As global markets navigate a complex landscape with major indices showing mixed performances, the technology-heavy Nasdaq Composite has managed to hit a record high amidst broader declines. This backdrop of economic uncertainty and shifting monetary policies underscores the importance of identifying tech stocks that demonstrate resilience and potential for growth, making them worth watching in December 2024.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1316 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

NCAB Group (OM:NCAB)

Simply Wall St Growth Rating: ★★★★★☆

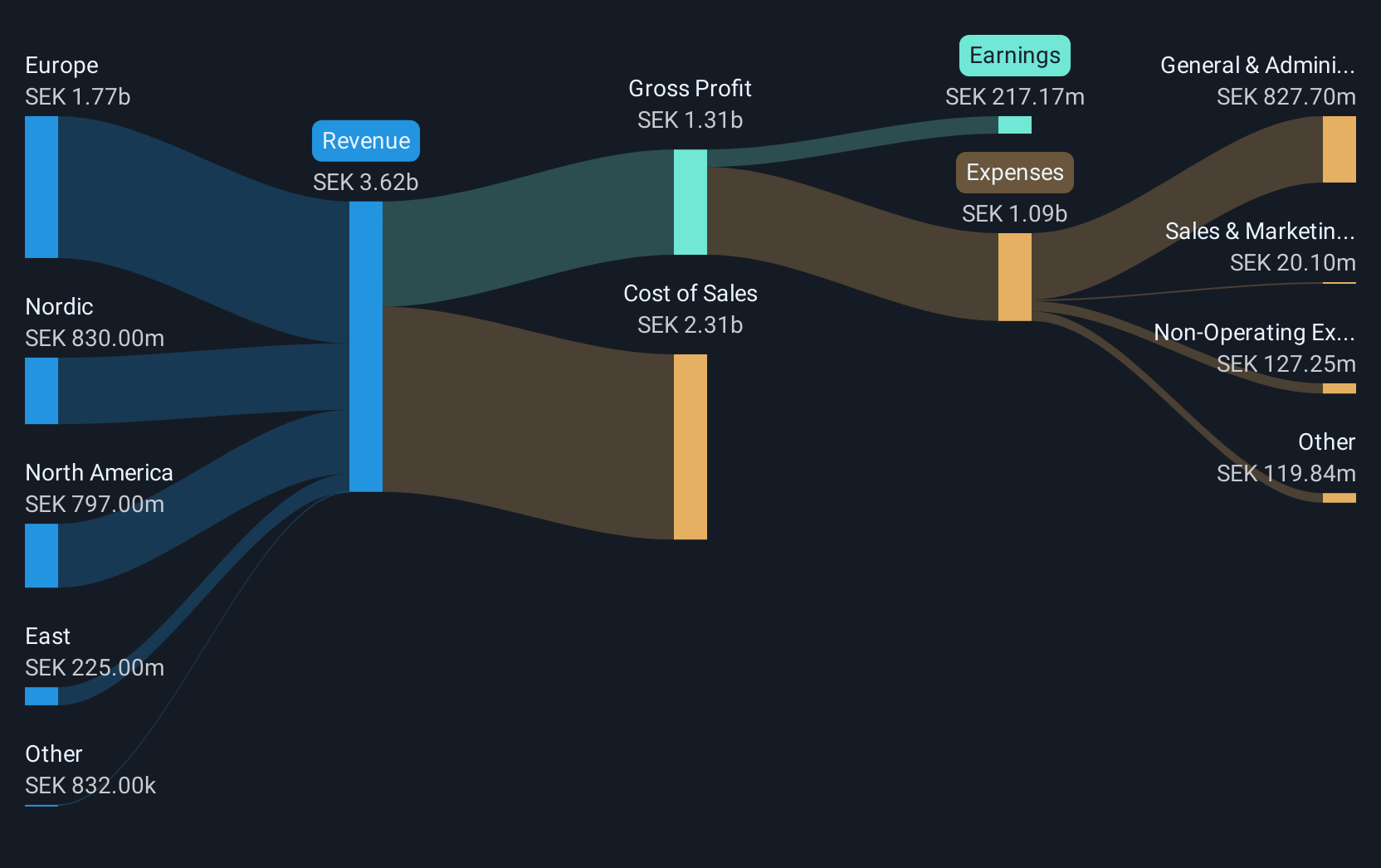

Overview: NCAB Group AB (publ) is a company that manufactures and sells printed circuit boards across Sweden, the Nordic region, Europe, North America, and Asia with a market capitalization of approximately SEK11.69 billion.

