Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term China International Capital Corporation Limited (HKG:3908) shareholders have had that experience, with the share price dropping 44% in three years, versus a market decline of about 3.9%. Furthermore, it's down 20% in about a quarter. That's not much fun for holders.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for China International Capital

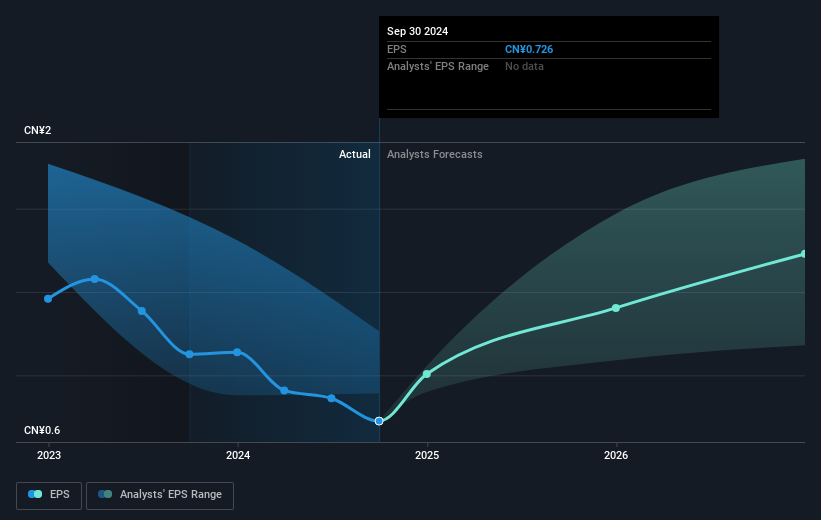

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

China International Capital saw its EPS decline at a compound rate of 27% per year, over the last three years. In comparison the 18% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on China International Capital's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for China International Capital the TSR over the last 3 years was -41%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

China International Capital shareholders have received returns of 20% over twelve months (even including dividends), which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 4%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. Before deciding if you like the current share price, check how China International Capital scores on these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.