As global markets navigate a complex landscape marked by stronger-than-expected U.S. labor data and persistent inflation concerns, investors are keenly observing the impact of economic policies and interest rate decisions on equity performance. With small-cap stocks underperforming and value stocks showing resilience amidst market volatility, the search for undervalued opportunities becomes increasingly pertinent. Identifying stocks trading below their intrinsic value requires careful analysis of financial health, growth potential, and market conditions—factors that can offer promising prospects even in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.19 | CN¥34.17 | 49.7% |

| Clear Secure (NYSE:YOU) | US$26.72 | US$53.44 | 50% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.39 | CN¥100.73 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.60 | CN¥31.06 | 49.8% |

| Ningbo Haitian Precision MachineryLtd (SHSE:601882) | CN¥20.26 | CN¥40.47 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.99 | CLP580.39 | 49.9% |

| Constellium (NYSE:CSTM) | US$10.35 | US$20.64 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.88 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5874.00 | ¥11677.29 | 49.7% |

Let's explore several standout options from the results in the screener.

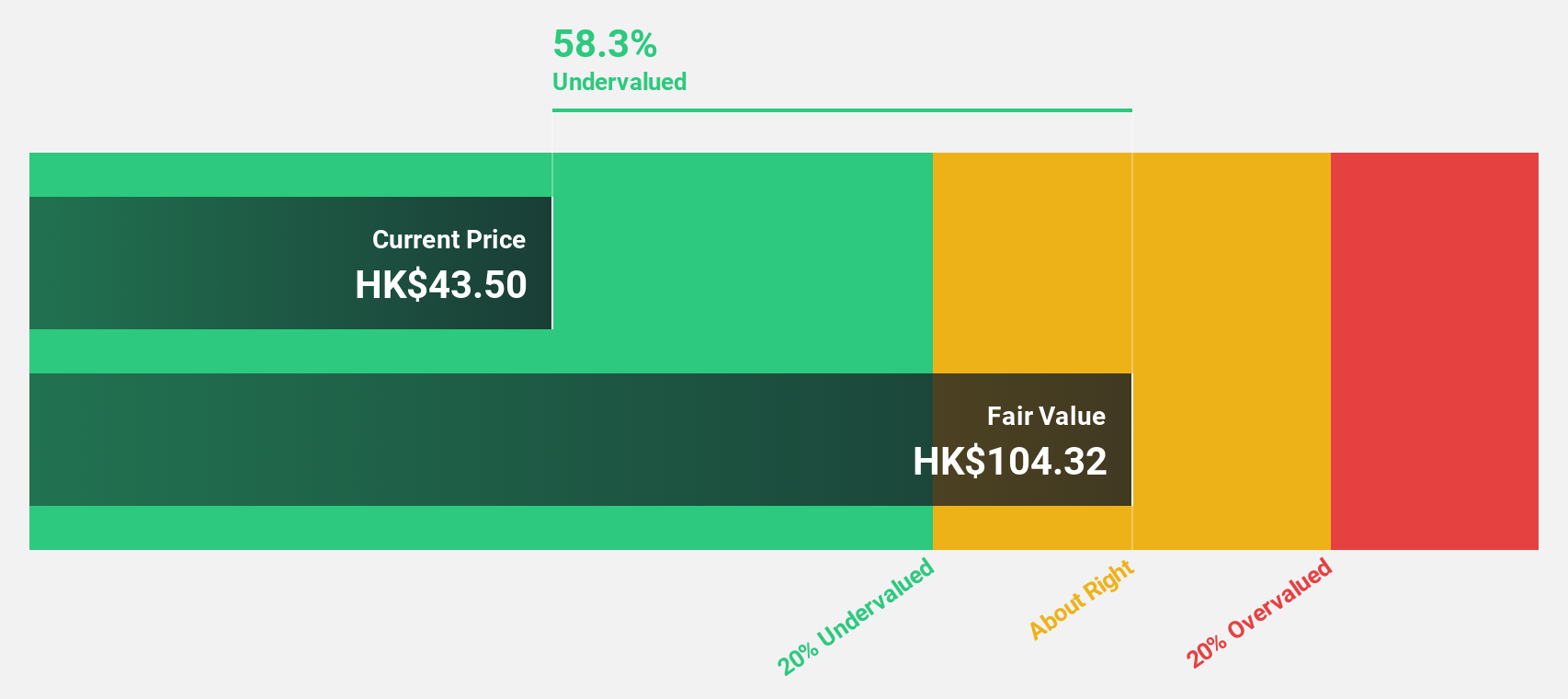

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that functions as a contract research, development, and manufacturing organization with operations in China, North America, Europe, and internationally, and has a market cap of HK$39.54 billion.

Operations: The company generates its revenue primarily from the Pharmaceuticals segment, which accounted for CN¥2.80 billion.

