In recent weeks, major U.S. stock indexes have rebounded, buoyed by cooling inflation and robust bank earnings, with small-cap stocks also experiencing notable gains as reflected in the S&P MidCap 400's performance. As investors navigate these shifting market dynamics, identifying stocks with solid foundations becomes crucial; such companies often demonstrate resilience through strong financial health and growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

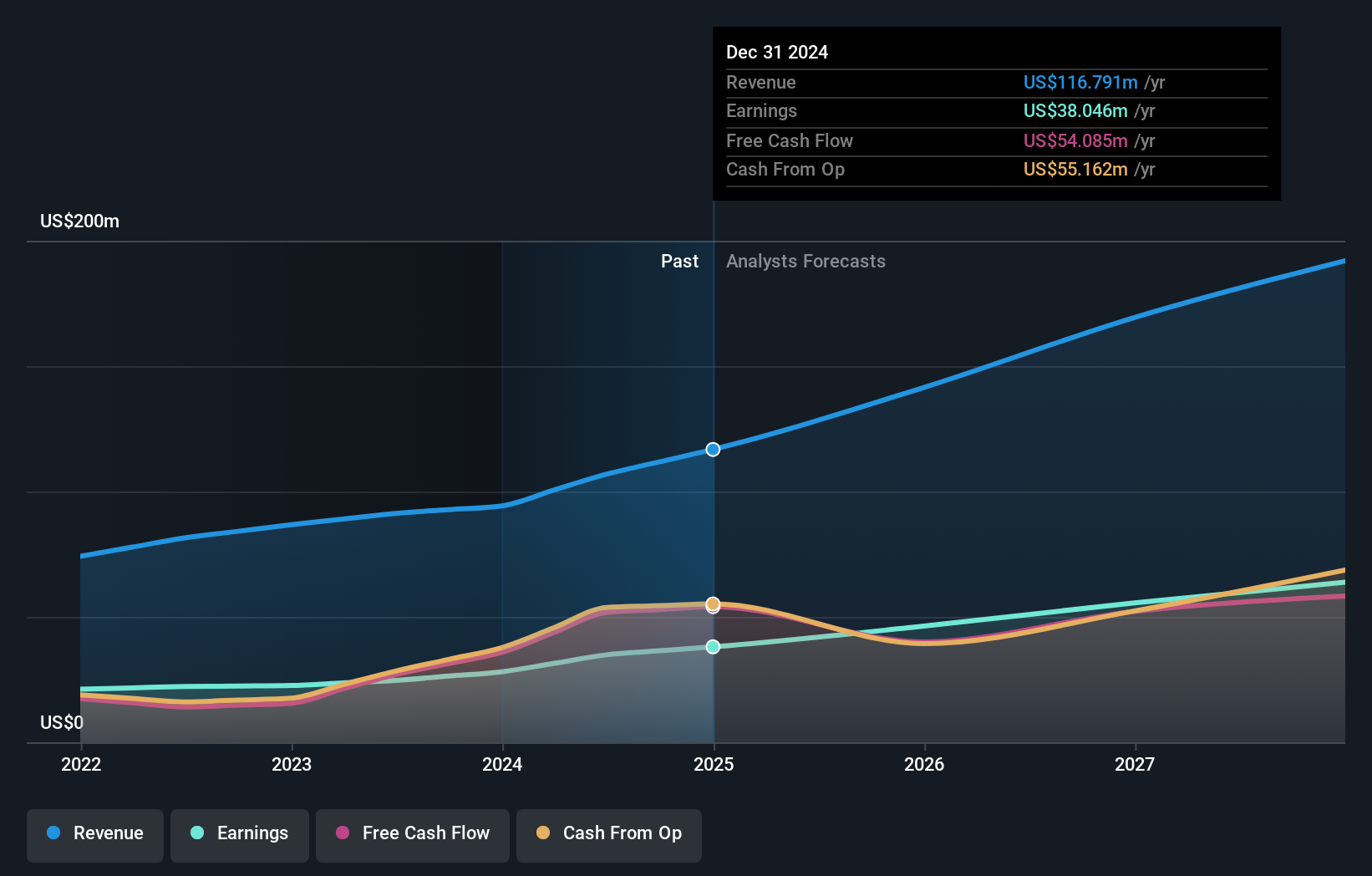

Overview: Plover Bay Technologies Limited is an investment holding company that specializes in designing, developing, and marketing software-defined wide area network routers, with a market capitalization of HK$4.96 billion.

