As global markets navigate a mixed economic landscape, with recent declines in U.S. consumer confidence and durable goods orders, the spotlight has turned to small-cap stocks as potential opportunities amidst broader market fluctuations. In this environment, identifying promising small-cap companies requires a keen eye for those that demonstrate resilience and innovation, offering unique growth potential despite prevailing economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

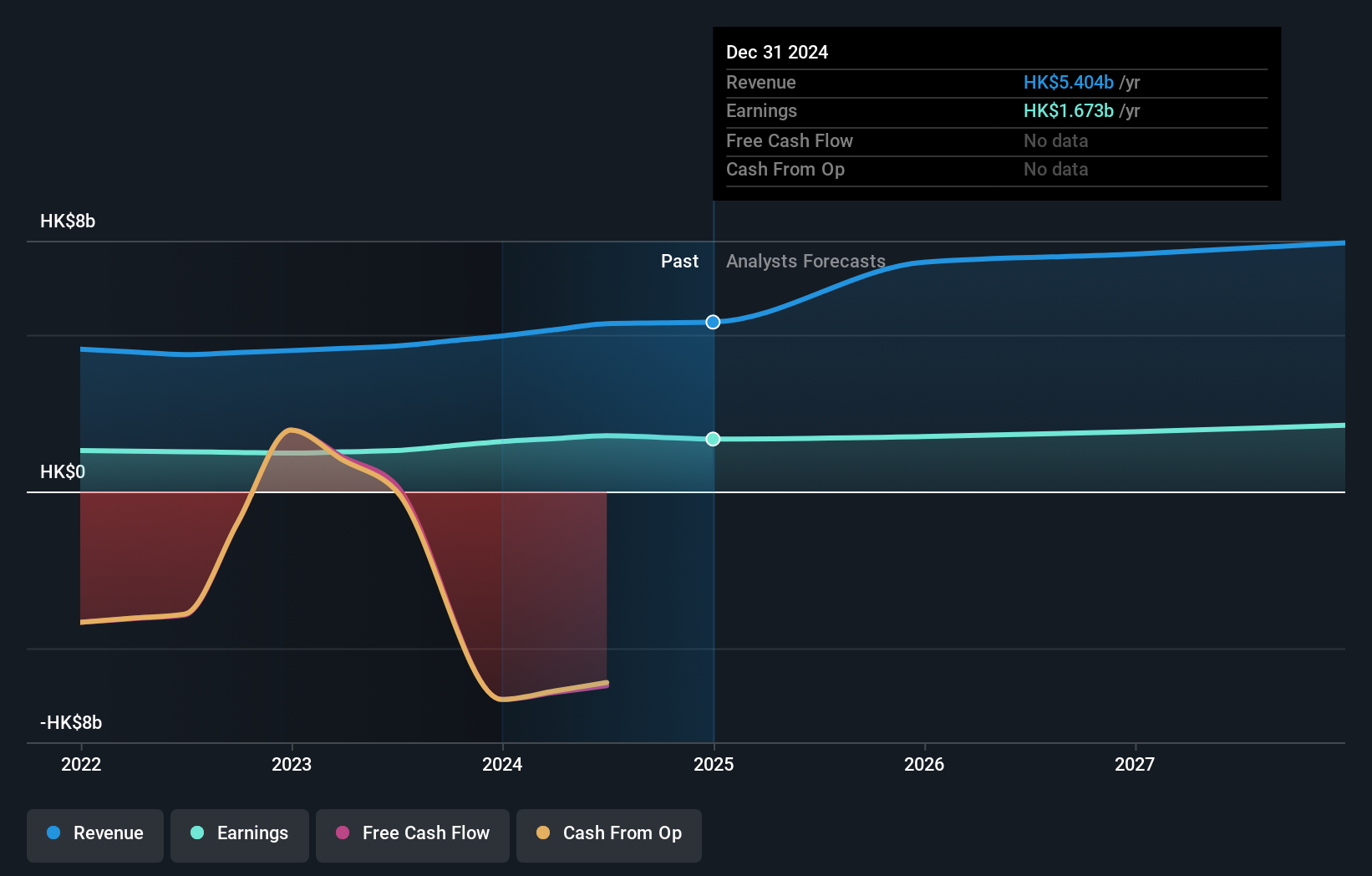

Overview: Dah Sing Financial Holdings Limited is an investment holding company offering banking, insurance, and financial services in Hong Kong, Macau, and the People's Republic of China with a market capitalization of approximately HK$9.11 billion.

Operations: The company's revenue streams are primarily derived from Personal Banking (HK$2.68 billion), Corporate Banking (HK$853.60 million), and Treasury and Global Markets (HK$1.34 billion). The Insurance Business contributes HK$246.25 million, while Mainland China and Macau Banking add HK$176.27 million to the total revenue mix.

Dah Sing Financial Holdings, with total assets of HK$272.4 billion and equity of HK$42.4 billion, showcases a robust financial standing. Its total deposits stand at HK$214.2 billion against loans of HK$141.9 billion, indicating a solid deposit base. The company has an appropriate level of bad loans at 1.9%, reflecting sound risk management practices, although its allowance for bad loans is relatively low at 43%. Earnings surged by 36% over the past year, outpacing the industry growth rate of 1%. Trading at about 29% below estimated fair value suggests potential undervaluation in the market.

