Q Technology (Group) Company Limited (HKG:1478) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 38%.

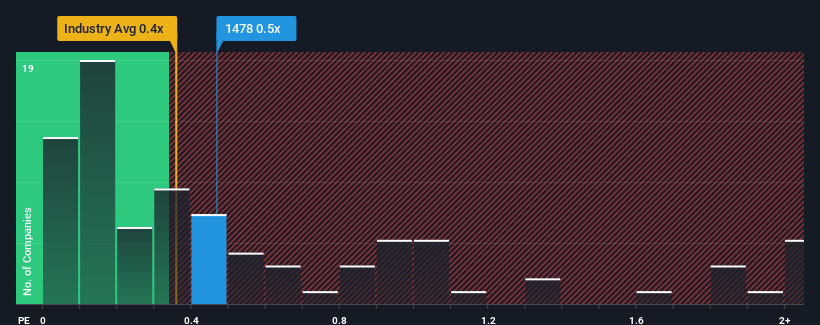

Although its price has surged higher, it's still not a stretch to say that Q Technology (Group)'s price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Electronic industry in Hong Kong, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Q Technology (Group)

What Does Q Technology (Group)'s P/S Mean For Shareholders?

Q Technology (Group) certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Q Technology (Group) will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Q Technology (Group)?

Q Technology (Group)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 18% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 7.5% per annum over the next three years. With the industry predicted to deliver 24% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Q Technology (Group) is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Q Technology (Group) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Q Technology (Group)'s revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Q Technology (Group) with six simple checks.

If you're unsure about the strength of Q Technology (Group)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.