Global markets have been navigating a complex landscape, marked by the Federal Reserve's cautious approach to interest rate cuts and political uncertainties like potential government shutdowns. Amidst these broader economic shifts, investors are turning their attention to penny stocks—traditionally lower-priced shares of smaller or newer companies—that might offer unique opportunities for growth. Despite their somewhat outdated moniker, penny stocks can still hold significant potential when backed by strong financial health, making them an intriguing area for those looking to uncover hidden value in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,850 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Goodbaby International Holdings (SEHK:1086)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Goodbaby International Holdings Limited is an investment holding company that focuses on the research, development, design, manufacture, marketing, and sale of durable juvenile products across Europe, North America, Mainland China, and other international markets with a market cap of HK$1.47 billion.

Operations: The company's revenue from car seats and accessories amounts to HK$3.59 billion.

Market Cap: HK$1.47B

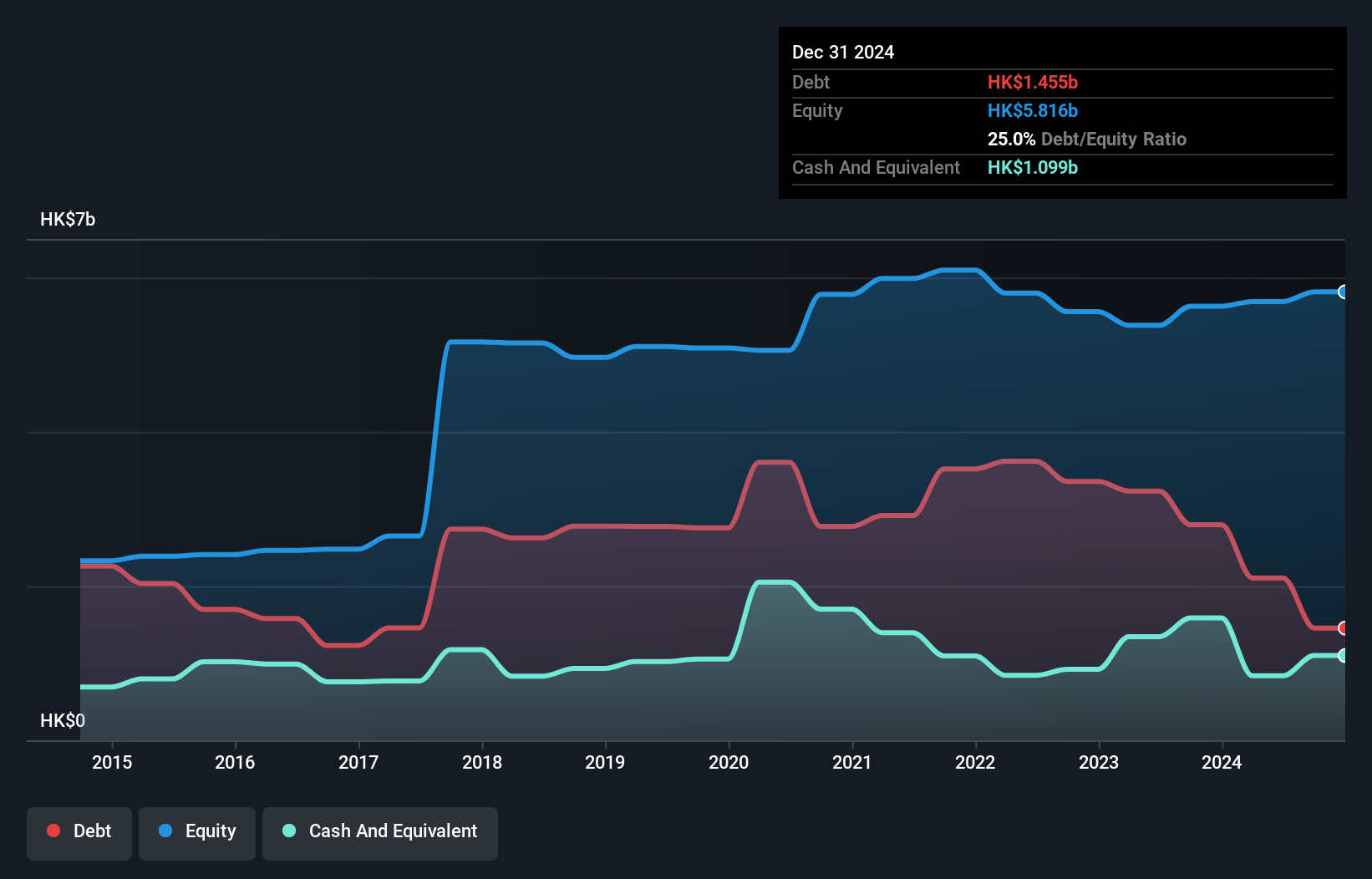

Goodbaby International Holdings has demonstrated significant earnings growth of 507.1% over the past year, surpassing industry trends, though this was partially influenced by a large one-off gain. The company reported revenues of HK$6.49 billion for the first nine months of 2024, reflecting an increase from the previous year. Despite its high volatility and relatively low return on equity at 6.4%, Goodbaby maintains satisfactory debt levels with net debt to equity at 22.3%. Its short-term assets cover both short-term and long-term liabilities, indicating solid financial stability amidst a less experienced management team with an average tenure of 1.8 years.

