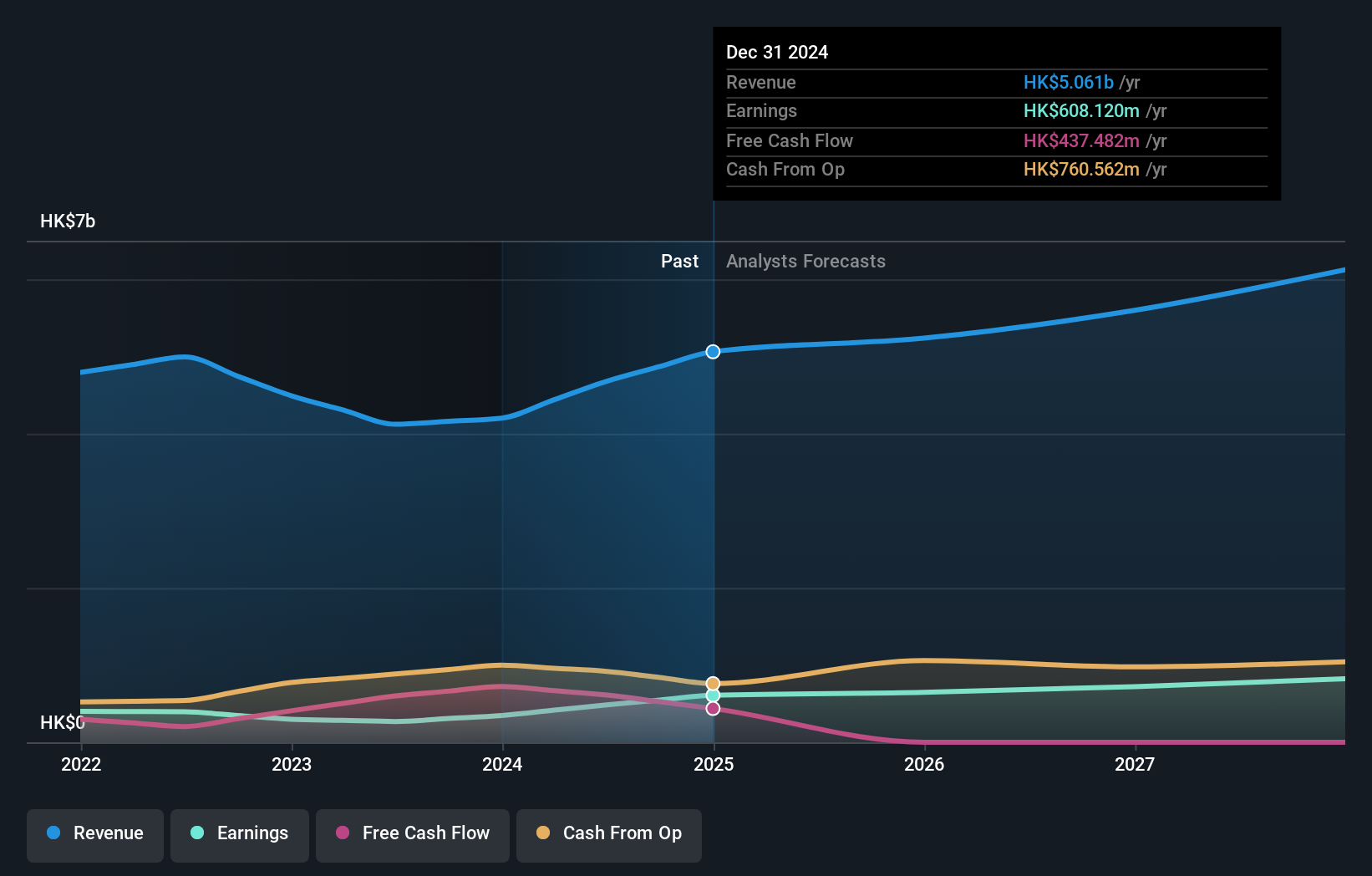

Overview: Best Pacific International Holdings Limited, with a market cap of HK$3.10 billion, is engaged in the manufacturing, trading, and sale of elastic fabric, elastic webbing, and lace through its subsidiaries.

Operations: The company's primary revenue streams are derived from the manufacturing and trading of elastic fabric and lace, generating HK$3.76 billion, and elastic webbing, contributing HK$915.53 million.

Best Pacific International Holdings, a small-cap player in the textile industry, has shown remarkable earnings growth of 80% over the past year, outpacing its luxury industry peers. Trading at 46% below estimated fair value suggests potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 13.8%, reflecting prudent financial management as it reduced from 82.7% to 36% over five years. With interest payments well covered by EBIT at a ratio of 6.9x and positive free cash flow, Best Pacific seems positioned for continued stability and potential growth in its niche market segment.

