CircuTech International Holdings Limited (HKG:8051) shares have continued their recent momentum with a 33% gain in the last month alone. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

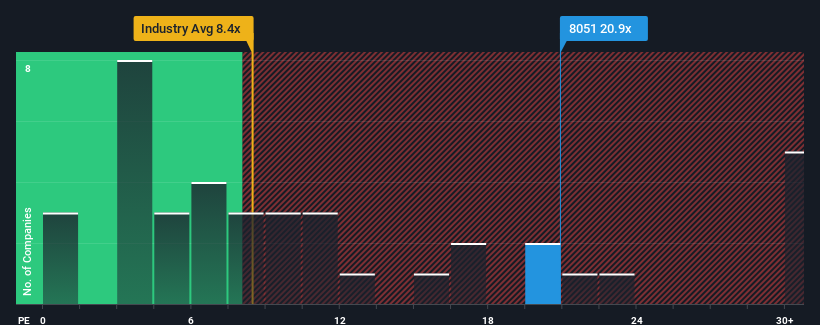

Following the firm bounce in price, CircuTech International Holdings' price-to-earnings (or "P/E") ratio of 20.9x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

It looks like earnings growth has deserted CircuTech International Holdings recently, which is not something to boast about. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for CircuTech International Holdings

How Is CircuTech International Holdings' Growth Trending?

CircuTech International Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period was better as it's delivered a decent 8.9% overall rise in EPS. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that CircuTech International Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

Shares in CircuTech International Holdings have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that CircuTech International Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with CircuTech International Holdings (at least 1 which can't be ignored), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than CircuTech International Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.