As we approach the end of 2024, global markets have shown mixed signals with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains amidst a holiday-shortened week. While large-cap growth stocks initially led the rally, small-cap indices like the S&P 600 have faced challenges due to declining manufacturing data and fluctuating unemployment claims, highlighting a complex economic landscape for smaller companies. In this environment, identifying promising small-cap stocks often involves examining those with strong fundamentals and notable insider activity, as these factors can signal potential resilience or growth prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 25.1x | 0.8x | 27.04% | ★★★★★☆ |

| Maharashtra Seamless | 10.6x | 1.8x | 33.15% | ★★★★★☆ |

| Calfrac Well Services | 11.5x | 0.2x | 37.36% | ★★★★★☆ |

| Avia Avian | 15.1x | 3.5x | 18.67% | ★★★★☆☆ |

| Healius | NA | 0.6x | 11.64% | ★★★★☆☆ |

| German American Bancorp | 14.7x | 4.9x | 45.89% | ★★★☆☆☆ |

| Hemisphere Energy | 5.9x | 2.2x | -103.75% | ★★★☆☆☆ |

| RGC Resources | 17.1x | 2.4x | 22.09% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -79.03% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

BFF Bank (BIT:BFF)

Simply Wall St Value Rating: ★★★★★★

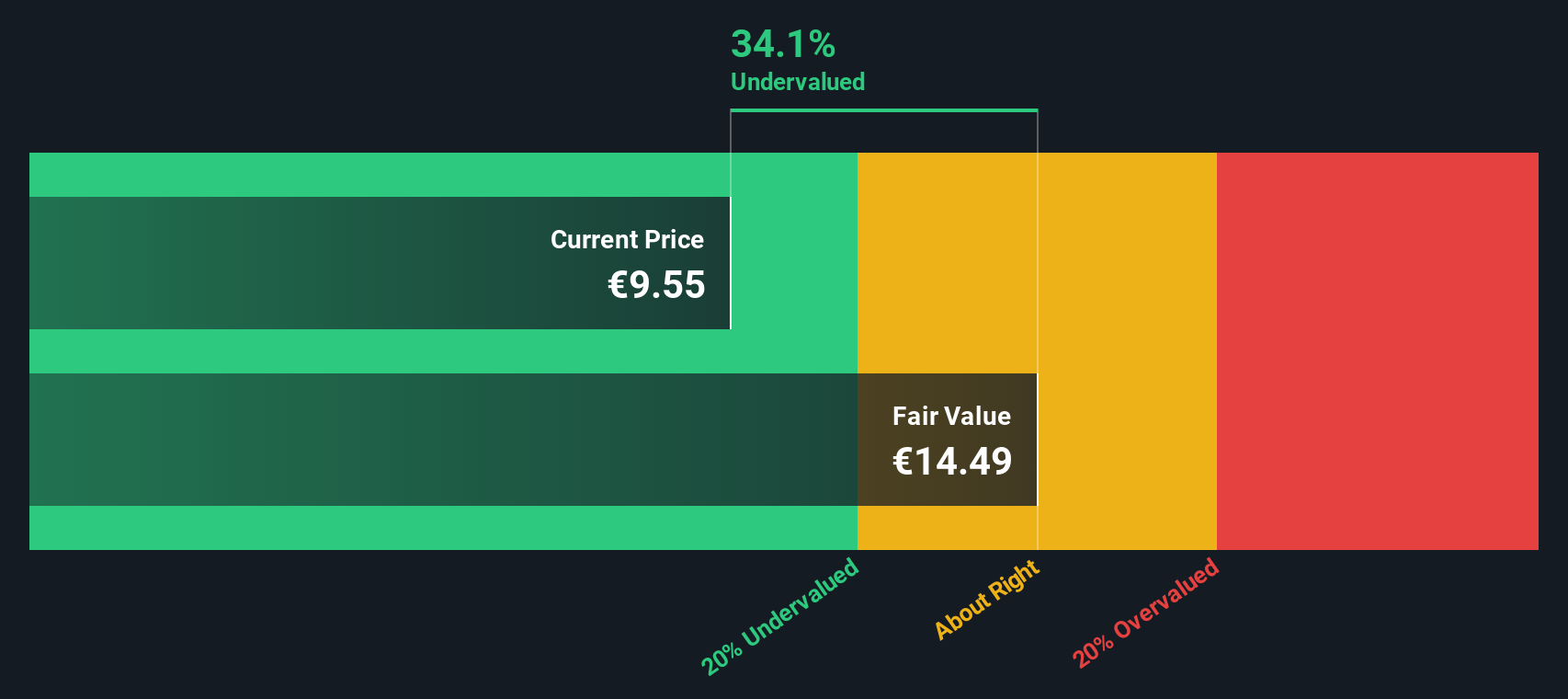

Overview: BFF Bank is a financial institution primarily engaged in providing commercial financial services, with a market capitalization of €1.25 billion.

