For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Guan Chao Holdings Limited (HKG:1872) shareholders for doubting their decision to hold, with the stock down 64% over a half decade. Furthermore, it's down 56% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Guan Chao Holdings

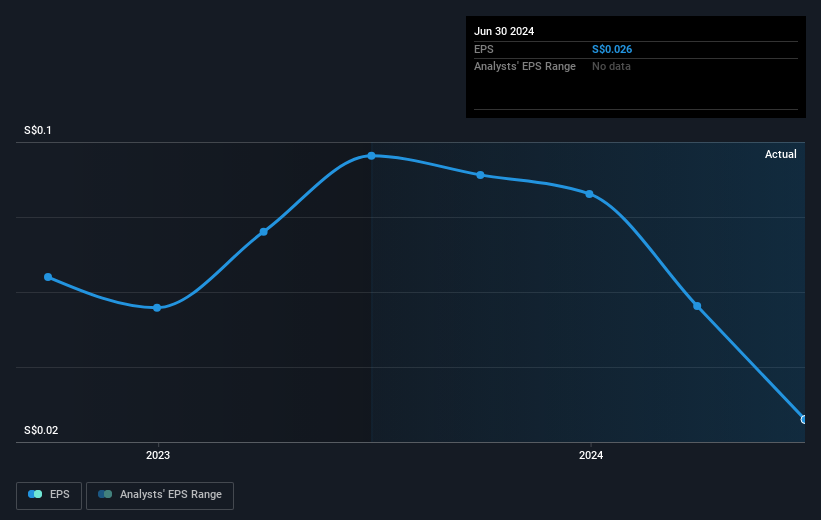

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Guan Chao Holdings' earnings per share (EPS) dropped by 18% each year. This change in EPS is remarkably close to the 18% average annual decrease in the share price. This suggests that market participants have not changed their view of the company all that much. So it's fair to say the share price has been responding to changes in EPS.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Guan Chao Holdings' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Guan Chao Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Guan Chao Holdings hasn't been paying dividends, but its TSR of -2.4% exceeds its share price return of -64%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Guan Chao Holdings shareholders have received a total shareholder return of 249% over the last year. Notably the five-year annualised TSR loss of 0.5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 6 warning signs for Guan Chao Holdings (2 make us uncomfortable) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.