- Get an in-depth perspective on Goodbaby International Holdings' performance by reading our balance sheet health report here.

- Learn about Goodbaby International Holdings' future growth trajectory here.

Modern Innovative Digital Technology (SEHK:2322)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Innovative Digital Technology Company Limited operates in trading, money lending and factoring, as well as finance leasing and financial services in the People’s Republic of China and Hong Kong, with a market cap of HK$3.09 billion.

Operations: The company generates revenue from several segments, including Trading (HK$60.02 million), Money Lending and Factoring (HK$16.18 million), Finance Leasing (HK$10.57 million), and Financial Services (HK$5.82 million).

Market Cap: HK$3.09B

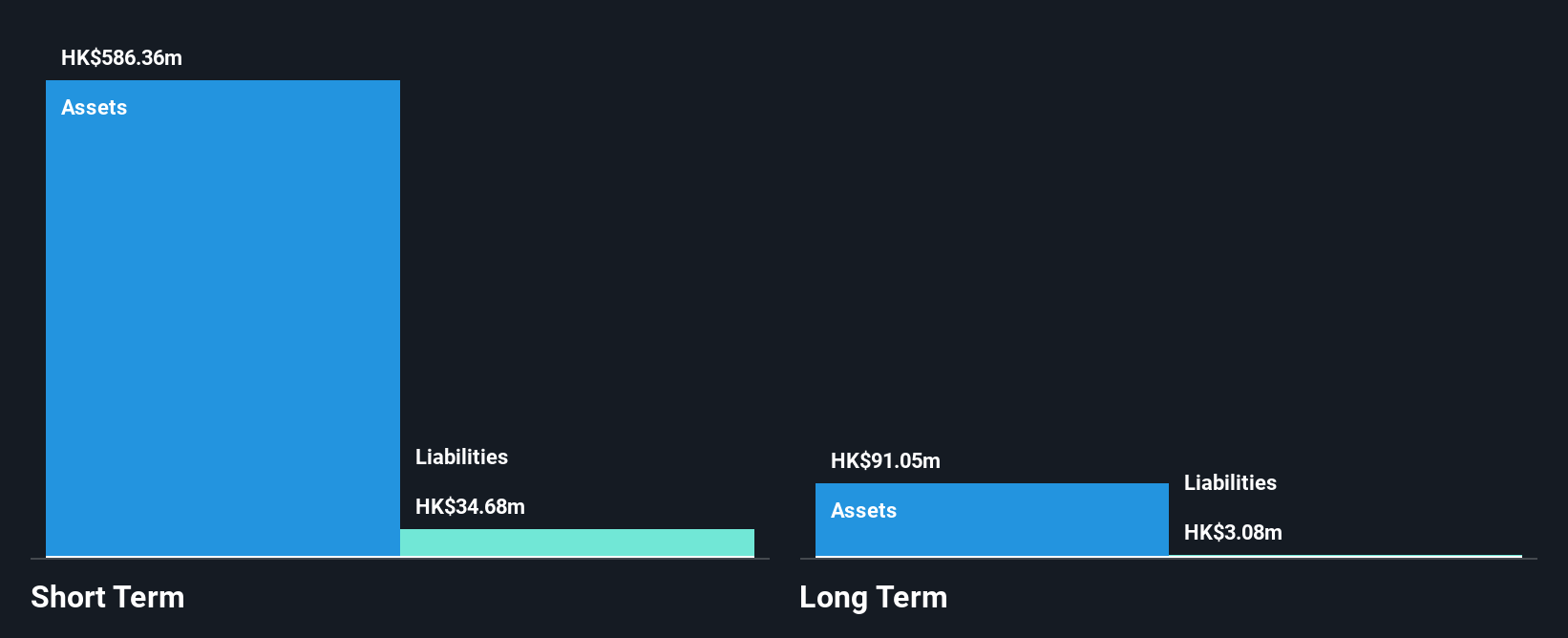

Modern Innovative Digital Technology Company Limited, with a market cap of HK$3.09 billion, operates across multiple revenue streams including Trading (HK$60.02 million) and Money Lending (HK$16.18 million). Despite being debt-free, the company is currently unprofitable with increasing losses over five years at 34.2% annually and reported a net loss of HK$30.68 million for the recent half year. Recent board changes include appointing Mr. Han Zhenghai as Deputy Chairman and Ms. Cao Li as Executive Director, potentially bringing fresh strategic perspectives to address financial challenges amidst stable weekly volatility at 7%.

- Jump into the full analysis health report here for a deeper understanding of Modern Innovative Digital Technology.

- Explore historical data to track Modern Innovative Digital Technology's performance over time in our past results report.

North East Rubber (SET:NER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: North East Rubber Public Company Limited manufactures and sells rubber products in Thailand with a market cap of THB8.61 billion.

