While it may not be enough for some shareholders, we think it is good to see the GCL New Energy Holdings Limited (HKG:451) share price up 11% in a single quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. In that time the share price has melted like a snowball in the desert, down 90%. So we're relieved for long term holders to see a bit of uplift. The thing to think about is whether the business has really turned around. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for GCL New Energy Holdings

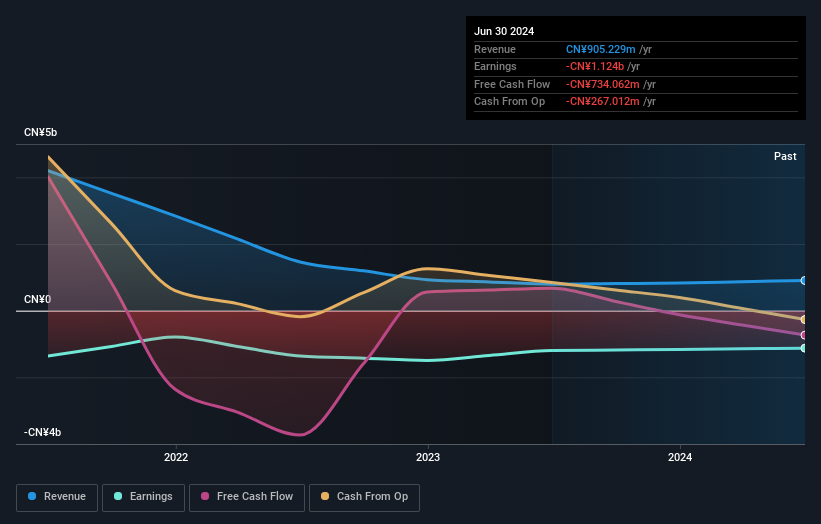

GCL New Energy Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, GCL New Energy Holdings' revenue dropped 63% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 24%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on GCL New Energy Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that GCL New Energy Holdings shareholders have received a total shareholder return of 31% over the last year. There's no doubt those recent returns are much better than the TSR loss of 13% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for GCL New Energy Holdings (of which 2 make us uncomfortable!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.