Estimated Discount To Fair Value: 37.7%

WuXi XDC Cayman is trading at HK$33, significantly below its estimated fair value of HK$52.93, indicating potential undervaluation based on cash flows. The company has shown strong earnings growth of 153.3% over the past year and is expected to continue with a forecasted annual earnings growth rate of 27.65%. However, its Return on Equity is projected to be relatively low at 17.1% in three years, which may be a concern for some investors.

- Our growth report here indicates WuXi XDC Cayman may be poised for an improving outlook.

- Click here to discover the nuances of WuXi XDC Cayman with our detailed financial health report.

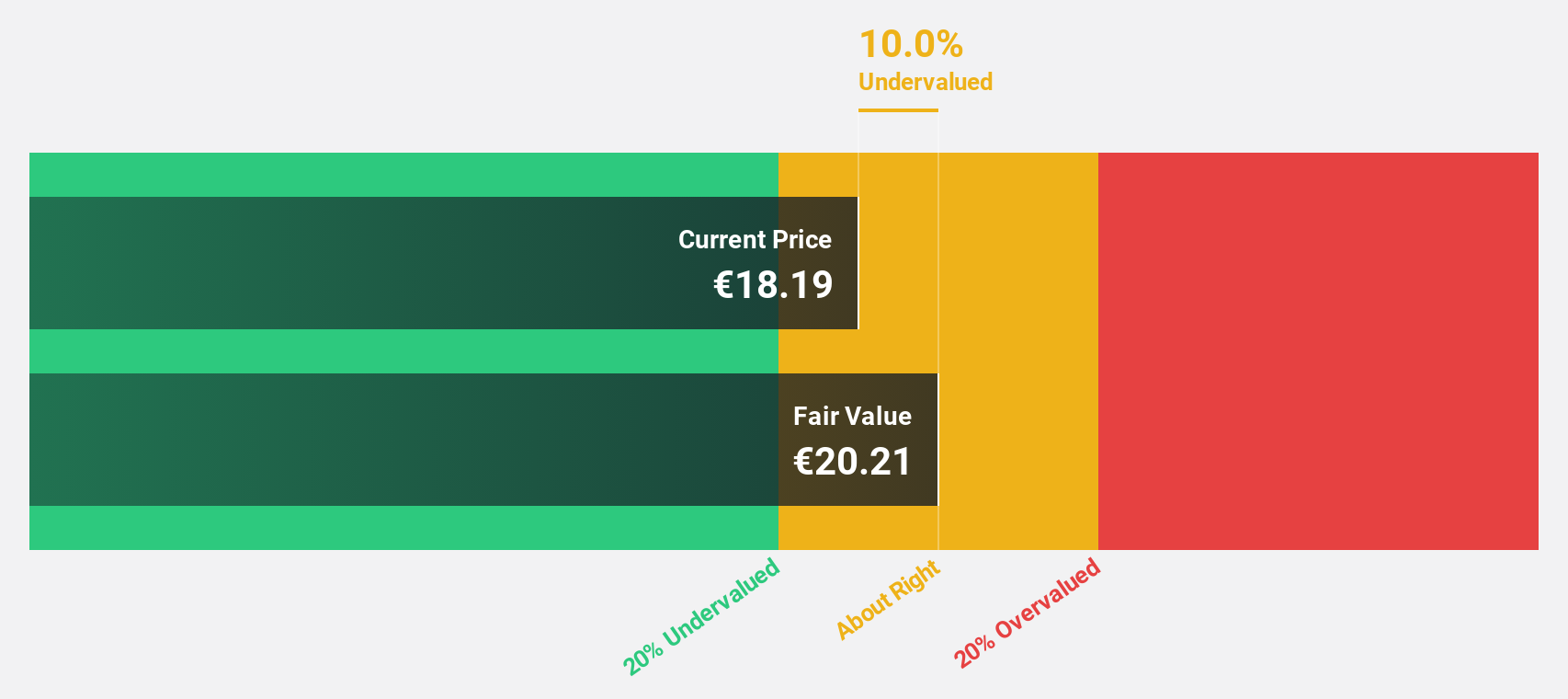

IMMOFINANZ (WBAG:IIA)

Overview: IMMOFINANZ AG is a real estate company that acquires, develops, owns, rents, and manages properties across several Central and Eastern European countries including Austria and Germany, with a market cap of €2.18 billion.

Operations: The company's revenue primarily comes from its Office segment, generating €237.95 million, and its Retail segment, contributing €298.13 million.

Estimated Discount To Fair Value: 24.7%

IMMOFINANZ is trading at €15.82, below its estimated fair value of €21.01, suggesting undervaluation based on cash flows. The company reported a rise in sales and revenue for the third quarter of 2024, though net income dropped to €7.51 million from €35.99 million a year ago. Despite this, earnings are forecast to grow significantly at 70.61% annually, although debt coverage by operating cash flow remains inadequate and Return on Equity is expected to be low at 7.6%.

