As global markets navigate a period marked by interest rate adjustments and mixed economic signals, investors are keeping a close eye on the Federal Reserve's upcoming meeting, which is expected to result in another rate cut. Amidst these uncertainties, dividend stocks offer a potential source of stability and income, making them an attractive consideration for those looking to weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1849 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

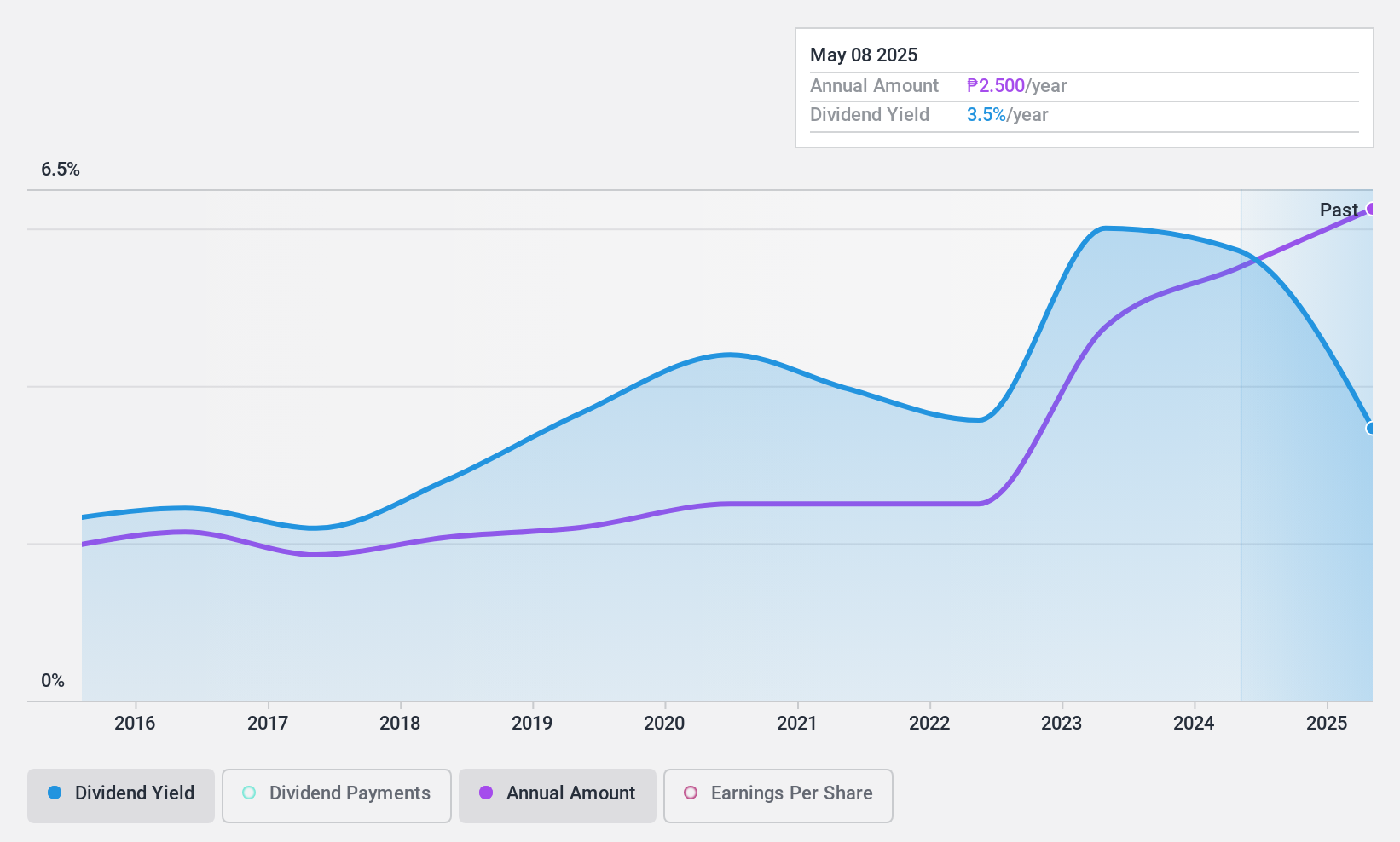

China Banking (PSE:CBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Banking Corporation offers a range of banking and financial products and services to individuals and businesses in the Philippines, with a market cap of ₱168.21 billion.

Operations: China Banking Corporation generates revenue from its diverse array of banking and financial products and services tailored for both individual and corporate clients in the Philippines.

Dividend Yield: 3.5%

China Banking Corporation offers a reliable dividend history with stable and growing payments over the past decade. The dividend yield of 3.52% is lower than the top tier in the Philippine market, but it is well covered by earnings due to a low payout ratio of 13.3%. Despite concerns about high non-performing loans at 2.4%, recent earnings growth and fair valuation suggest potential for continued stability in dividend distribution.

- Navigate through the intricacies of China Banking with our comprehensive dividend report here.

- Our expertly prepared valuation report China Banking implies its share price may be lower than expected.

