Despite an already strong run, Haosen Fintech Group Limited (HKG:3848) shares have been powering on, with a gain of 43% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

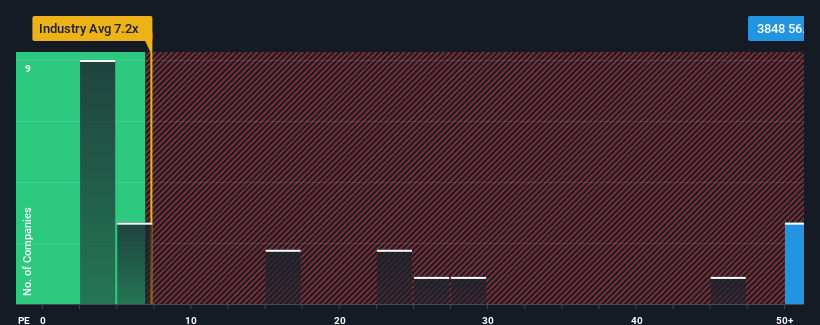

After such a large jump in price, Haosen Fintech Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 56.9x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Haosen Fintech Group's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Haosen Fintech Group

How Is Haosen Fintech Group's Growth Trending?

Haosen Fintech Group's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 63%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 22% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Haosen Fintech Group's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Haosen Fintech Group's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Haosen Fintech Group currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Haosen Fintech Group is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Haosen Fintech Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.