Operations: The company generates revenue primarily from financial services, with a focus on commercial activities. Recent data indicates that the gross profit margin was 68.20% as of September 30, 2024, marking a decrease from previous periods where it often exceeded 89%. Operating expenses have shown variability, including instances of negative values due to adjustments or recoveries. The net income margin for the same period stood at approximately 50.26%, reflecting profitability trends over time.

PE: 6.9x

BFF Bank, a smaller company in the financial sector, recently reported a net income of €189.9 million for the nine months ending September 2024 and initiated a €300 million fixed-income offering. Insider confidence is evident as Massimiliano Belingheri purchased 64,102 shares valued at approximately €498,393 between October and November 2024. Despite relying entirely on external borrowing, which poses higher risks due to lack of customer deposits, earnings are projected to grow annually by 3.67%.

- Click to explore a detailed breakdown of our findings in BFF Bank's valuation report.

Gain insights into BFF Bank's past trends and performance with our Past report.

BHG Group (OM:BHG)

Simply Wall St Value Rating: ★★★★☆☆

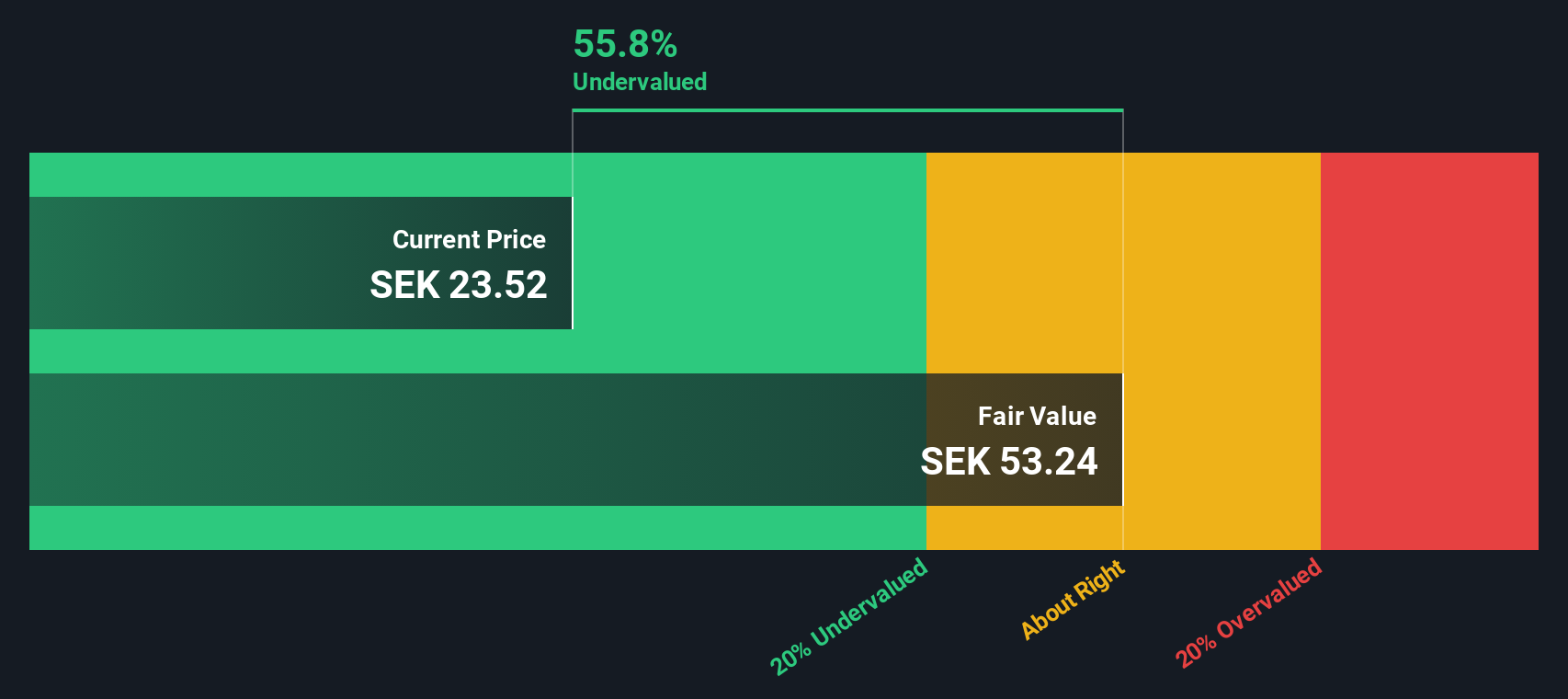

Overview: BHG Group is a company that operates in the e-commerce sector, focusing on segments like home improvement and premium living, with a market capitalization of SEK 2.58 billion.

Operations: The company generates revenue primarily from three segments: Home Improvement (SEK 5.16 billion), Value Home (SEK 2.52 billion), and Premium Living (SEK 2.28 billion). Over recent periods, the gross profit margin has shown variability, reaching as high as 19.15% in mid-2021 before fluctuating to around 16.48% in late 2024.

