As global markets navigate a period of mixed performance, with major indices showing varied results and central banks adjusting interest rates, investors are increasingly attentive to potential opportunities in undervalued stocks. In this environment, identifying stocks trading below their fair value can be crucial for those looking to capitalize on market inefficiencies and position themselves advantageously amid economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.90 | ₹2254.60 | 49.9% |

| Kuaishou Technology (SEHK:1024) | HK$42.75 | HK$85.08 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.362 | £0.72 | 49.7% |

| Lindab International (OM:LIAB) | SEK225.40 | SEK450.75 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.84 | 49.9% |

| GlobalData (AIM:DATA) | £1.875 | £3.75 | 50% |

| Western Alliance Bancorporation (NYSE:WAL) | US$82.86 | US$165.30 | 49.9% |

| HealthEquity (NasdaqGS:HQY) | US$94.76 | US$189.22 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.12 | CN¥22.17 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.62 | A$9.23 | 49.9% |

Let's explore several standout options from the results in the screener.

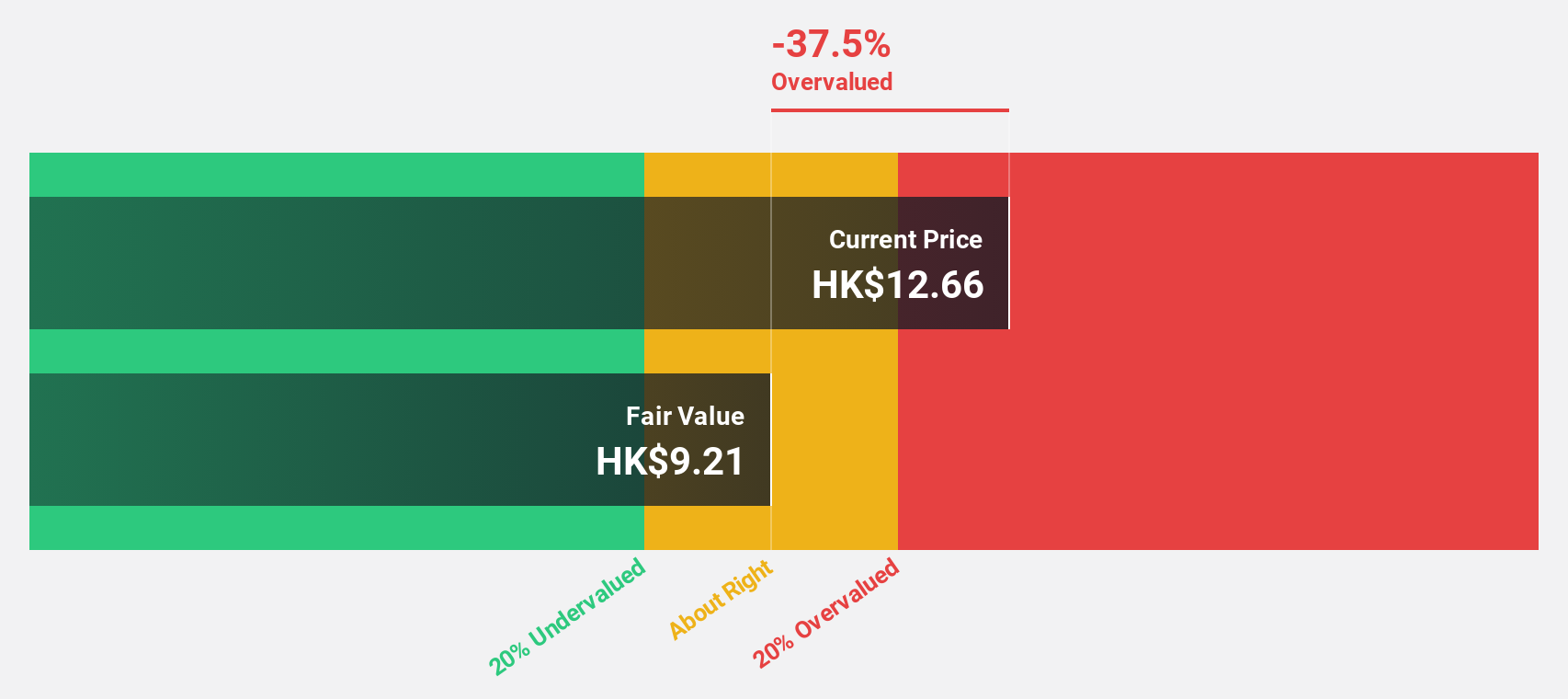

Yeahka (SEHK:9923)

Overview: Yeahka Limited, with a market cap of HK$3.74 billion, is an investment holding company that offers payment and business services to merchants and consumers in the People’s Republic of China.

