As global markets continue to reach new heights, with the S&P 500 and Russell 2000 indices hitting record intraday highs, investor sentiment remains buoyant despite geopolitical tensions and tariff concerns. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial for navigating potential market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Rimoni Industries | NA | 4.80% | 4.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Haohai Biological Technology (SEHK:6826)

Simply Wall St Value Rating: ★★★★★☆

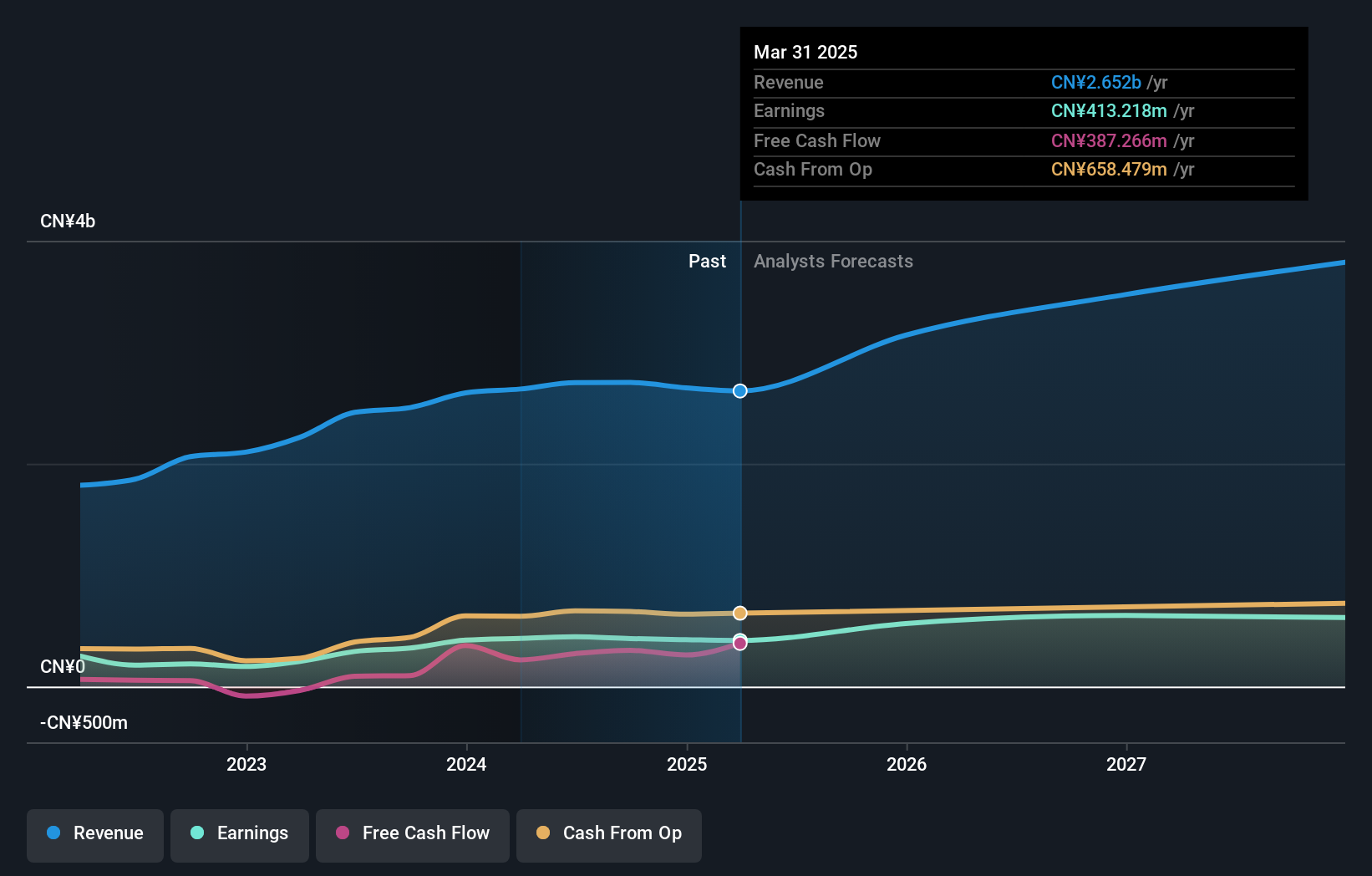

Overview: Shanghai Haohai Biological Technology Co., Ltd. is a company engaged in the production and sale of biologics, with a market capitalization of HK$14.38 billion.

Operations: The company generates revenue primarily from the production and sale of biologics, particularly medical hyaluronic acid, amounting to CN¥2.75 billion.

Shanghai Haohai Biological Technology, a promising player in the biotech sector, has shown robust earnings growth of 24.5% over the past year, outpacing the industry average of 4%. The company reported sales of CNY 2.07 billion for the first nine months of 2024, up from CNY 1.98 billion a year earlier, with net income rising to CNY 340.89 million from CNY 326.8 million. Trading at approximately 78% below its estimated fair value suggests potential undervaluation. Despite an increased debt-to-equity ratio from 0.7 to 7 over five years, it remains financially sound with more cash than total debt and positive free cash flow.