PE: -8.7x

BHG Group has caught attention as a potentially undervalued investment, especially with insider confidence shown by Martin Leo purchasing 60,000 shares for approximately SEK 1.01 million. Despite recent volatility in the share price and reliance on external borrowing, the company's financials reveal a narrowing net loss of SEK 67.2 million in Q3 2024 from SEK 1,308.8 million a year ago. With earnings forecasted to grow annually by over 113%, BHG's future prospects appear promising amidst ongoing restructuring efforts discussed in their shareholder meeting this December.

- Navigate through the intricacies of BHG Group with our comprehensive valuation report here.

Understand BHG Group's track record by examining our Past report.

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

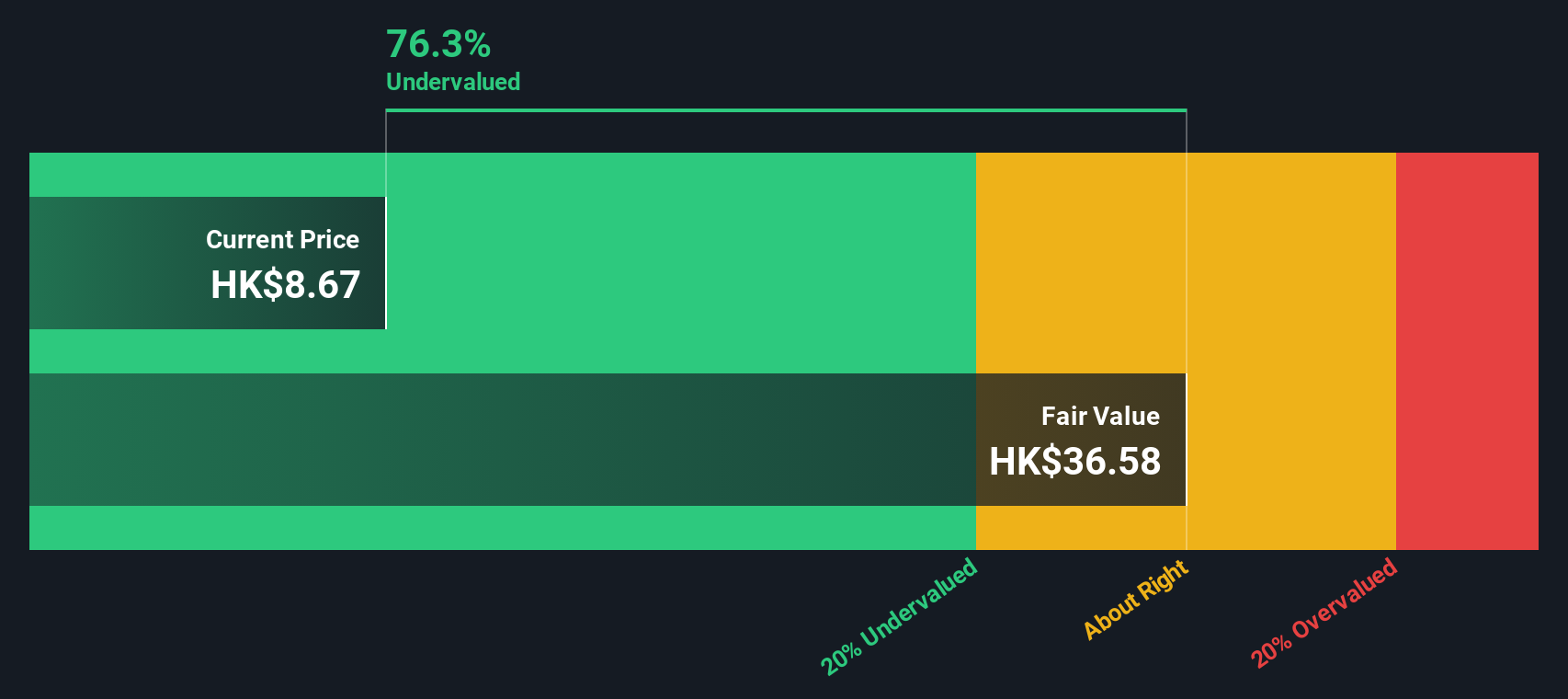

Overview: Wasion Holdings is engaged in the development and production of advanced metering infrastructure and distribution operations, with a market cap of CN¥3.45 billion.

Operations: The company's revenue streams are primarily derived from Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure. Over the period analyzed, the gross profit margin showed a notable upward trend, reaching 35.19% by June 2024. Operating expenses include significant allocations to sales & marketing and R&D activities.

PE: 10.8x

Wasion Holdings, a player in the smart metering industry, presents an intriguing opportunity for those exploring undervalued stocks. With earnings projected to grow by 22.78% annually, the company has caught attention despite relying entirely on external borrowing for funding. Insider confidence is evident as Founder & Executive Chairman Wei Ji purchased 1 million shares recently for approximately US$5.08 million, reflecting potential belief in future growth prospects amidst its small-cap positioning challenges.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this valuation report.

Evaluate Wasion Holdings' historical performance by accessing our past performance report.

Next Steps

- Click this link to deep-dive into the 187 companies within our Undervalued Small Caps With Insider Buying screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com