Operations: The company generates revenue from its Business Services segment, totaling CN¥3.47 billion.

Estimated Discount To Fair Value: 22%

Yeahka is trading 22% below its estimated fair value of HK$11.74, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 38.5% annually, outpacing the Hong Kong market's growth rate, and revenue is expected to increase faster than the market average. However, recent insider selling could raise concerns. The appointment of Mr. Ouyang Rihui as an independent non-executive director may enhance strategic digital upgrades and fintech services development.

- Upon reviewing our latest growth report, Yeahka's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Yeahka with our comprehensive financial health report here.

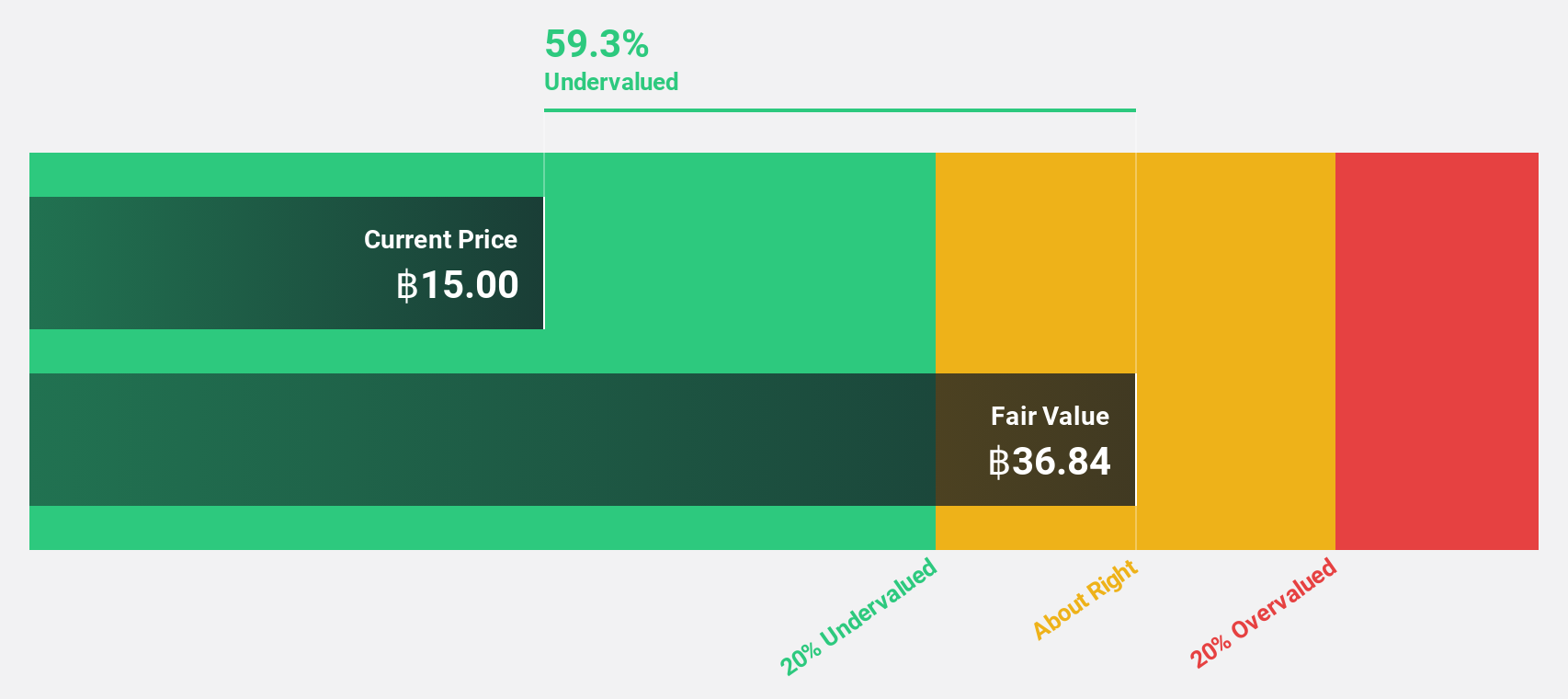

SISB (SET:SISB)

Overview: SISB Public Company Limited provides educational services and has a market cap of THB28.44 billion.

Operations: The company generates revenue from its International School segment, amounting to THB2.32 billion.

Estimated Discount To Fair Value: 44.9%

SISB is trading 44.9% below its estimated fair value of THB54.93, highlighting potential undervaluation based on cash flows. Recent earnings grew by a very large margin over the past year, with revenue and net income showing strong increases for the third quarter and nine months of 2024. Forecasts indicate earnings growth at 21.87% annually, surpassing Thailand's market rate, while revenue is expected to grow faster than the market average at 14.6% per year.

