As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, small-cap stocks have shown resilience with the S&P MidCap 400 and Russell 2000 indices posting gains despite broader market volatility. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals that can weather economic uncertainties and capitalize on growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Pico Far East Holdings (SEHK:752)

Simply Wall St Value Rating: ★★★★★★

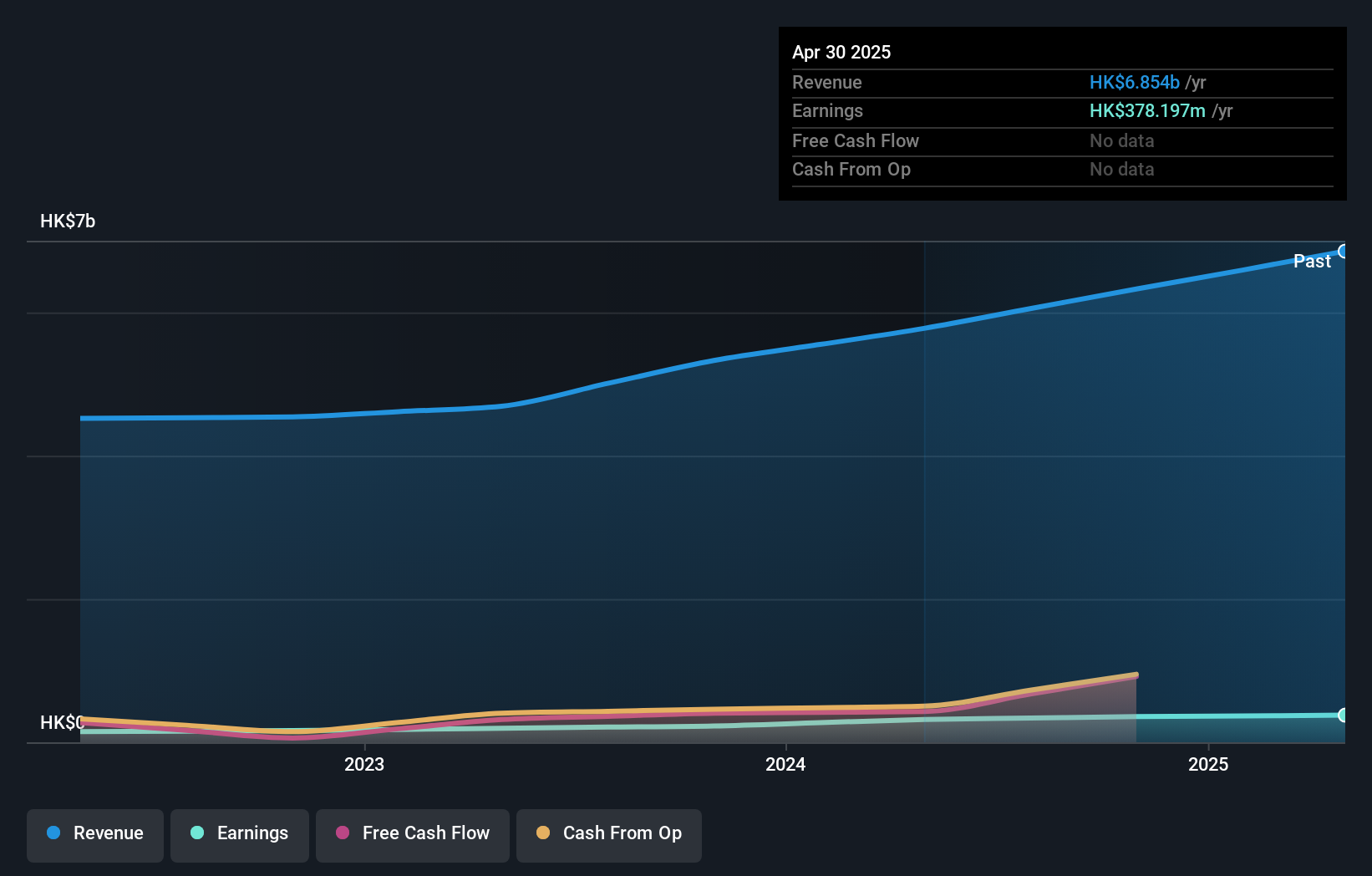

Overview: Pico Far East Holdings Limited is an investment holding company involved in exhibition, event, and brand activation; visual branding activation; museum and themed environments; and meeting architecture activation, with a market capitalization of approximately HK$2.30 billion.

Operations: The company's primary revenue stream is derived from exhibition, event, and brand activation, generating HK$5.01 billion. Visual branding activation and museum and themed entertainment contribute HK$454.95 million and HK$444.37 million, respectively. Meeting architecture activation adds HK$162.78 million to the overall revenue mix.

Pico Far East Holdings, a small cap player in the media industry, has shown impressive financial resilience. Their earnings surged by 64% last year, outpacing the industry's -2% performance. The company seems to manage its debt well, with a debt-to-equity ratio dropping from 23% to 14% over five years. Moreover, Pico's interest payments are comfortably covered by EBIT at a robust 20x coverage. Trading significantly below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector. The company's high-quality earnings and positive free cash flow further bolster its investment appeal.

