As global markets navigate a complex landscape with mixed performances across major indexes, investors are eyeing opportunities in various corners of the market. Penny stocks, often representing smaller or newer companies, remain a relevant investment area despite being considered somewhat outdated. These stocks can provide growth potential at lower price points and may offer compelling opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £778.02M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.39 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,813 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Electricité et Eaux de Madagascar Société Anonyme (ENXTPA:EEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Electricité et Eaux de Madagascar Société Anonyme operates in the luxury hotel industry in Cambodia and has a market capitalization of €17.56 million.

Operations: The company generates its revenue primarily from real estate, amounting to €0.23 million.

Market Cap: €17.56M

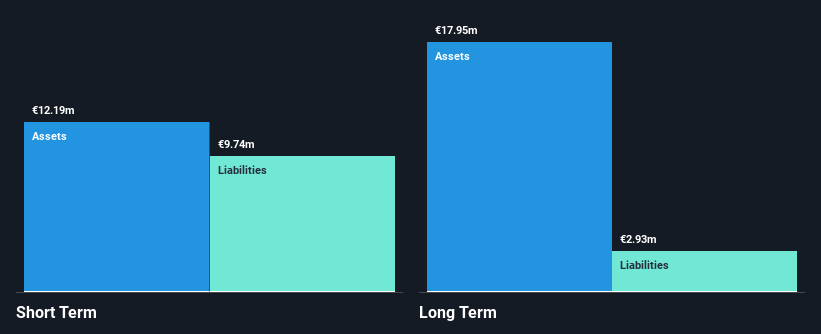

Electricité et Eaux de Madagascar Société Anonyme, with a market cap of €17.56 million, operates in the luxury hotel industry in Cambodia and is pre-revenue, generating only €0.34 million. The company recently reported a net loss of €1.25 million for the half-year ended June 2024, reversing from a net income of €6.39 million last year. Despite having more cash than total debt and covering its liabilities with short-term assets (€12.2M), its operating cash flow remains negative and share price volatility is high compared to other French stocks, indicating potential risks for investors considering this penny stock.

- Get an in-depth perspective on Electricité et Eaux de Madagascar Société Anonyme's performance by reading our balance sheet health report here.

- Understand Electricité et Eaux de Madagascar Société Anonyme's track record by examining our performance history report.

Four Seas Mercantile Holdings (SEHK:374)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Four Seas Mercantile Holdings Limited is an investment holding company involved in the manufacture and trade of snack foods, confectionery, beverages, frozen food products, noodles, and ham-related products in Hong Kong and Mainland China, with a market cap of approximately HK$998.89 million.

Operations: The company's revenue is primarily derived from its food processing segment, which generated HK$3.66 billion.

Market Cap: HK$998.89M

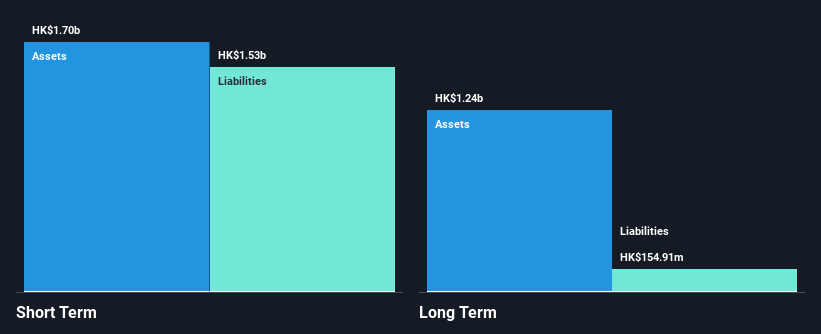

Four Seas Mercantile Holdings, with a market cap of HK$998.89 million, reported sales of HK$1.72 billion for the half-year ended September 2024, down from HK$1.95 billion the previous year, and net income decreased to HK$20.46 million from HK$30.27 million. Despite a seasoned management team and board, its debt-to-equity ratio has risen over five years to 77.8%, posing potential risks alongside low interest coverage (1.8x). However, earnings have grown significantly by 96.9% in the past year compared to industry decline and are well-covered by operating cash flow at 34.7%.

- Unlock comprehensive insights into our analysis of Four Seas Mercantile Holdings stock in this financial health report.

- Explore historical data to track Four Seas Mercantile Holdings' performance over time in our past results report.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products in China and internationally, with a market cap of HK$4.42 billion.

Operations: The company generates revenue primarily from its business operations in the PRC, amounting to CN¥1.11 billion.

Market Cap: HK$4.42B

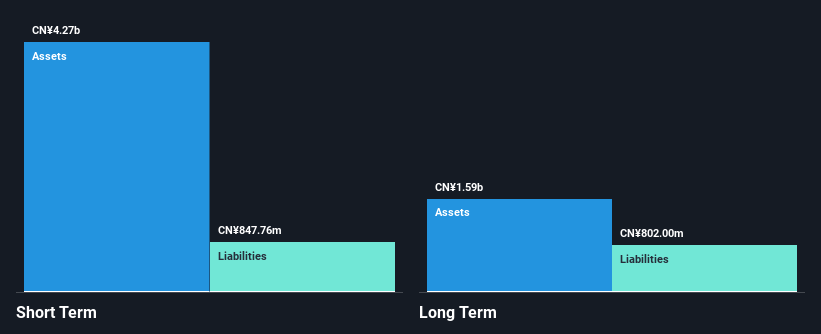

Global New Material International Holdings, with a market cap of HK$4.42 billion, primarily generates revenue from its operations in China, totaling CN¥1.11 billion. The company's earnings have grown modestly by 0.9% over the past year but are forecasted to increase significantly at 31.24% annually. Its financial stability is supported by short-term assets (CN¥4.3 billion) exceeding both short and long-term liabilities and more cash than total debt, ensuring liquidity and coverage of interest payments (6.3x EBIT). Recent board appointments could enhance strategic direction given Mr. LIM's extensive industry expertise in pearl pigments.

- Click to explore a detailed breakdown of our findings in Global New Material International Holdings' financial health report.

- Examine Global New Material International Holdings' earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Discover the full array of 5,813 Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com