Namura Shipbuilding (TSE:7014)

Simply Wall St Value Rating: ★★★★★★

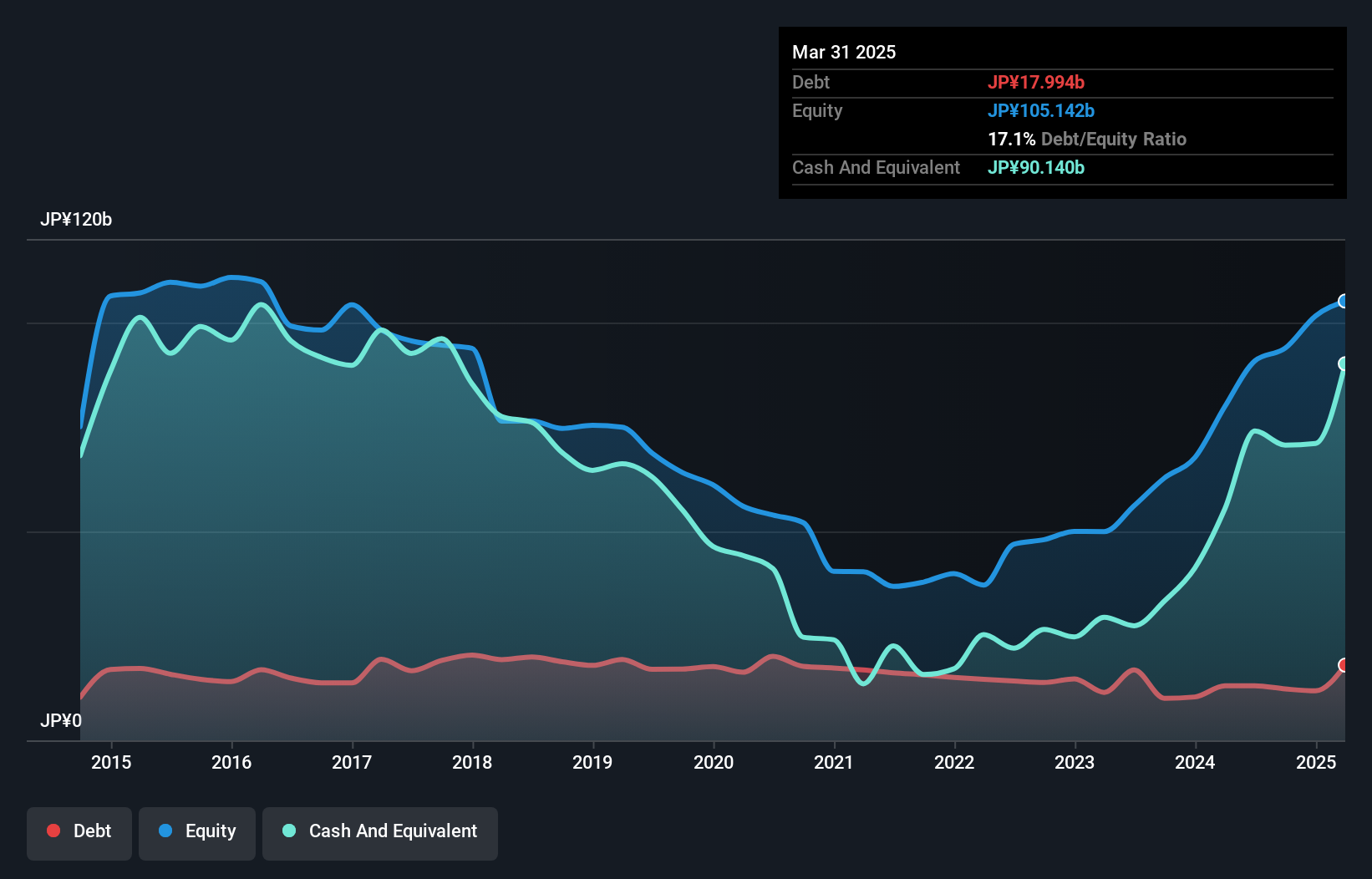

Overview: Namura Shipbuilding Co., Ltd. operates globally in the manufacturing and sale of ships, machinery, and steel structures, with a market capitalization of approximately ¥129.46 billion.

Operations: Namura Shipbuilding generates revenue primarily from new ship construction, contributing ¥119.29 billion, and ship repairs, adding ¥20.71 billion. The steel structure and machinery segment brings in an additional ¥6.12 billion.

Namura Shipbuilding, a small player in the shipbuilding industry, seems to be making waves with its impressive earnings growth of 263% over the past year, significantly outpacing the machinery industry's modest 1.6%. This performance is buoyed by high-quality earnings and a favorable valuation at 94% below estimated fair value. The company has effectively halved its debt-to-equity ratio from 27% to 13% over five years, indicating prudent financial management. Despite recent share price volatility, Namura's ability to cover interest payments comfortably and maintain positive free cash flow suggests robust financial health moving forward.

Make It Happen

- Gain an insight into the universe of 4662 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com