As global markets experience fluctuations, with U.S. consumer confidence falling and major stock indexes showing mixed results, investors are seeking opportunities that can navigate these uncertain times. Penny stocks, a term that may seem outdated but still relevant today, often represent smaller or newer companies with potential for growth at lower price points. By focusing on those with strong financials and solid fundamentals, investors can uncover hidden gems in this investment area that might offer both stability and potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,829 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Golden Solar New Energy Technology Holdings (SEHK:1121)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Solar New Energy Technology Holdings Limited is an investment holding company that manufactures and sells footwear products across various international markets, with a market cap of approximately HK$4.04 billion.

Operations: The company's revenue is primarily derived from its Original Equipment Manufacturer (OEM) segment, which generated CN¥209.30 million, followed by Photovoltaic Products at CN¥49.29 million, Graphene-Based Products at CN¥7.01 million, and Boree Products contributing CN¥1.72 million.

Market Cap: HK$4.04B

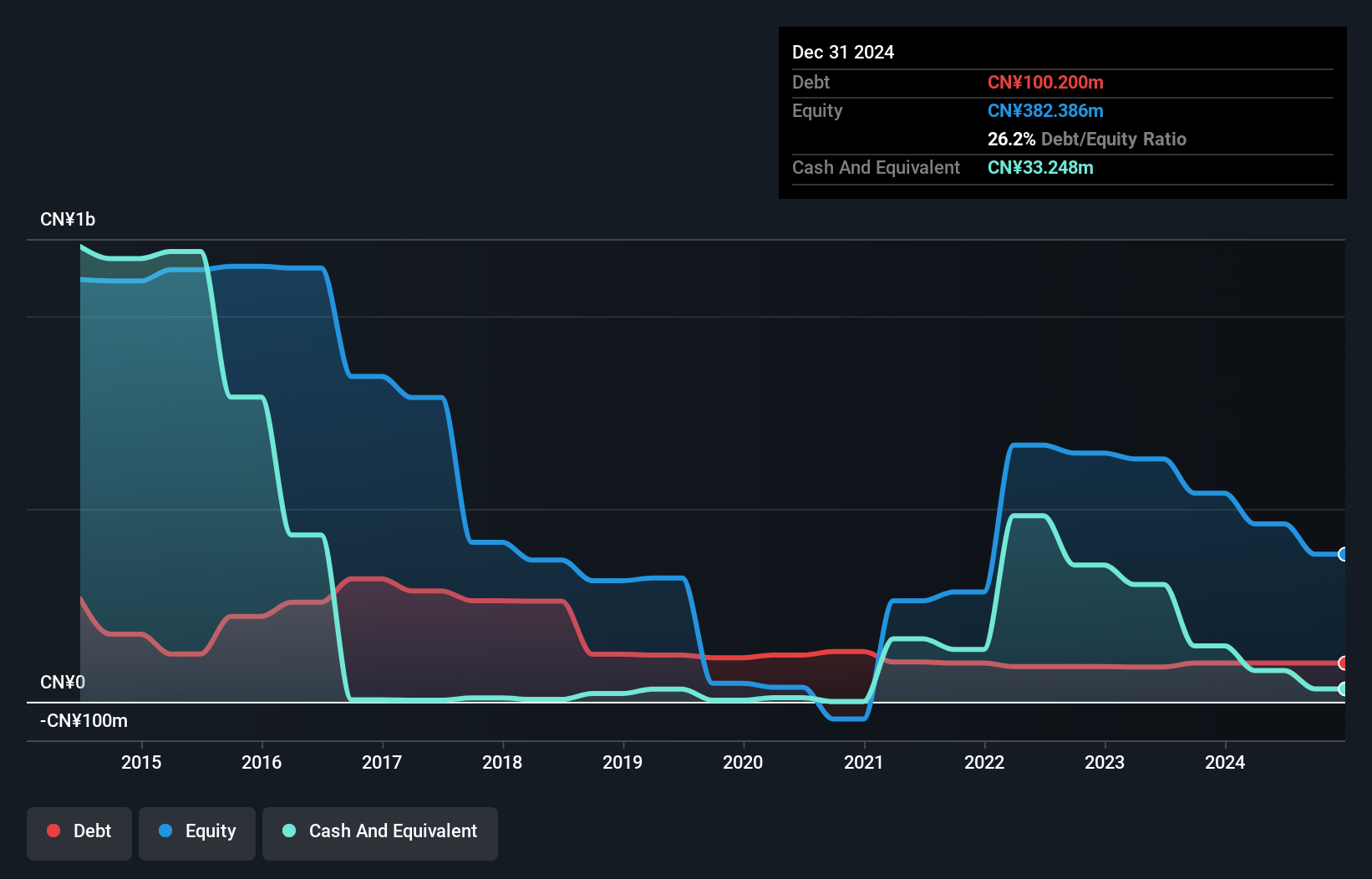

Golden Solar New Energy Technology Holdings Limited is navigating financial challenges, with a negative return on equity and ongoing unprofitability. Despite this, the company maintains a satisfactory net debt to equity ratio of 4.2% and has not experienced significant shareholder dilution recently. Its short-term assets exceed both short and long-term liabilities, providing some financial stability. Recent developments include an agreement for constructing a high-efficiency photovoltaic power station in China, potentially enhancing its Photovoltaic Products segment. However, the company's cash runway remains limited to less than one year if free cash flow continues to decrease at historical rates.

- Click here to discover the nuances of Golden Solar New Energy Technology Holdings with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Golden Solar New Energy Technology Holdings' track record.

SenseTime Group (SEHK:20)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SenseTime Group Inc. is an investment holding company that develops and sells artificial intelligence software platforms across the People's Republic of China, Northeast Asia, Southeast Asia, and internationally, with a market cap of approximately HK$53.77 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to CN¥3.71 billion.