Samart Aviation Solutions (SET:SAV)

Simply Wall St Value Rating: ★★★★★★

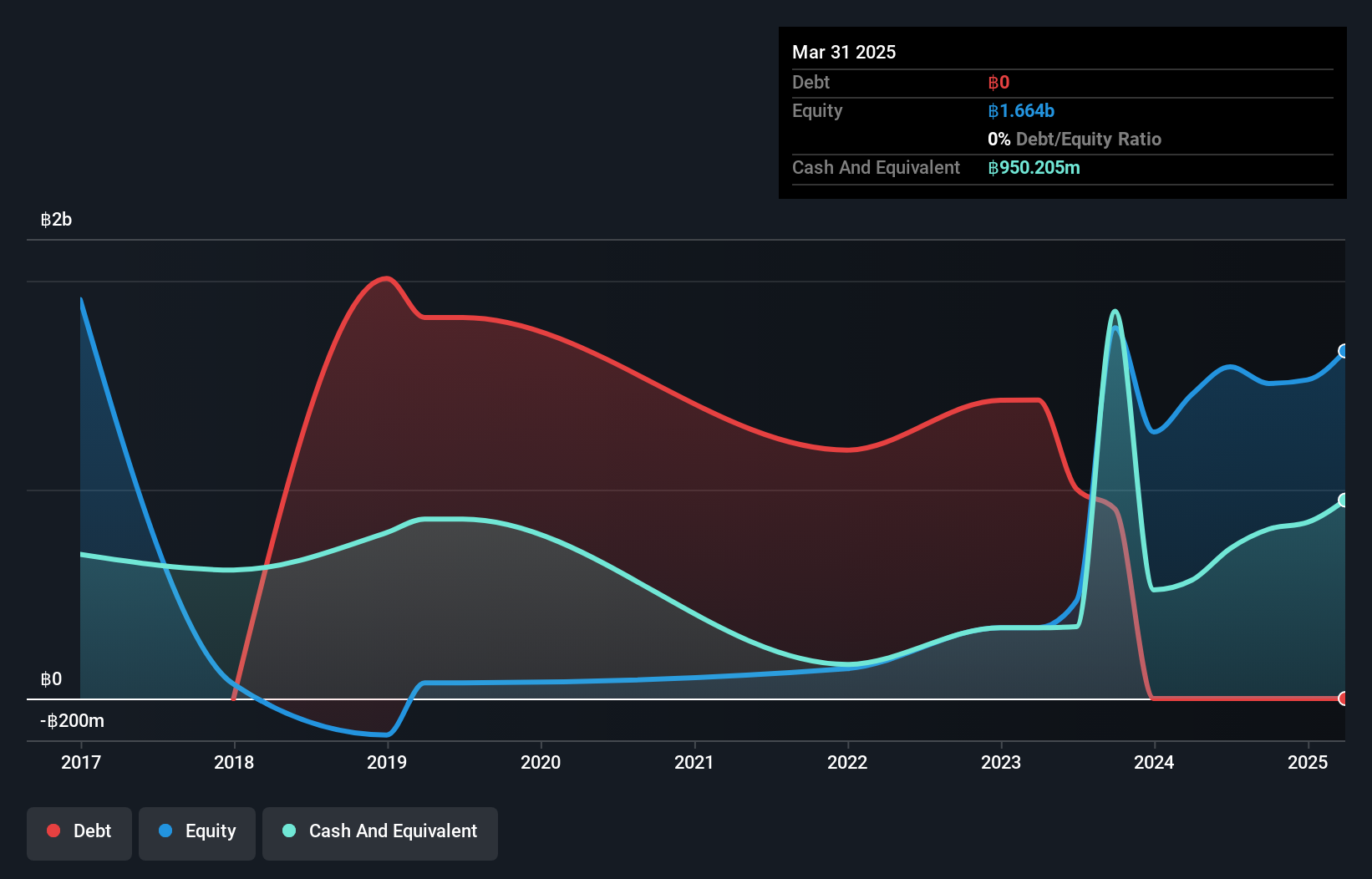

Overview: Samart Aviation Solutions Public Company Limited is an investment holding company that provides air traffic control services in Cambodia, with a market cap of THB12.67 billion.

Operations: Samart Aviation Solutions generates revenue primarily from its Utilities and Transportations segment, amounting to THB1.82 billion.