- According our earnings growth report, there's an indication that SISB might be ready to expand.

- Unlock comprehensive insights into our analysis of SISB stock in this financial health report.

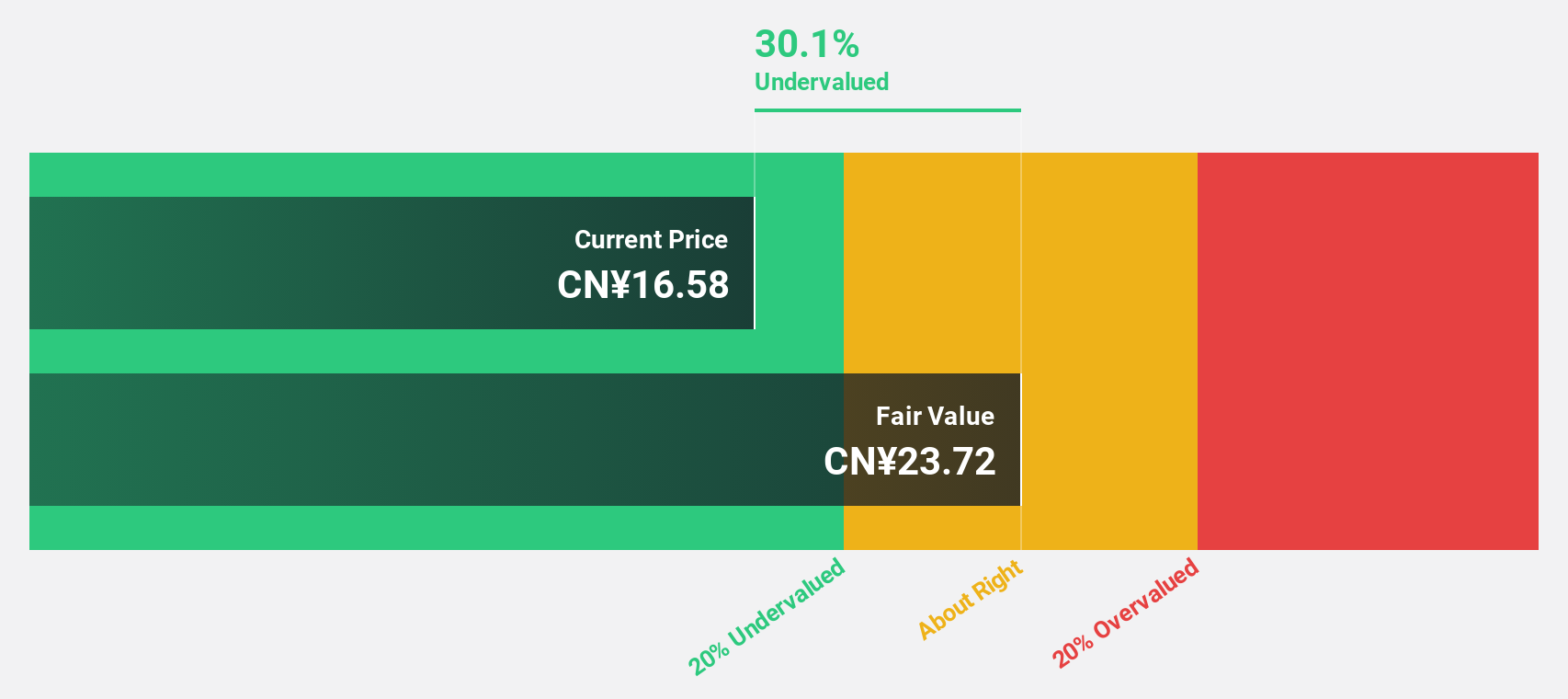

Beijing ConST Instruments Technology (SZSE:300445)

Overview: Beijing ConST Instruments Technology Inc. researches, develops, manufactures, and sells digital testing instruments and equipment in China and internationally, with a market cap of CN¥3.63 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 39.9%

Beijing ConST Instruments Technology is trading 39.9% below its estimated fair value of CN¥29.5, suggesting potential undervaluation based on cash flows. The company reported nine-month sales of CN¥358.21 million, up from CN¥331.46 million a year earlier, with net income rising to CN¥89.42 million from CN¥70.16 million last year. Forecasts predict earnings growth of 26.93% annually, outpacing the Chinese market's rate and revenue growth exceeding 20% per year.

- In light of our recent growth report, it seems possible that Beijing ConST Instruments Technology's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Beijing ConST Instruments Technology.

Key Takeaways

- Delve into our full catalog of 884 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com