As global markets navigate a complex landscape marked by resilient labor markets and inflationary concerns, investors are closely watching for opportunities amid the volatility. With U.S. equities experiencing declines and value stocks outperforming growth counterparts, the search for undervalued stocks becomes particularly relevant. In this environment, identifying stocks trading below their estimated value can offer potential advantages, as they may provide a cushion against market fluctuations while offering room for appreciation as conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥27.91 | CN¥55.63 | 49.8% |

| Alltop Technology (TPEX:3526) | NT$265.50 | NT$529.34 | 49.8% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.24 | TRY78.32 | 49.9% |

| FINDEX (TSE:3649) | ¥920.00 | ¥1836.04 | 49.9% |

| Solum (KOSE:A248070) | ₩18740.00 | ₩37472.86 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Mobvista (SEHK:1860) | HK$8.05 | HK$16.09 | 50% |

| Zhende Medical (SHSE:603301) | CN¥20.94 | CN¥41.80 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5870.00 | ¥11691.00 | 49.8% |

| Mobileye Global (NasdaqGS:MBLY) | US$16.51 | US$32.92 | 49.9% |

Here's a peek at a few of the choices from the screener.

Norconsult (OB:NORCO)

Overview: Norconsult ASA offers consultancy services specializing in community planning, engineering design, and architecture both in the Nordics and internationally, with a market cap of NOK12.88 billion.

Operations: The company's revenue segments include Sweden (NOK1.75 billion), Denmark (NOK858 million), Norway Regions (NOK2.78 billion), Renewable Energy (NOK909 million), Norway Head Office (NOK2.99 billion), and Digital and Techno-Garden (NOK1.20 billion).

