As global markets react to the uncertainties surrounding the incoming Trump administration's policies, investors are keeping a close eye on sector-specific movements and inflation data. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a compelling investment area. These stocks can offer surprising value when backed by strong financial health, potentially leading to significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £810.04M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £387.38M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £69.99M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.43 | SGD303.74M | ★★★★★☆ |

Click here to see the full list of 5,805 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation is a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies, with a market capitalization of approximately HK$2.15 billion.

Operations: The company generates revenue primarily from North America, contributing $198.50 million, and the People's Republic of China, adding $61.48 million.

Market Cap: HK$2.15B

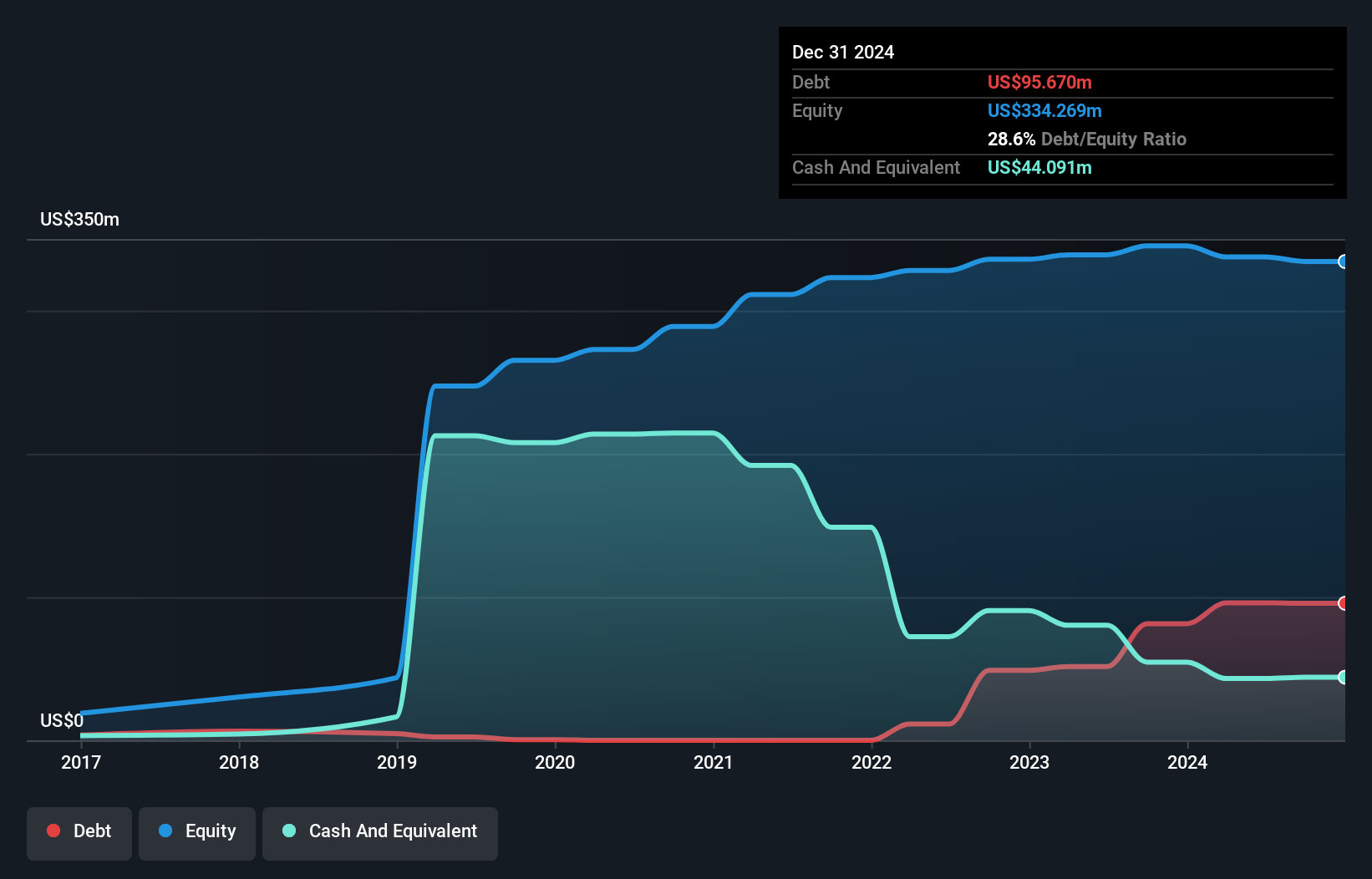

Frontage Holdings has faced challenges, including a recent drop from the S&P Global BMI Index and negative earnings growth of 64.9% over the past year. Despite stable weekly volatility, its share price remains highly volatile. The company's debt is well covered by operating cash flow, but interest payments are not adequately covered by EBIT. Recent financials show a net loss of US$0.117 million for the half-year ending June 2024, with profit margins declining to 2.3%. Trading at a significant discount to estimated fair value could present an opportunity for risk-tolerant investors in the penny stock space.

- Jump into the full analysis health report here for a deeper understanding of Frontage Holdings.