Voneseals Technology (Shanghai) (SZSE:301161)

Simply Wall St Value Rating: ★★★★★★

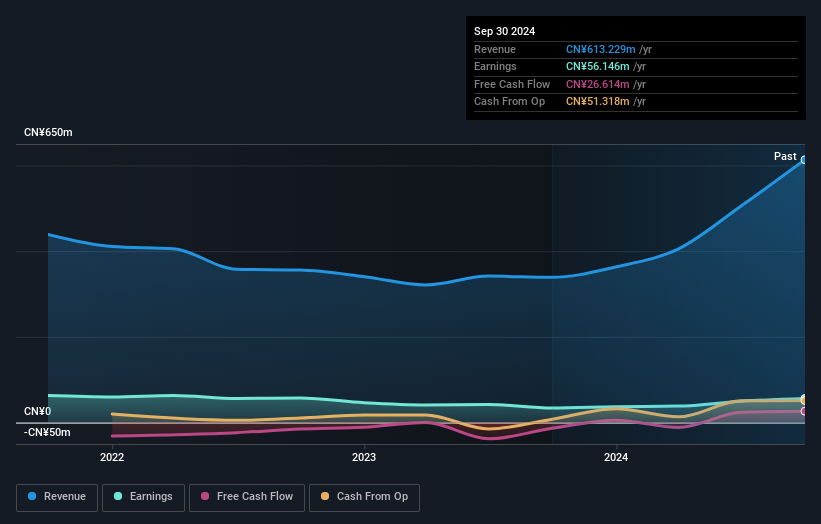

Overview: Voneseals Technology (Shanghai) Inc. specializes in the research, development, production, and sale of hydraulic and pneumatic sealing products in China, with a market cap of CN¥2.56 billion.

Operations: Voneseals Technology generates revenue primarily from the sale of hydraulic and pneumatic sealing products in China. The company has reported a net profit margin trend that is noteworthy, with recent figures showing it at 15.7%.

Voneseals Technology, a smaller player in the tech scene, has shown promising growth with earnings increasing by 64% over the past year. Their recent financials reveal sales of CNY 516.6 million and a net income of CNY 50.38 million for nine months ending September 2024, marking an improvement from the previous year's figures. The company boasts high-quality past earnings and more cash than total debt, suggesting robust financial health. Despite a volatile share price recently, its ability to cover interest payments comfortably indicates stability in operations. Earnings per share rose to CNY 0.42 from CNY 0.26 last year, reflecting solid performance amidst industry challenges.

Energiekontor (XTRA:EKT)

Simply Wall St Value Rating: ★★★★★☆

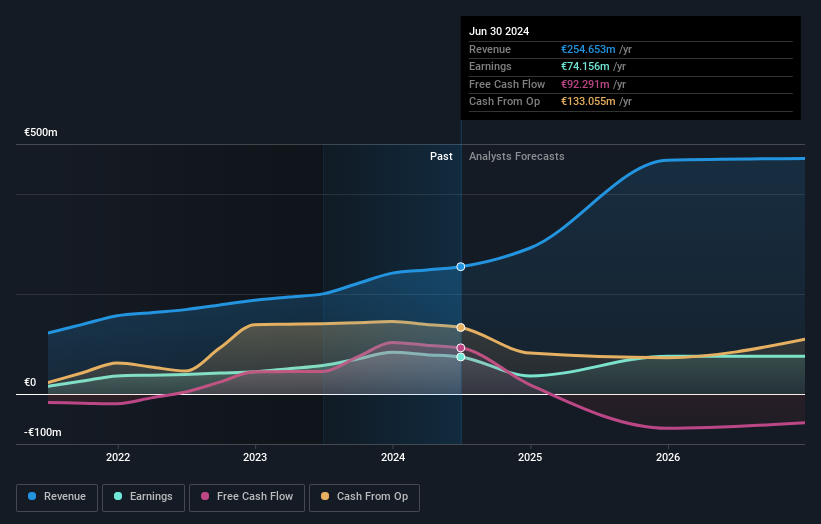

Overview: Energiekontor AG is a project developer involved in the planning, construction, and operation of wind and solar parks across Germany, Portugal, and the United States, with a market capitalization of approximately €681.37 million.

Operations: Energiekontor AG generates revenue primarily through Project Development and Sales, contributing €171.48 million, and Power Generation in Group-Owned Wind and Solar Parks, adding €78.30 million.

Energiekontor, a dynamic player in renewable energy, showcases promising attributes despite its removal from the German TECDAX indices. The firm has seen a significant earnings growth of 30%, outpacing the electrical industry average. Its net debt to equity ratio stands at 144%, indicating high leverage, yet interest payments are well-covered by EBIT at six times coverage. Trading at a price-to-earnings ratio of 9x compared to the German market's 16x suggests undervaluation. With an ambitious project pipeline of 12 gigawatts and ongoing construction for over one gigawatt, Energiekontor seems poised for continued expansion in wind and solar projects across multiple countries.

- Take a closer look at Energiekontor's potential here in our health report.

Examine Energiekontor's past performance report to understand how it has performed in the past.

Where To Now?

- Dive into all 4636 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com