Samart Aviation Solutions, a nimble player in the aviation sector, has demonstrated impressive financial resilience. With no debt and positive free cash flow of THB 456.22 million as of September 2024, its fiscal health seems robust. Over the past year, earnings surged by 49%, outpacing the infrastructure industry’s growth rate of 20%. Recent earnings reports show a net income increase to THB 126.06 million for Q3 from THB 90.79 million the previous year, with basic EPS rising to THB 0.197 from THB 0.156. These figures suggest a promising trajectory for this small yet dynamic company amidst industry challenges.

eCloudvalley Digital Technology (TWSE:6689)

Simply Wall St Value Rating: ★★★★★★

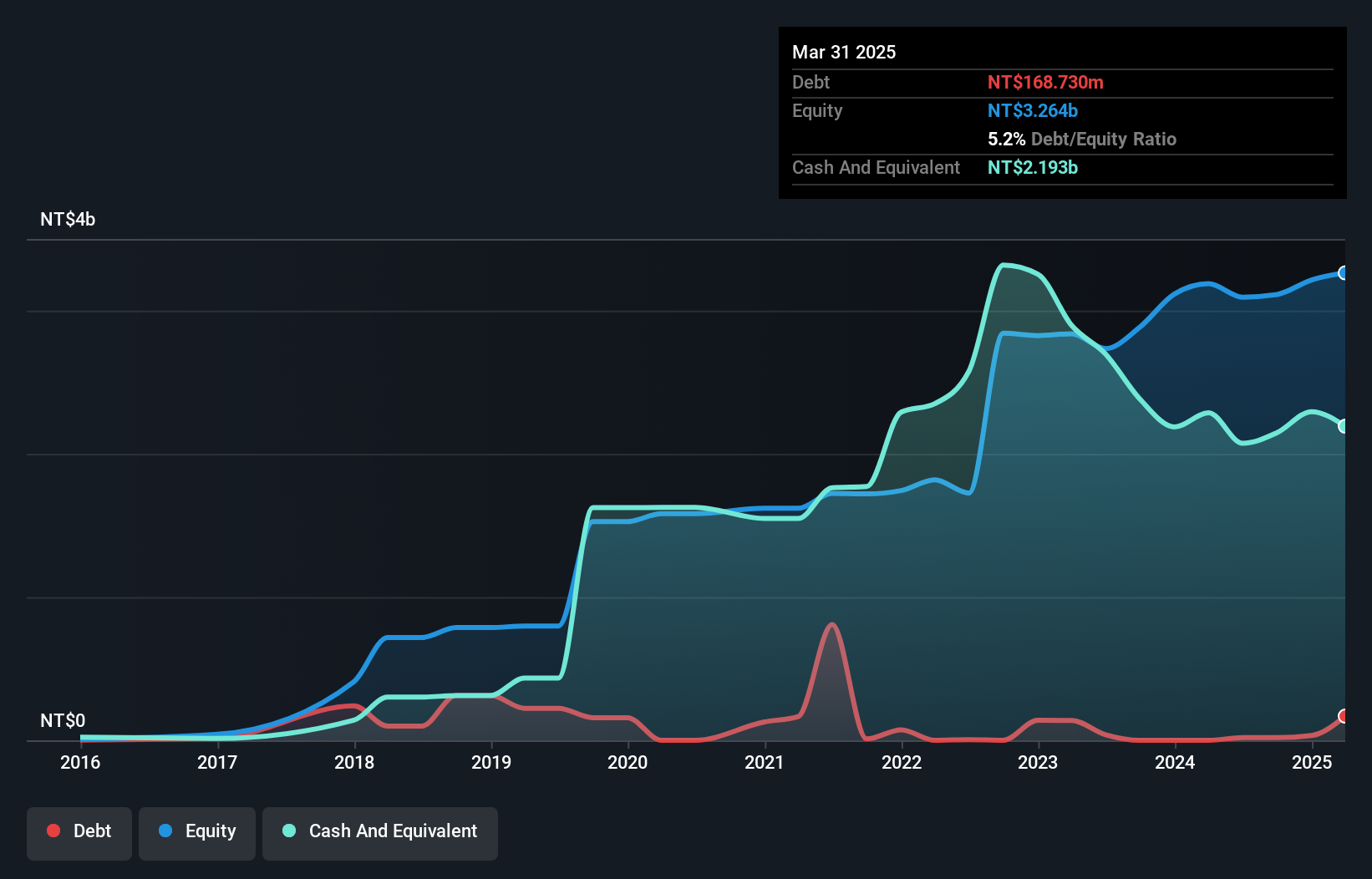

Overview: eCloudvalley Digital Technology Co., Ltd. is a company with a market cap of NT$8.54 billion, specializing in providing cloud-based solutions and services.

Operations: eCloudvalley Digital Technology generates revenue primarily through its cloud-based solutions and services. The company's financial performance is characterized by a notable gross profit margin trend, which reflects its ability to manage costs effectively relative to revenue generation.

eCloudvalley Digital Technology shows promising growth, with earnings up 22.5% last year, outpacing the IT sector's 9.9%. The company is trading at a notable discount of 62.6% below its estimated fair value and has managed to reduce its debt-to-equity ratio from 10.3% to just 0.6% over five years, indicating improved financial health. Recent quarterly results highlight sales of TWD 3,338 million compared to TWD 2,470 million previously, while net income rose modestly from TWD 47.73 million to TWD 59.9 million, reflecting steady operational performance despite market volatility concerns over the past three months.

Make It Happen

- Navigate through the entire inventory of 4644 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com