- Understand Frontage Holdings' earnings outlook by examining our growth report.

AInnovation Technology Group (SEHK:2121)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AInnovation Technology Group Co., Ltd, along with its subsidiaries, focuses on the research, development, and sale of artificial intelligence-based software and hardware technology solutions in China, with a market cap of approximately HK$2.61 billion.

Operations: The company generates revenue of CN¥1.40 billion from its Artificial Intelligence Service segment.

Market Cap: HK$2.61B

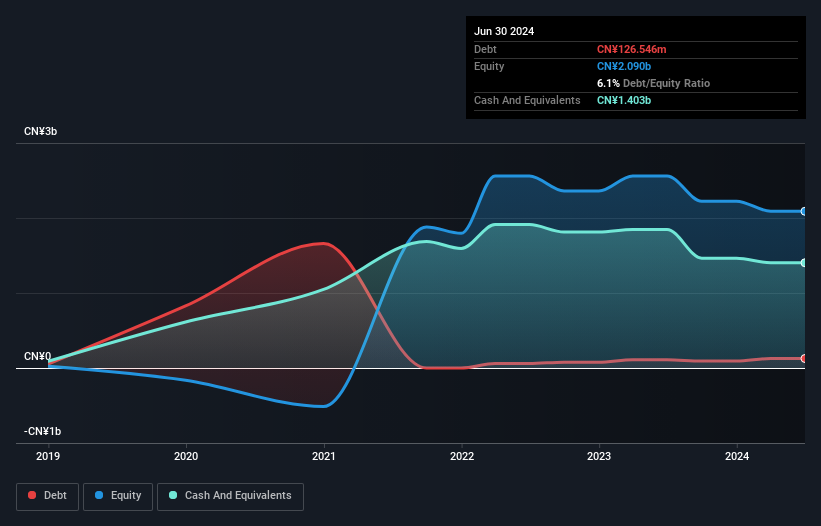

AInnovation Technology Group, with a market cap of HK$2.61 billion, is navigating the complexities of penny stocks by leveraging its AI technology solutions in China. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities. The company has initiated a share repurchase program to potentially enhance net assets and earnings per share. Additionally, its strategic alliance with China Resources Digital Holdings aims to drive innovation through industrial intelligence solutions, indicating potential for future revenue growth despite current financial challenges.

- Take a closer look at AInnovation Technology Group's potential here in our financial health report.

- Review our growth performance report to gain insights into AInnovation Technology Group's future.

Changshu Fengfan Power Equipment (SHSE:601700)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Changshu Fengfan Power Equipment Co., Ltd. operates in the power equipment industry, focusing on the manufacturing and distribution of power transmission and transformation products, with a market cap of approximately CN¥5.53 billion.

Operations: There are no reported revenue segments for Changshu Fengfan Power Equipment Co., Ltd.