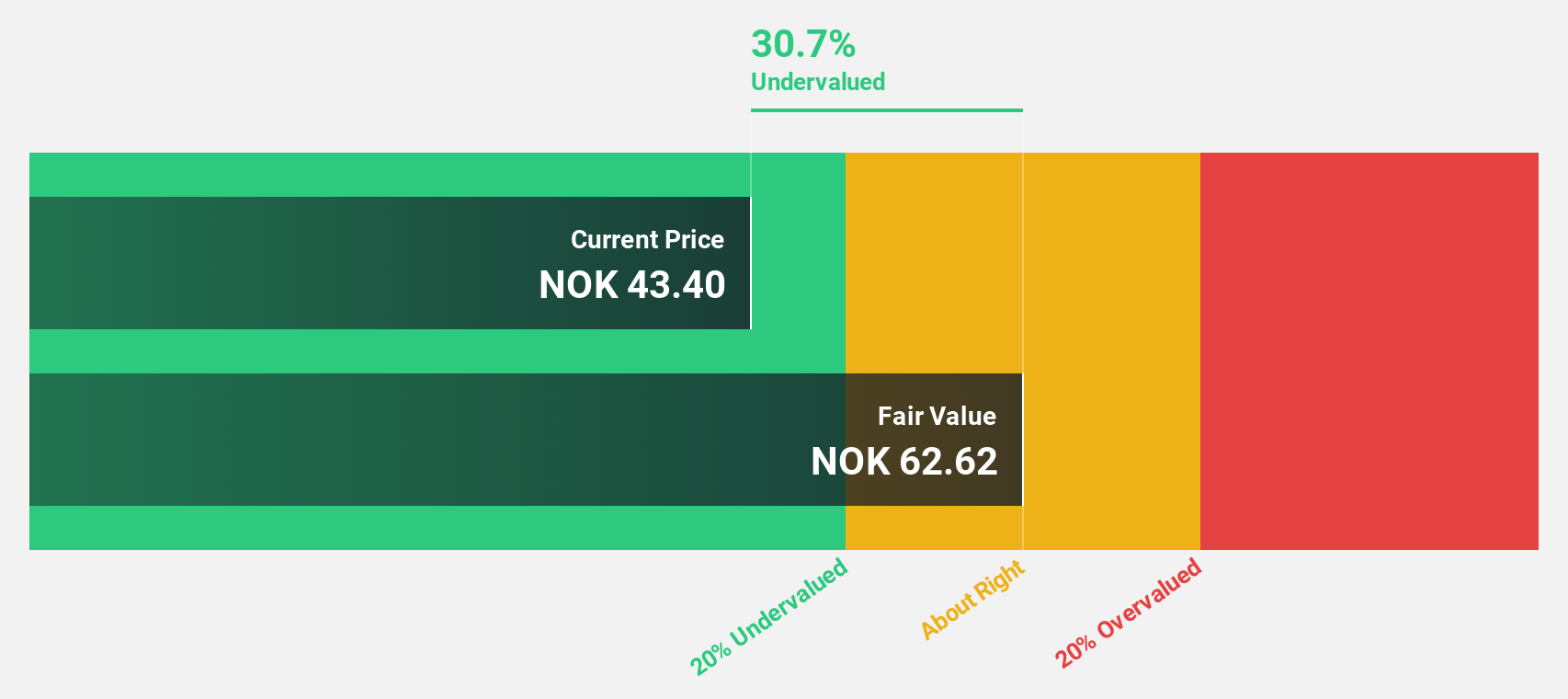

Estimated Discount To Fair Value: 30.9%

Norconsult is trading at NOK44.65, 30.9% below its estimated fair value of NOK64.66, indicating it may be undervalued based on cash flows. Despite a decline in profit margins from 5.4% to 3.6%, earnings are expected to grow significantly at 30.05% annually over the next three years, outpacing the Norwegian market's forecasted growth of 8.5%. Recent framework agreements with The Norwegian Defence Estates Agency could bolster future revenue streams and profitability.

- Our growth report here indicates Norconsult may be poised for an improving outlook.

- Navigate through the intricacies of Norconsult with our comprehensive financial health report here.

Wasion Holdings (SEHK:3393)

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia with a market cap of HK$7.05 billion.

Operations: The company generates revenue from three main segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

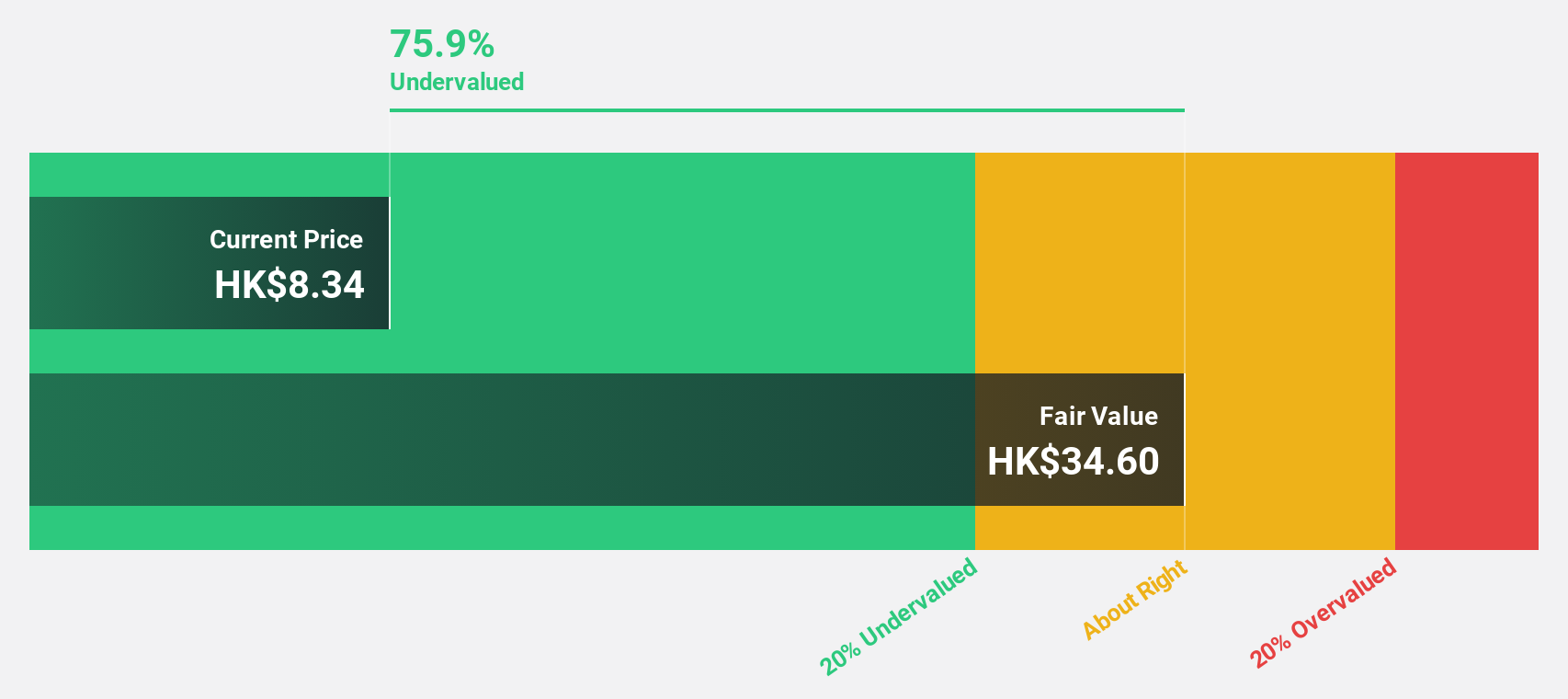

Estimated Discount To Fair Value: 49.5%

Wasion Holdings is trading at HK$7.08, significantly below its estimated fair value of HK$14.01, highlighting potential undervaluation based on cash flows. The company has demonstrated robust earnings growth of 61.9% over the past year and is expected to maintain strong annual profit growth of 22.6%, surpassing the Hong Kong market average. However, despite these positive indicators, its return on equity is forecasted to remain modest at 15.4% in three years.