Market Cap: HK$53.77B

SenseTime Group is currently unprofitable, yet it has shown progress by reducing losses at a rate of 14.4% per year over the past five years. The company maintains positive shareholder equity, a significant improvement from negative equity five years ago. Despite recent shareholder dilution and high share price volatility, SenseTime's financial position remains robust with short-term assets of CN¥16.2 billion covering both short-term and long-term liabilities comfortably. Additionally, its cash reserves exceed total debt, providing a sufficient cash runway for over three years if free cash flow continues to reduce at historical rates of 23.4% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of SenseTime Group.

- Review our growth performance report to gain insights into SenseTime Group's future.

Digital Domain Holdings (SEHK:547)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Digital Domain Holdings Limited is an investment holding company involved in the media entertainment and trading sectors across various countries, with a market capitalization of HK$3.91 billion.

Operations: The company's revenue is primarily derived from the Media Entertainment segment, which generated HK$503.44 million.

Market Cap: HK$3.91B

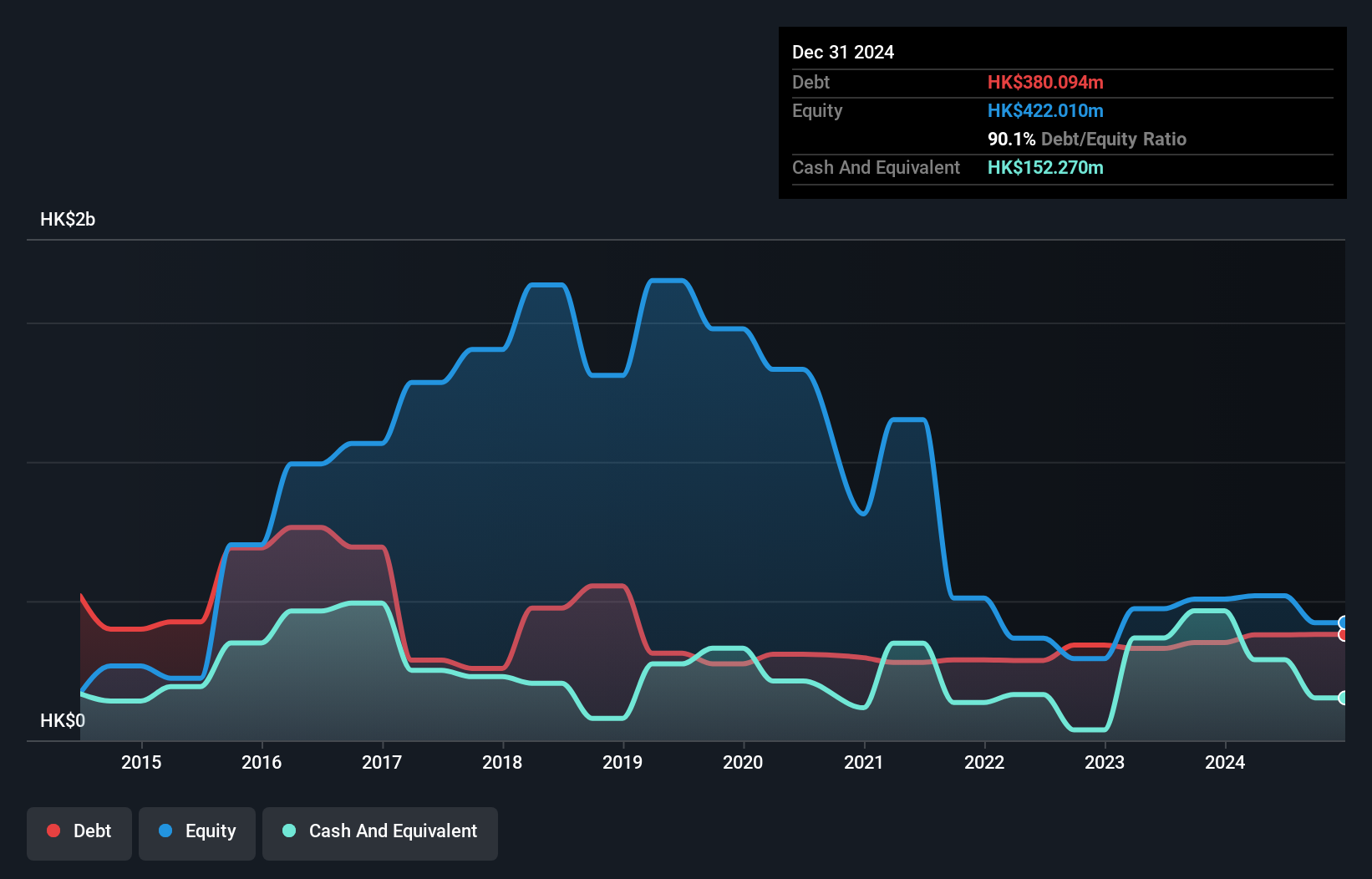

Digital Domain Holdings Limited, despite being unprofitable, has demonstrated resilience by reducing losses over the past five years. The company’s financial position is stable, with short-term assets of HK$635.6 million exceeding both short-term and long-term liabilities. Recent collaboration with Amazon Web Services aims to enhance its Autonomous Virtual Human technology's scalability and global reach across various industries. However, shareholder dilution has occurred recently, and the company faces a limited cash runway if growth continues at historical rates. A special shareholders meeting is scheduled to discuss strategic agreements that could impact future operations.

- Navigate through the intricacies of Digital Domain Holdings with our comprehensive balance sheet health report here.

- Gain insights into Digital Domain Holdings' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Take a closer look at our Penny Stocks list of 5,829 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com