Market Cap: CN¥5.53B

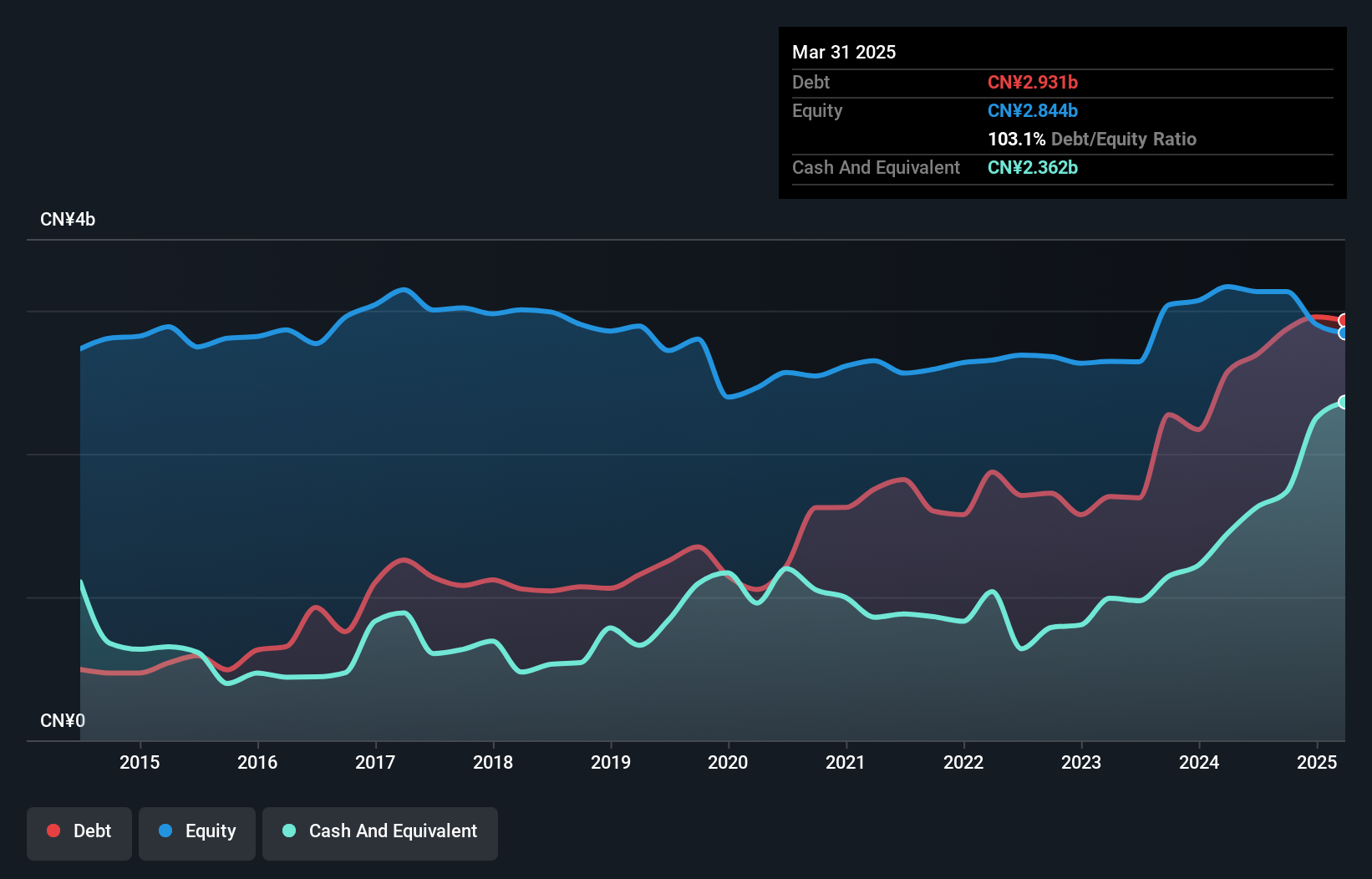

Changshu Fengfan Power Equipment, with a market cap of CN¥5.53 billion, is experiencing significant earnings growth, having increased by 193.2% over the past year. The company has announced a share repurchase program worth up to CN¥300 million, aimed at enhancing employee incentives and promoting long-term development. Despite its strong short-term asset position covering both short and long-term liabilities, its operating cash flow remains negative, indicating challenges in debt coverage. While the debt-to-equity ratio has risen to 91.6%, net debt levels are satisfactory at 36.2%. The company's return on equity is low at 4.9%.

- Dive into the specifics of Changshu Fengfan Power Equipment here with our thorough balance sheet health report.

- Evaluate Changshu Fengfan Power Equipment's historical performance by accessing our past performance report.

Make It Happen

- Embark on your investment journey to our 5,805 Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com