In a week marked by record highs for major U.S. stock indexes and mixed sector performances, global markets have been navigating through political developments in Europe and economic data releases in the U.S. With growth stocks outperforming value shares significantly, investors may find dividend stocks appealing as they offer potential income stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.86% | ★★★★★★ |

Click here to see the full list of 1926 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

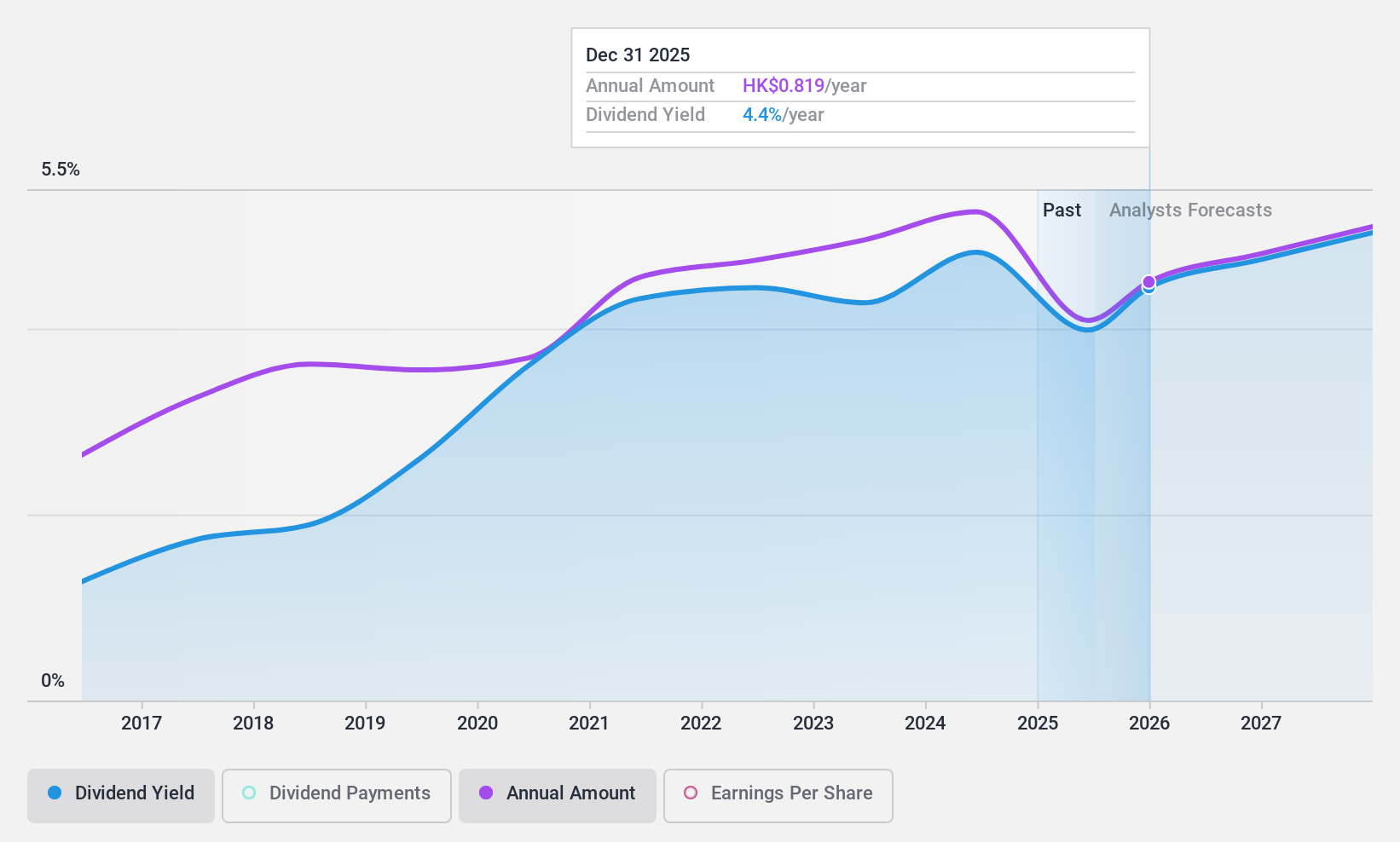

Sinopharm Group (SEHK:1099)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinopharm Group Co. Ltd., along with its subsidiaries, operates in the wholesale and retail sectors of pharmaceuticals, medical devices, and healthcare products in China, with a market cap of HK$66.16 billion.

Operations: Sinopharm Group Co. Ltd.'s revenue is primarily derived from Pharmaceutical Distribution (CN¥442.11 billion), Medical Devices (CN¥125.75 billion), and Retail Pharmacy (CN¥34.55 billion) segments in China.

Dividend Yield: 4.3%

Sinopharm Group's dividends have been stable and reliable over the past decade, with a low cash payout ratio of 16% indicating strong coverage by cash flows. Despite trading at a good value compared to peers, its dividend yield of 4.35% is below the top tier in Hong Kong. Recent earnings showed a decline in net income to CNY 5.28 billion for the first nine months of 2024, suggesting potential challenges but dividends remain covered with a payout ratio of 31.3%.