- The analysis detailed in our Wasion Holdings growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Wasion Holdings' balance sheet health report.

Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957)

Overview: Yunnan Botanee Bio-Technology Group Co. LTD is involved in the manufacture and sale of skincare and makeup products in China, with a market cap of CN¥17.36 billion.

Operations: The company generates its revenue primarily from the skincare and makeup product segments within China.

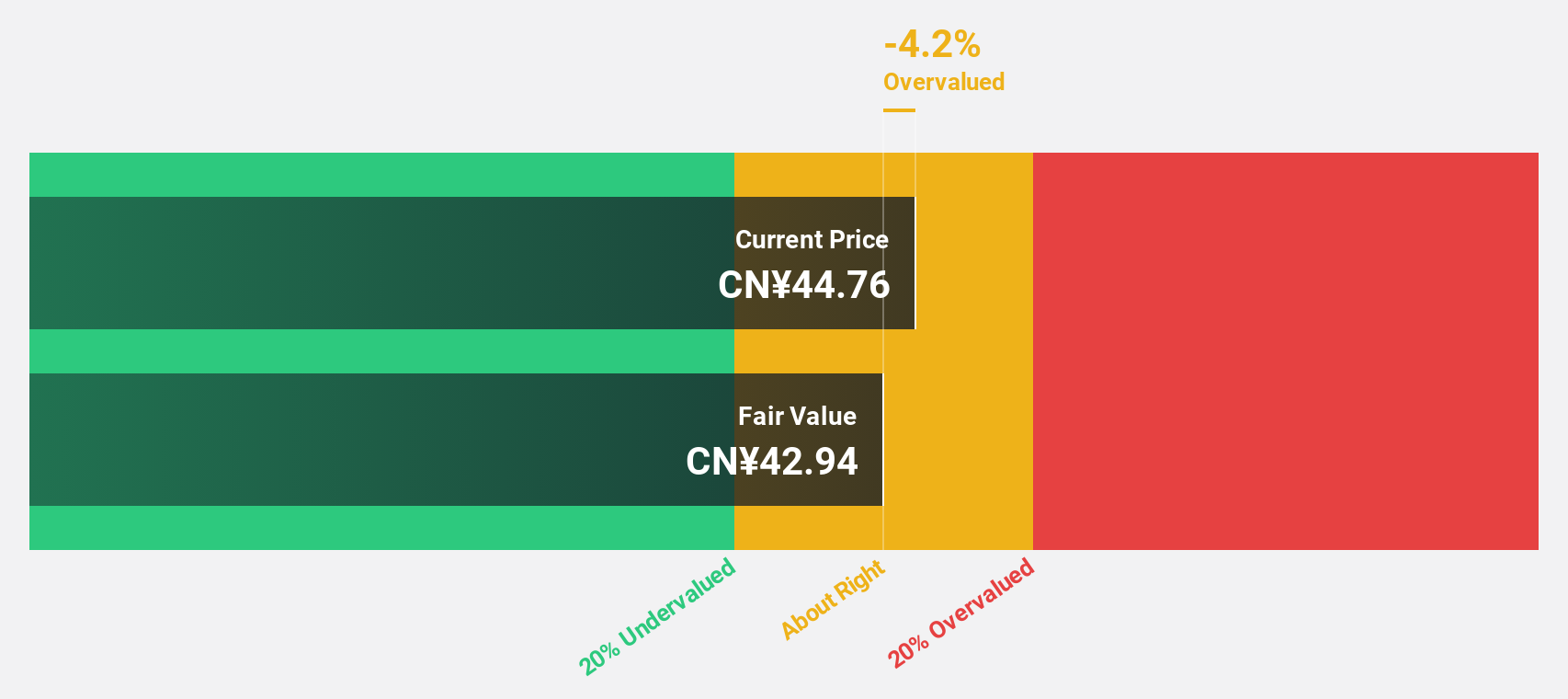

Estimated Discount To Fair Value: 43.5%

Yunnan Botanee Bio-Technology Group is trading at CN¥41.32, considerably below its estimated fair value of CN¥73.10, suggesting it is undervalued based on cash flows. Despite a decline in net income to CN¥414.77 million from CN¥579.19 million last year, the company’s earnings are forecasted to grow significantly at 30.3% annually, outpacing the market average of 25.3%. However, profit margins have decreased and dividends remain poorly covered by free cash flows.

- According our earnings growth report, there's an indication that Yunnan Botanee Bio-Technology GroupLTD might be ready to expand.

- Dive into the specifics of Yunnan Botanee Bio-Technology GroupLTD here with our thorough financial health report.

Where To Now?

- Gain an insight into the universe of 867 Undervalued Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com