Operations: The company generates revenue primarily through the sales of SD-WAN routers, with mobile first connectivity contributing $59.87 million and fixed first connectivity accounting for $15.19 million, alongside software licenses and warranty and support services bringing in $31.86 million.

Plover Bay, a nimble player in the tech space, showcases strong financial health with cash surpassing total debt and interest payments comfortably covered. The company's earnings rocketed 41% last year, outpacing the communications sector's downturn of 15.6%. Trading at about 20% below its estimated fair value, this firm seems undervalued. Recent guidance suggests net profit for ten months ending October 2024 surpassed last year's US$28 million by over 10%, driven by robust sales in SD-WAN routers and new connectivity products. With a forecasted annual earnings growth of 17%, Plover Bay appears poised for continued success.

Launch Tech (SEHK:2488)

Simply Wall St Value Rating: ★★★★★☆

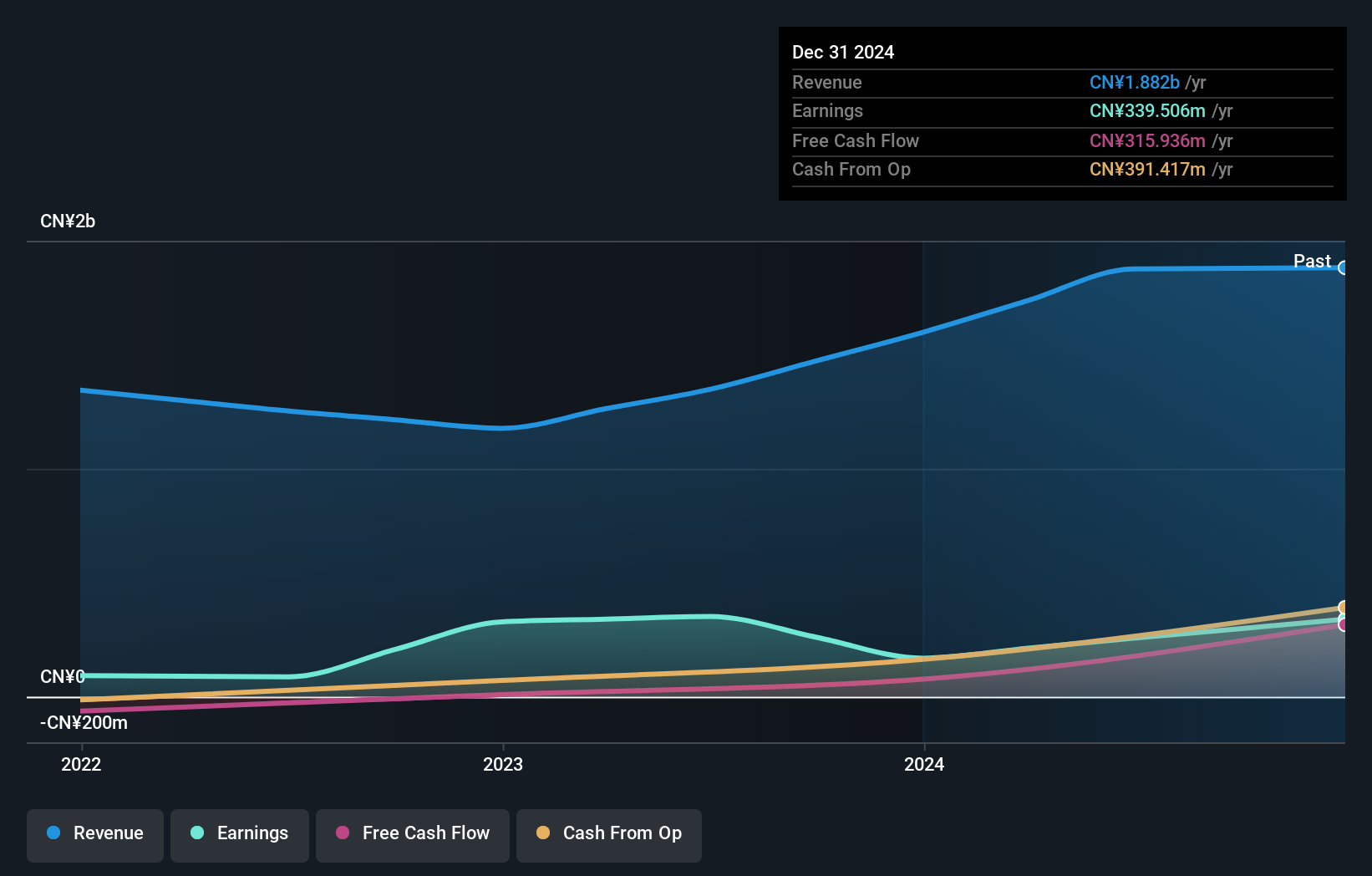

Overview: Launch Tech Company Limited, along with its subsidiaries, offers products and services to the automotive aftermarket and automobile industry both within the People's Republic of China and internationally, with a market capitalization of HK$3.84 billion.

Operations: Launch Tech generates revenue primarily from its automotive products and services offered in China and internationally. The company has a market capitalization of HK$3.84 billion.