Operations: NCAB Group AB focuses on the production and sale of printed circuit boards, with significant revenue contributions from Europe (SEK1.91 billion) and North America (SEK786.7 million).

NCAB Group, navigating a challenging landscape with a recent 31.2% dip in earnings, contrasts sharply with its industry's 10.3% growth. Yet, forecasts are more optimistic, predicting an annual revenue increase of 11.4% and earnings growth of 24.2%, outpacing the Swedish market projections of 1.3% and 14.7%, respectively. This resilience is underscored by a robust forecasted Return on Equity at 26.7%. Despite these promising figures, substantial insider selling over the past three months could signal caution among those closest to company operations.

- Navigate through the intricacies of NCAB Group with our comprehensive health report here.

Explore historical data to track NCAB Group's performance over time in our Past section.

Cathay Group Holdings (SEHK:1981)

Simply Wall St Growth Rating: ★★★★☆☆

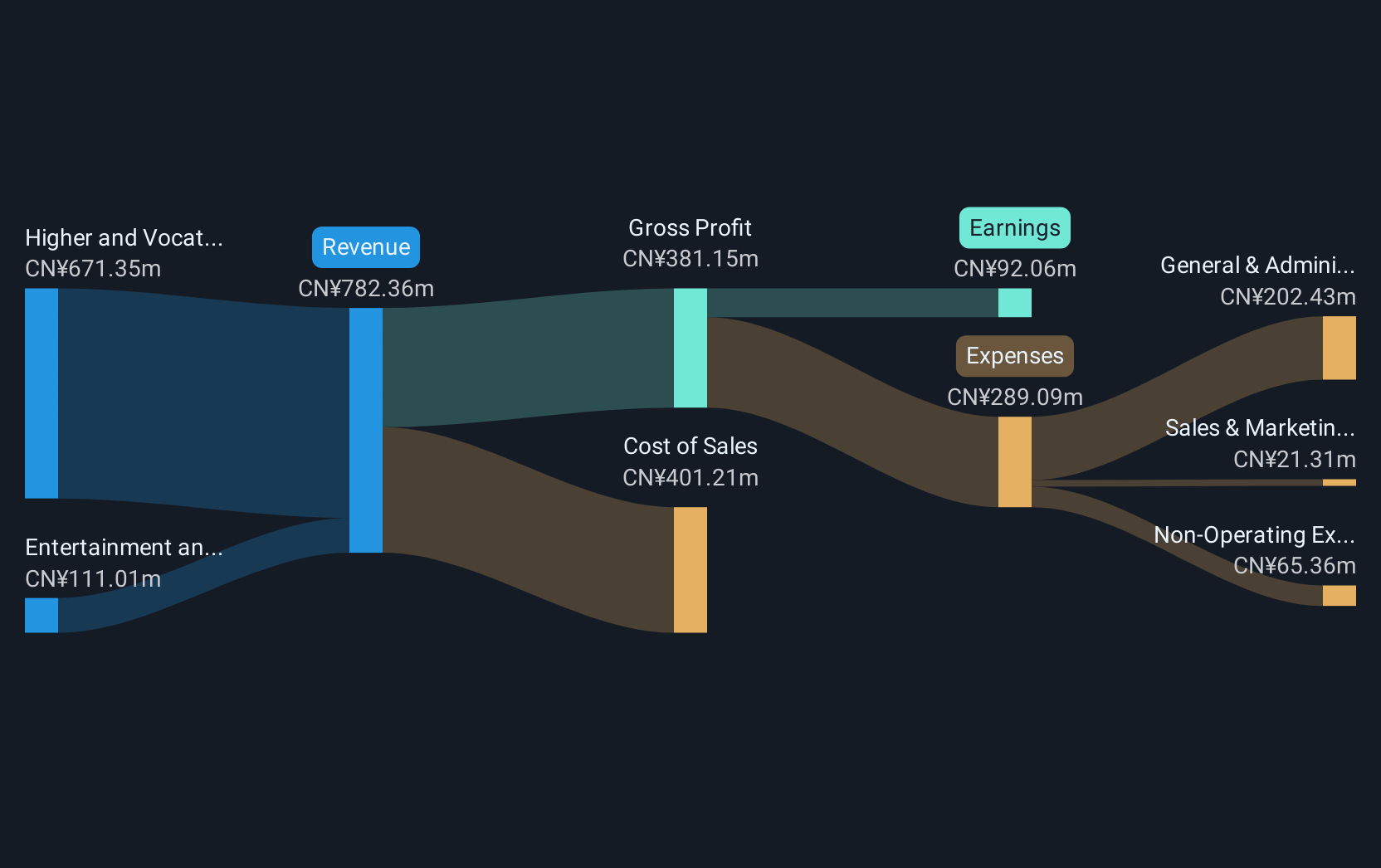

Overview: Cathay Group Holdings Inc. is an investment holding company involved in entertainment production and higher education in China and internationally, with a market cap of HK$2.30 billion.

Operations: Cathay Group Holdings Inc. generates revenue primarily from higher and vocational education, contributing CN¥606.66 million, and entertainment and livestreaming e-commerce, which brings in CN¥162.17 million. The company's operations span both domestic and international markets within these sectors.

Cathay Group Holdings, amidst a dynamic tech landscape, forecasts an impressive 98.76% annual earnings growth and an 8.7% increase in revenue per year, outstripping the Hong Kong market's 7.8% expansion pace. This robust growth trajectory is further bolstered by strategic R&D investments, positioning them well against peers despite current unprofitability. The recent move to a new business address in Hong Kong underscores their expansion and adaptability within the competitive tech sector, promising potential for future scalability and market penetration.