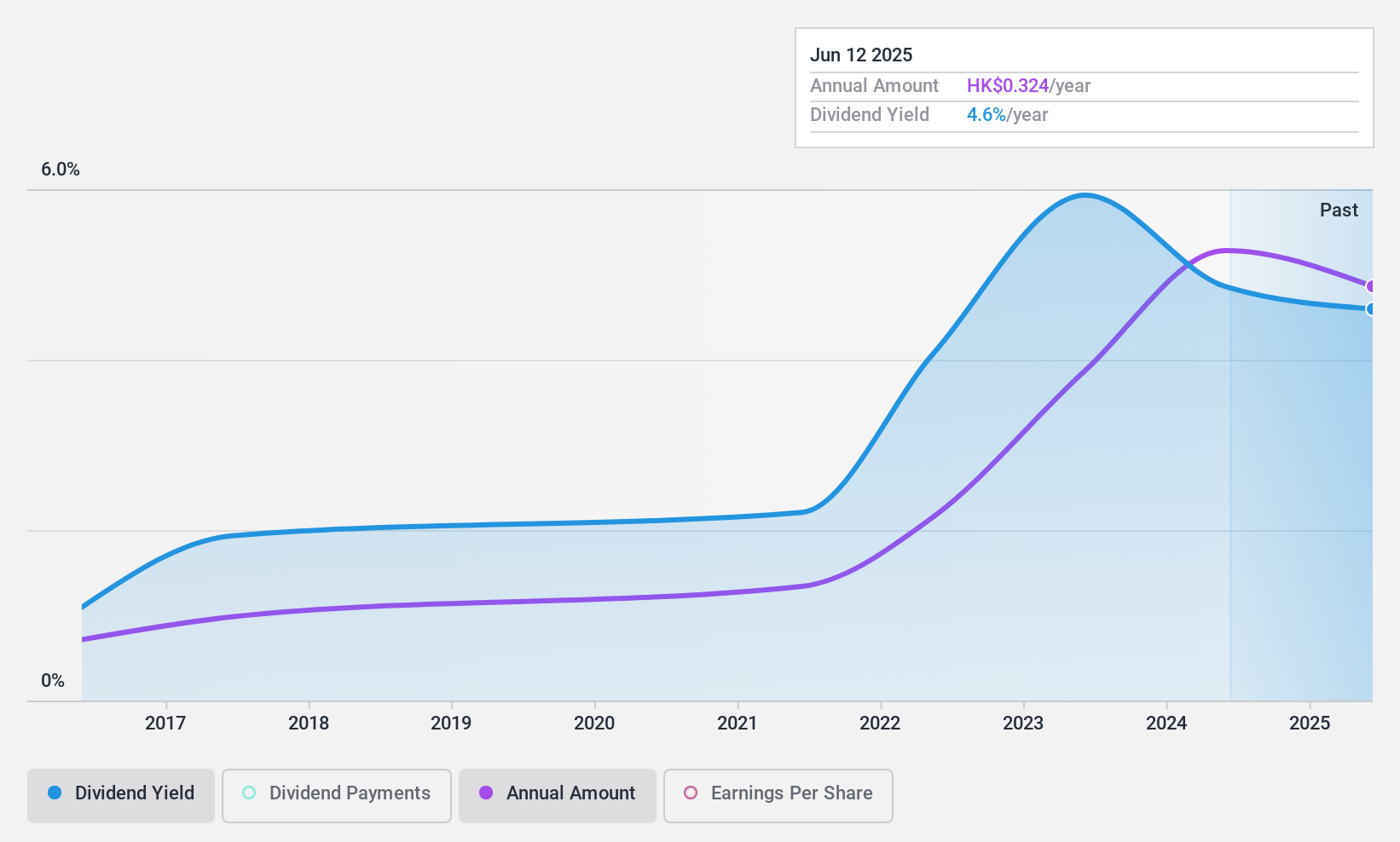

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited is involved in the research, development, manufacture, and sale of agricultural and power machinery globally, with a market cap of HK$16.01 billion.

Operations: First Tractor Company Limited generates revenue through its global operations in agricultural and power machinery, along with related products.

Dividend Yield: 4.4%

First Tractor's dividend payments are covered by earnings and cash flows, with a payout ratio of 35.4% and a cash payout ratio of 30%. Despite this coverage, the dividend track record is unstable, showing volatility over the past decade. Recent financial performance indicates modest growth in revenue and net income for the first nine months of 2024. The stock trades significantly below its estimated fair value, potentially offering value to investors focused on dividends.

- Click to explore a detailed breakdown of our findings in First Tractor's dividend report.

- Our comprehensive valuation report raises the possibility that First Tractor is priced lower than what may be justified by its financials.

Eastech Holding (TWSE:5225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastech Holding Limited, along with its subsidiaries, is involved in the research, development, design, assembly, manufacturing, and sale of speakers and electronic entertainment systems across various international markets including South Korea and Japan; it has a market cap of NT$9.67 billion.

Operations: Eastech Holding Limited generates revenue of NT$12.15 billion from its Audio/Video Products segment.

Dividend Yield: 5.2%

Eastech Holding's dividends are covered by earnings and cash flows, with a payout ratio of 53.5% and a cash payout ratio of 47%. Despite this coverage, the dividend history is volatile over the past decade. Recent earnings growth of 88% suggests strong financial performance, with Q3 net income rising to TWD 341.32 million from TWD 220.97 million last year. The stock trades at a discount to its estimated fair value, appealing for dividend-focused investors.

- Click here to discover the nuances of Eastech Holding with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Eastech Holding's current price could be quite moderate.

Key Takeaways

- Get an in-depth perspective on all 1849 Top Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com