Operations: The company generates revenue of THB25.15 billion from its Rubber Smoked Sheets, Skim Block Rubbers, and other rubber products.

Market Cap: THB8.61B

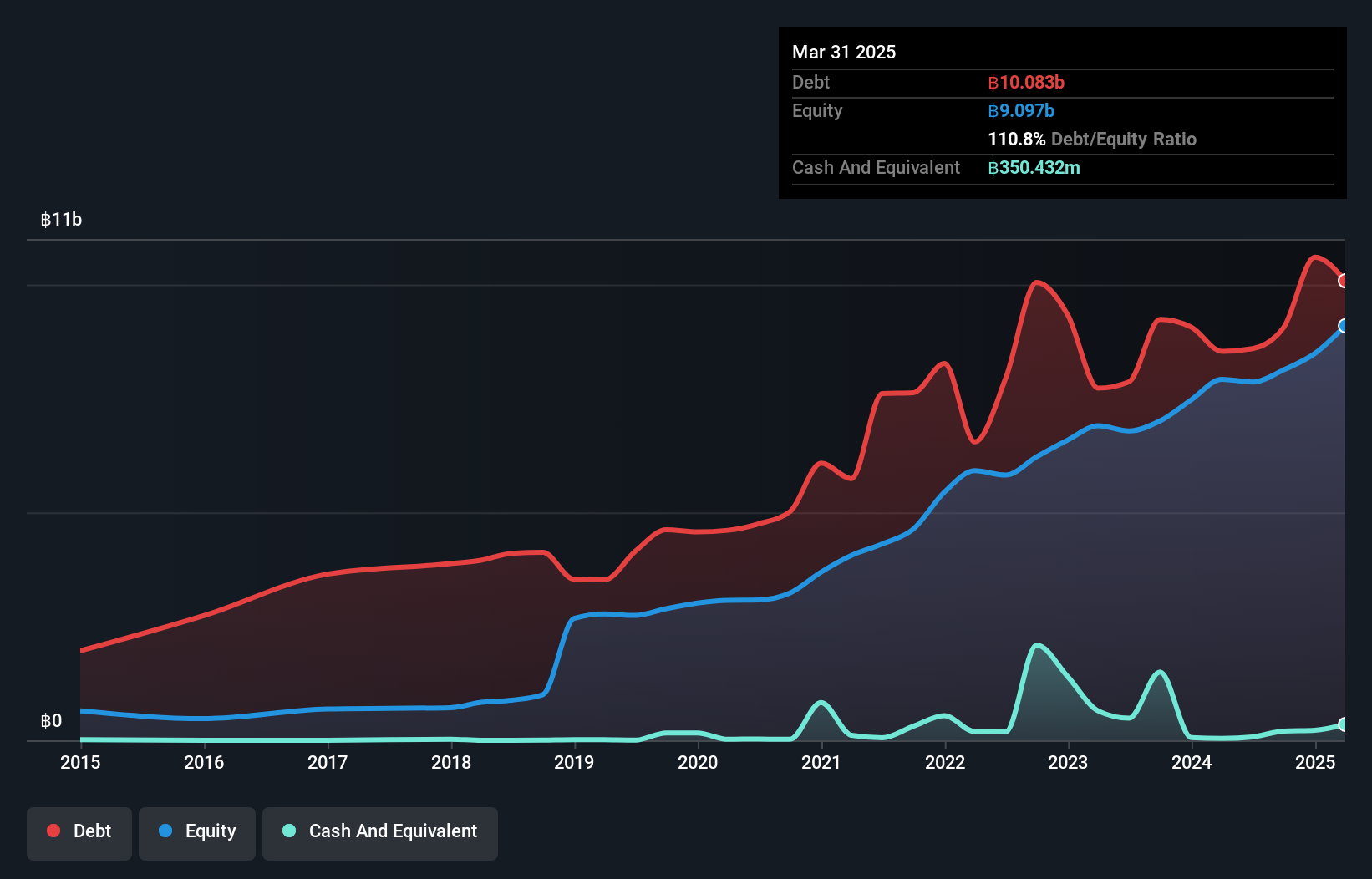

North East Rubber Public Company Limited, with a market cap of THB8.61 billion, reported strong revenue growth in its recent earnings announcement, reaching THB6.31 billion for the third quarter. However, its high net debt to equity ratio of 109% and insufficient operating cash flow coverage highlight financial leverage concerns. The company's interest payments are well covered by EBIT at 4.8 times, indicating manageable debt servicing despite the leverage level. Analysts expect earnings to grow annually by 12.8%, supported by a solid return on equity of 21.59%, though this is affected by high debt levels influencing profitability metrics positively.

- Unlock comprehensive insights into our analysis of North East Rubber stock in this financial health report.

- Review our growth performance report to gain insights into North East Rubber's future.

Make It Happen

- Unlock more gems! Our Penny Stocks screener has unearthed 5,847 more companies for you to explore.Click here to unveil our expertly curated list of 5,850 Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com