While it may not be enough for some shareholders, we think it is good to see the China Mengniu Dairy Company Limited (HKG:2319) share price up 23% in a single quarter. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 60% in that period. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for China Mengniu Dairy

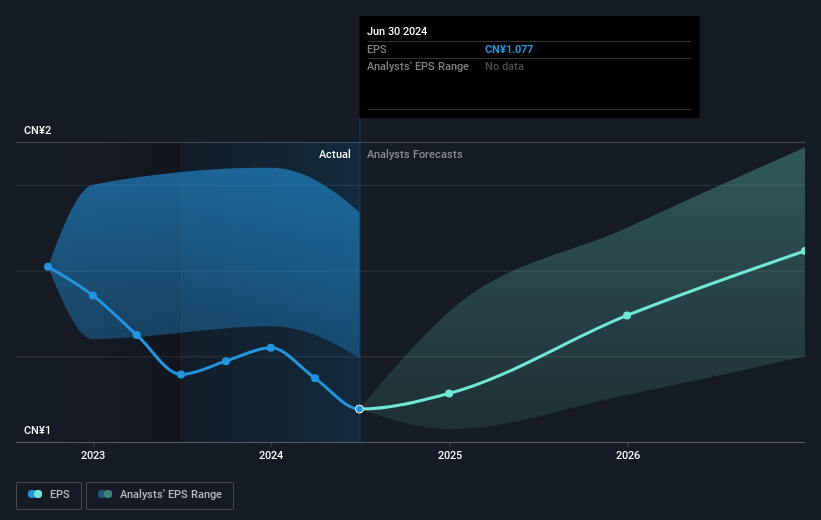

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, China Mengniu Dairy's earnings per share (EPS) dropped by 6.8% each year. This reduction in EPS is slower than the 26% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into China Mengniu Dairy's key metrics by checking this interactive graph of China Mengniu Dairy's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, China Mengniu Dairy's TSR for the last 3 years was -57%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in China Mengniu Dairy had a tough year, with a total loss of 6.5% (including dividends), against a market gain of about 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 7% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before forming an opinion on China Mengniu Dairy you might want to consider these 3 valuation metrics.

Of course China Mengniu Dairy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.