- Unlock comprehensive insights into our analysis of Cathay Group Holdings stock in this health report.

Understand Cathay Group Holdings' track record by examining our Past report.

Infomart (TSE:2492)

Simply Wall St Growth Rating: ★★★★★☆

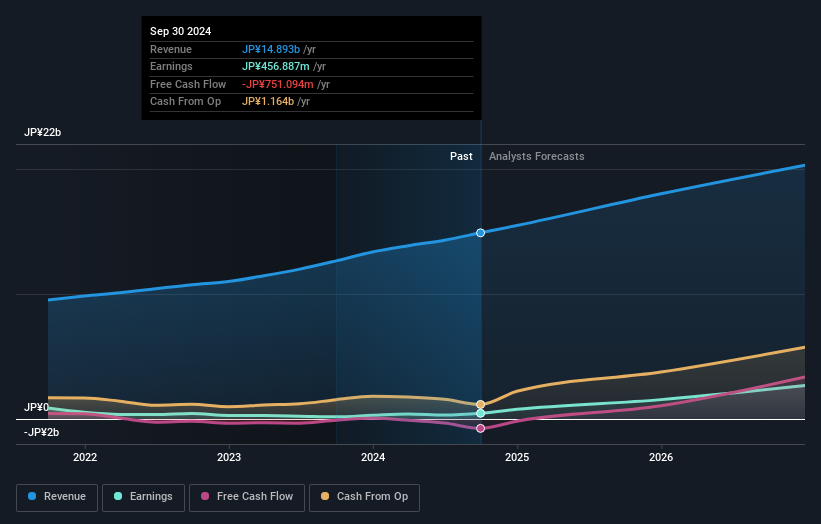

Overview: Infomart Corporation operates an online BtoB e-commerce trading platform for the food industry in Japan, with a market capitalization of approximately ¥65.85 billion.

Operations: The company generates revenue primarily from its B2B-PFES and B to B-PF FOOD segments, contributing ¥5.62 billion and ¥9.27 billion respectively. The focus on these areas highlights the company's role in facilitating e-commerce within Japan's food industry through its specialized platform.

Infomart Corporation, amid a tech industry where innovation is key, has projected a notable earnings growth of 40.9% annually, significantly outpacing the Japanese market's average of 7.9%. This growth is underpinned by an aggressive R&D strategy which saw expenses climb to substantial figures, reflecting their commitment to staying ahead in technological advancements. Furthermore, with revenue expected to increase by 10.8% per year—more than double the market rate of 4.2%—and recent strategic guidance forecasting net sales reaching ¥16 billion alongside an operating profit of ¥1 billion for the fiscal year ending December 2024, Infomart is poised for robust financial health and market competitiveness. Their recent dividend increase also signals confidence in sustained profitability and shareholder value enhancement.

- Click here and access our complete health analysis report to understand the dynamics of Infomart.

Gain insights into Infomart's past trends and performance with our Past report.

Taking Advantage

- Explore the 1316 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com