- Unlock comprehensive insights into our analysis of Sinopharm Group stock in this dividend report.

- The analysis detailed in our Sinopharm Group valuation report hints at an deflated share price compared to its estimated value.

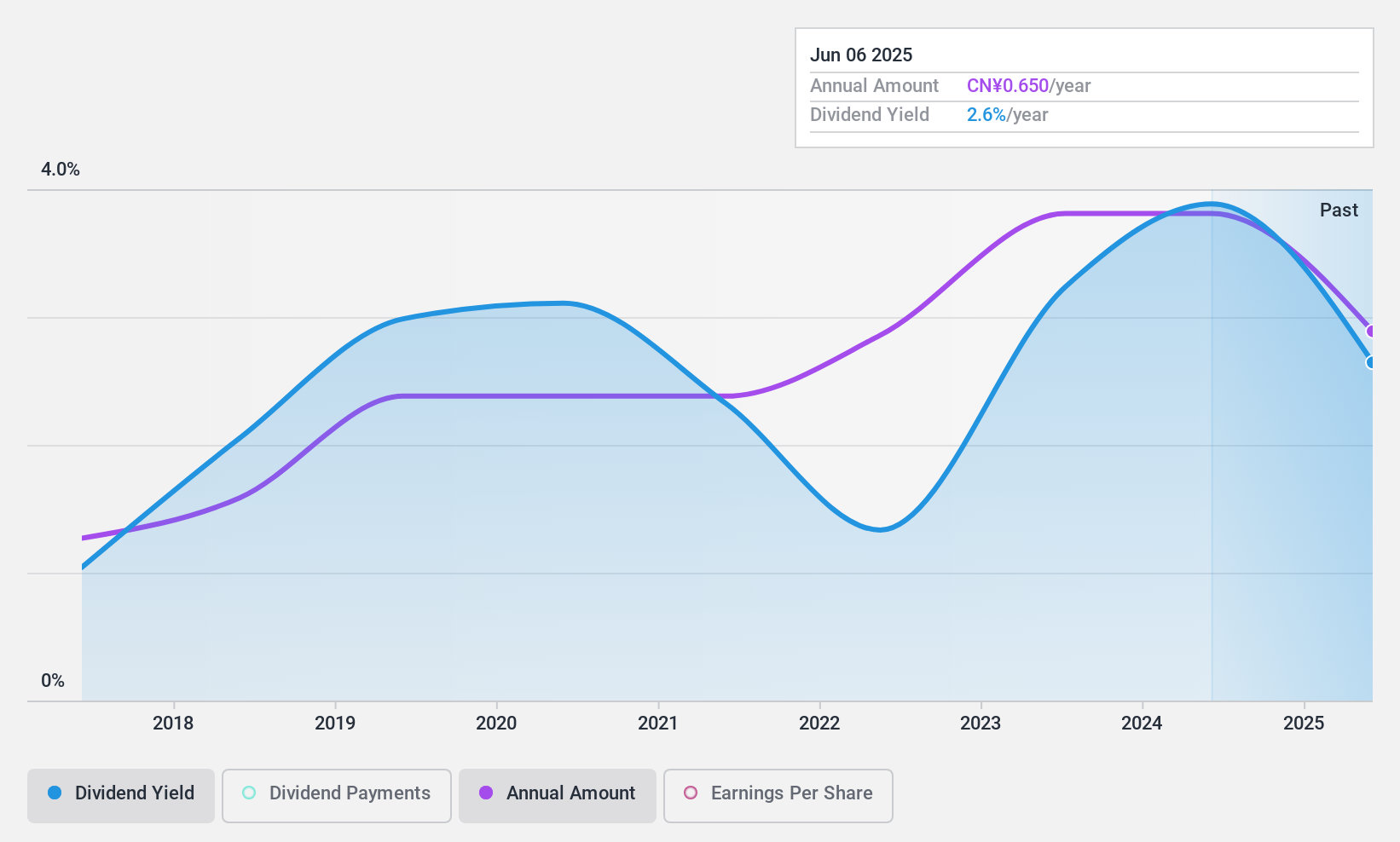

Comefly Outdoor (SHSE:603908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Comefly Outdoor Co., Ltd., operating as MOBI GARDEN, focuses on the research, design, development, and sale of outdoor products in China with a market cap of CN¥2.37 billion.

Operations: Comefly Outdoor Co., Ltd. generates its revenue primarily from the apparel segment, which accounts for CN¥1.38 billion.

Dividend Yield: 3.2%

Comefly Outdoor's dividends are supported by a payout ratio of 89.7% and a cash payout ratio of 51.3%, indicating solid coverage by earnings and cash flows despite only eight years of dividend history. The yield, at 3.24%, is competitive in the Chinese market, ranking in the top quartile. Recent earnings showed a decline with net income dropping to CNY 92.43 million for the first nine months of 2024, which may impact future dividend stability if trends continue.

- Delve into the full analysis dividend report here for a deeper understanding of Comefly Outdoor.