- Our earnings growth report unveils the potential for significant increases in IMMOFINANZ's future results.

- Take a closer look at IMMOFINANZ's balance sheet health here in our report.

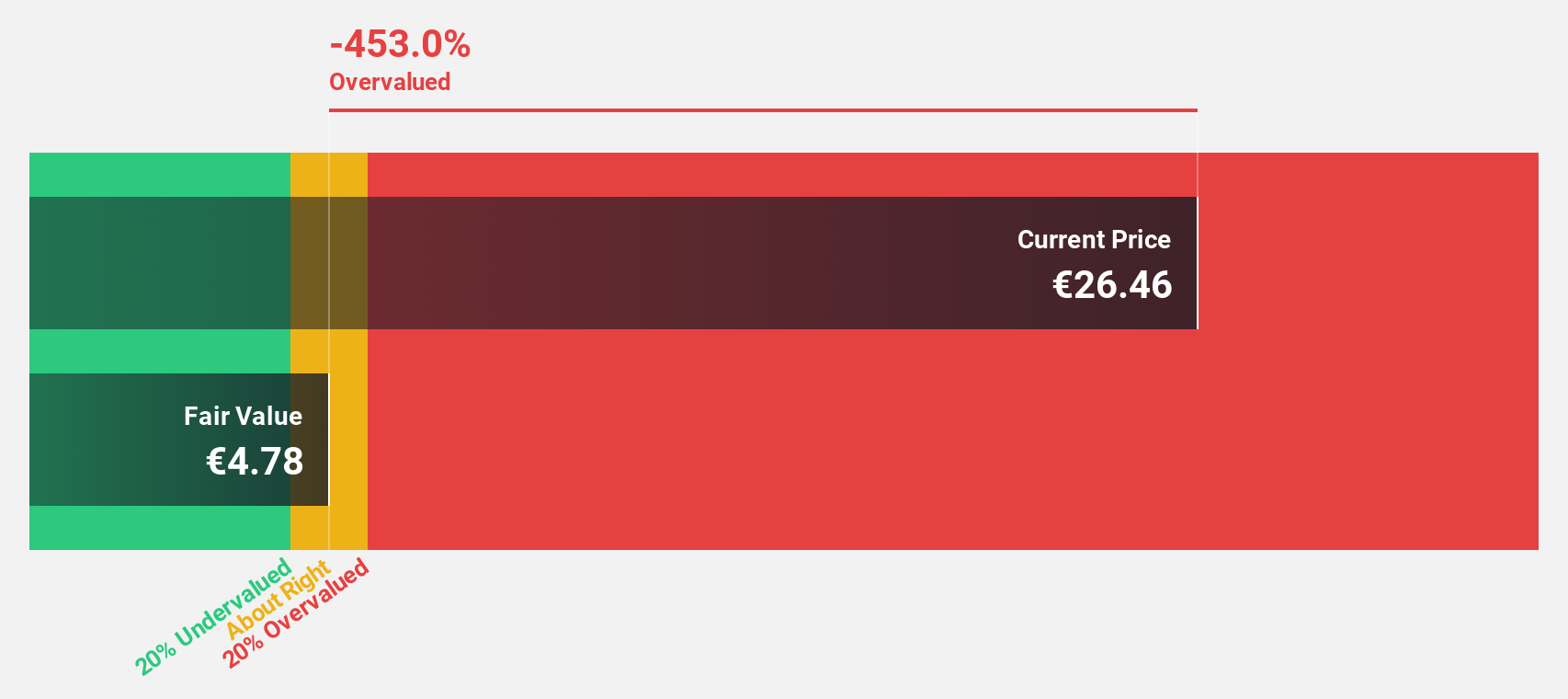

AUTO1 Group (XTRA:AG1)

Overview: AUTO1 Group SE is a technology company that operates a digital platform for buying and selling used cars online across Germany, France, Italy, and other international markets with a market cap of €3.53 billion.

Operations: The company's revenue is derived from two main segments: Retail, contributing €1.14 billion, and Merchant, accounting for €4.76 billion.

Estimated Discount To Fair Value: 38%

AUTO1 Group is trading at €16.25, significantly below its estimated fair value of €26.21, highlighting potential undervaluation based on cash flows. The company reported a turnaround with a net income of €7.65 million in Q3 2024, compared to a loss the previous year, and sales increased to €1.60 billion from €1.29 billion. Despite volatility in share price and low future Return on Equity forecasts, earnings are expected to grow robustly at 137.87% annually over the next three years as profitability improves above market average growth rates.

- In light of our recent growth report, it seems possible that AUTO1 Group's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of AUTO1 Group stock in this financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 875 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com