Launch Tech, a relatively small player in the auto components sector, shows an intriguing mix of strengths and challenges. Its revenue is expected to grow by 20% annually, yet recent earnings growth was negative at -27%, trailing the industry average of -19%. Profit margins have slipped from 26% to 14%, indicating some profitability pressures. Despite these hurdles, Launch Tech boasts high-quality past earnings and has more cash than its total debt. Recently, it initiated a share buyback program for up to 16 million shares, aiming to boost net asset value per share using surplus funds.

- Click here and access our complete health analysis report to understand the dynamics of Launch Tech.

Integral (TSE:5842)

Simply Wall St Value Rating: ★★★★★☆

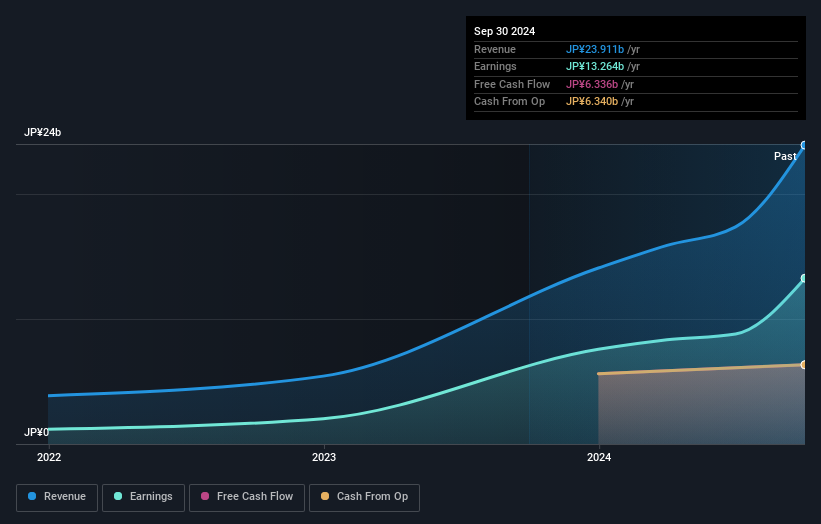

Overview: Integral Corporation is a private equity firm focusing on management buyouts, turnarounds, leveraged buyouts, mezzanine, and other minority investments with a market cap of ¥136.90 billion.

Operations: Integral generates revenue from its private equity activities, with a reported revenue of ¥23.91 billion.

Integral, a nimble player in the capital markets, has shown impressive earnings growth of 115% over the past year, outpacing industry peers. With cash exceeding total debt and free cash flow remaining positive, financial stability seems well-managed. The company's strategic expansion into real estate investment aims to bolster long-term growth and diversify assets under management. Despite trading at nearly 6% below estimated fair value, Integral's share price has been notably volatile recently. A recent board meeting focused on establishing a Nomination and Compensation Committee reflects ongoing governance enhancements to support future endeavors.

- Click to explore a detailed breakdown of our findings in Integral's health report.

Gain insights into Integral's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Explore the 4654 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com