- The valuation report we've compiled suggests that Comefly Outdoor's current price could be quite moderate.

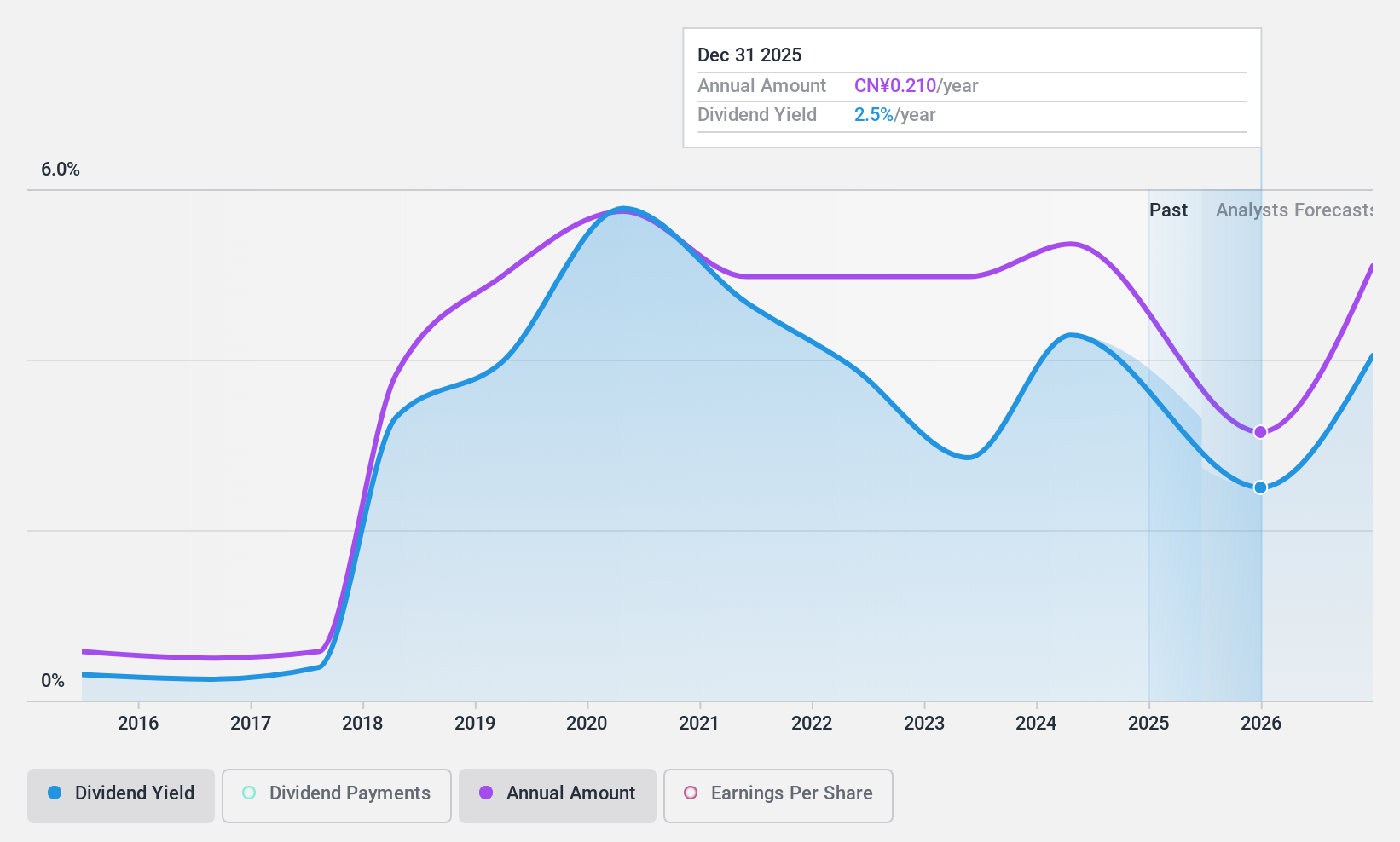

Teyi Pharmaceutical GroupLtd (SZSE:002728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd focuses on the research, development, production, and sale of Chinese patent medicines and pharmaceutical products in China, with a market cap of CN¥4.61 billion.

Operations: Teyi Pharmaceutical Group Co., Ltd generates revenue through its activities in the research, development, production, and sale of Chinese patent medicines and pharmaceutical preparations within China.

Dividend Yield: 3.7%

Teyi Pharmaceutical Group's dividends have shown stability and growth over the past decade, yet their sustainability is questionable due to a high payout ratio of 290.2% and lack of free cash flow coverage. Despite being in the top 25% for dividend yield in China at 3.74%, recent earnings reveal a significant drop, with net income plummeting from CNY 188.48 million to CNY 6.01 million, potentially affecting future payouts.

- Get an in-depth perspective on Teyi Pharmaceutical GroupLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Teyi Pharmaceutical GroupLtd is priced higher than what may be justified by its financials.

Next Steps

- Gain an insight into the universe of 1926 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com