Feilong Auto Components (SZSE:002536)

Simply Wall St Value Rating: ★★★★★★

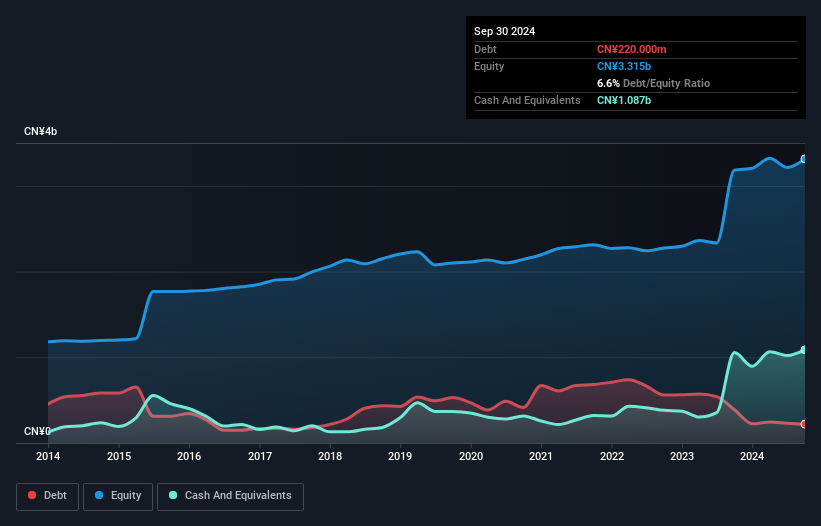

Overview: Feilong Auto Components Co., Ltd. processes, manufactures, and sells auto parts in China and internationally with a market capitalization of approximately CN¥6.28 billion.

Operations: Feilong Auto Components generates revenue primarily from its automotive parts segment, amounting to CN¥4.50 billion.

Feilong Auto Components, a promising player in the auto parts sector, has shown solid financial health with earnings rising by 21.3% over the past year, outpacing industry growth of 10.5%. The company’s price-to-earnings ratio of 21.5x is attractive compared to the broader CN market at 36.3x, indicating good value potential. Over five years, Feilong's debt to equity ratio improved significantly from 25.2% to just 6.6%, reflecting prudent financial management and more cash than its total debt suggests stability. Recent dividends highlight shareholder returns with CNY1 per ten shares paid recently in November 2024, enhancing investor appeal further.

- Unlock comprehensive insights into our analysis of Feilong Auto Components stock in this health report.

Evaluate Feilong Auto Components' historical performance by accessing our past performance report.

Shenglan Technology (SZSE:300843)

Simply Wall St Value Rating: ★★★★★☆

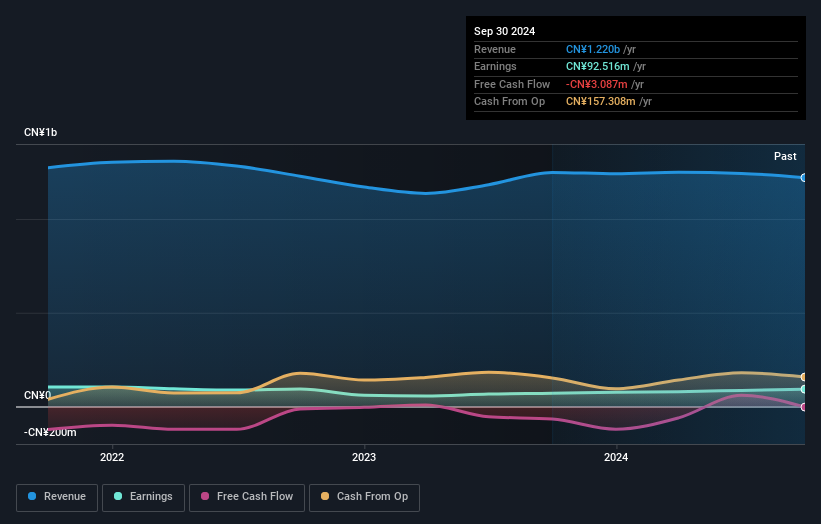

Overview: Shenglan Technology Co., Ltd. engages in the research, development, manufacture, and sale of electronic connectors, wire harness components, and precision parts globally with a market cap of CN¥4.67 billion.

Operations: Shenglan Technology generates revenue through the sale of electronic connectors, wire harness components, and precision parts. The company's financial performance is reflected in its market capitalization of CN¥4.67 billion.

Shenglan Technology, a small player in the electronics sector, has seen its earnings rise by 31% over the past year, outpacing the industry’s modest 1.8% growth. Despite this impressive earnings performance, revenue for nine months ending September dropped to CNY 923 million from CNY 944 million last year. Net income improved to CNY 88 million from CNY 72 million previously, with basic EPS climbing to CNY 0.58 from CNY 0.48. The company’s debt-to-equity ratio rose to 22% over five years while maintaining more cash than total debt suggests financial prudence amidst shareholder dilution concerns recently noted.

- Click here and access our complete health analysis report to understand the dynamics of Shenglan Technology.

Gain insights into Shenglan Technology's past trends and performance with our Past report.

Taking Advantage

- Embark on your investment journey to our 4635 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com