Those holding YesAsia Holdings Limited (HKG:2209) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. This latest share price bounce rounds out a remarkable 846% gain over the last twelve months.

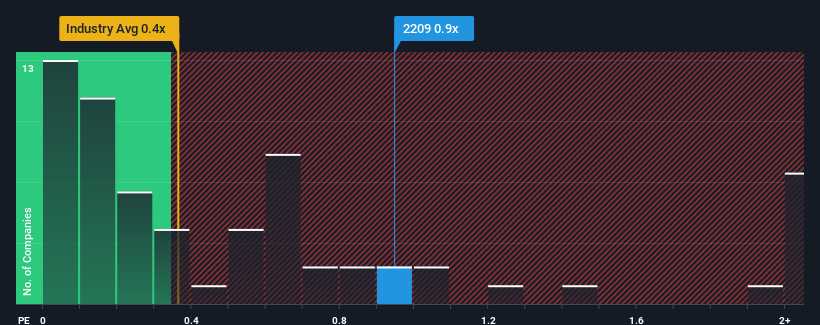

After such a large jump in price, you could be forgiven for thinking YesAsia Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 0.9x, considering almost half the companies in Hong Kong's Specialty Retail industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for YesAsia Holdings

What Does YesAsia Holdings' Recent Performance Look Like?

Recent times have been advantageous for YesAsia Holdings as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on YesAsia Holdings.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like YesAsia Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 75% gain to the company's top line. The latest three year period has also seen an excellent 42% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 62% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 30%, which is noticeably less attractive.

With this information, we can see why YesAsia Holdings is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On YesAsia Holdings' P/S

YesAsia Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that YesAsia Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for YesAsia Holdings (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on YesAsia Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.