In the midst of global market fluctuations, highlighted by uncertainties surrounding the incoming Trump administration's policies and mixed economic signals from major regions like Europe and China, investors are seeking stability and income in their portfolios. Dividend stocks can offer a reliable stream of income, which is especially appealing when navigating unpredictable market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.84% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

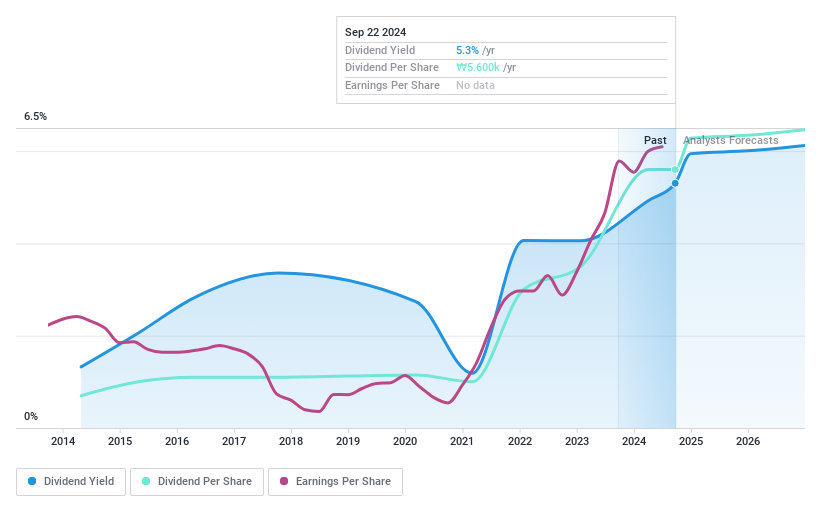

Kia (KOSE:A000270)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation manufactures and sells vehicles in South Korea, North America, and Europe, with a market cap of ₩38.44 trillion.

Operations: Kia Corporation's revenue segments include vehicle sales in South Korea, North America, and Europe.

Dividend Yield: 5.7%

Kia Corporation offers a compelling dividend profile, with a low payout ratio of 23%, ensuring dividends are well covered by earnings and cash flows. The dividend yield stands at an attractive 5.7%, placing it in the top quartile among Korean market peers. Kia's dividends have been stable and reliable over the past decade, showing consistent growth with minimal volatility. Recent earnings growth supports sustainability, as demonstrated by net income rising to KRW 8 billion for the first nine months of 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Kia.

- Insights from our recent valuation report point to the potential undervaluation of Kia shares in the market.

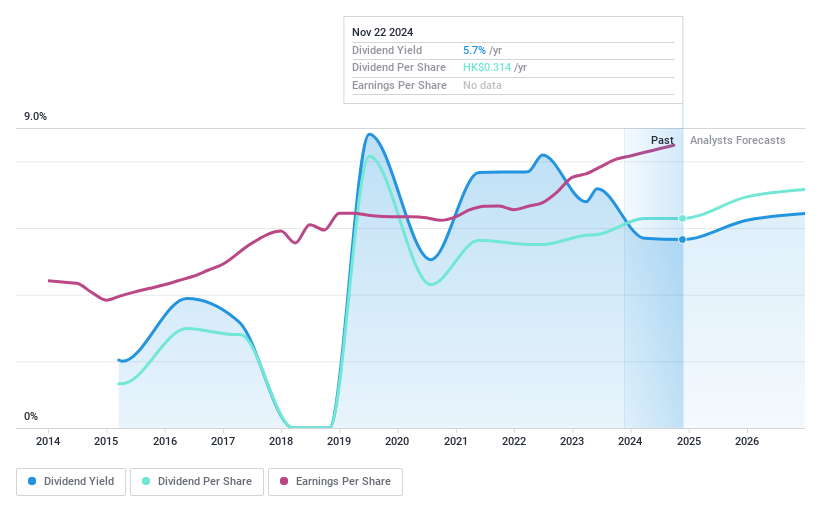

Qingdao Port International (SEHK:6198)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Port International Co., Ltd. operates the Port of Qingdao and has a market cap of HK$57.86 billion.

Operations: Qingdao Port International Co., Ltd. generates revenue from various segments, including container handling, bulk cargo handling, logistics and port value-added services, financial services related to port operations, and ancillary services.

Dividend Yield: 5.5%

Qingdao Port International's dividend payments, while covered by earnings with a payout ratio of 37.1%, have been volatile over the past decade. The recent interim dividend of RMB 113.4 per 1,000 shares highlights its commitment to shareholder returns despite past unreliability. With a cash payout ratio of 78.6%, dividends are supported by cash flows but remain less stable compared to peers in the Hong Kong market, where it trades at a favorable P/E ratio of 6.8x against the market average of 9.8x.

- Unlock comprehensive insights into our analysis of Qingdao Port International stock in this dividend report.

- The valuation report we've compiled suggests that Qingdao Port International's current price could be quite moderate.

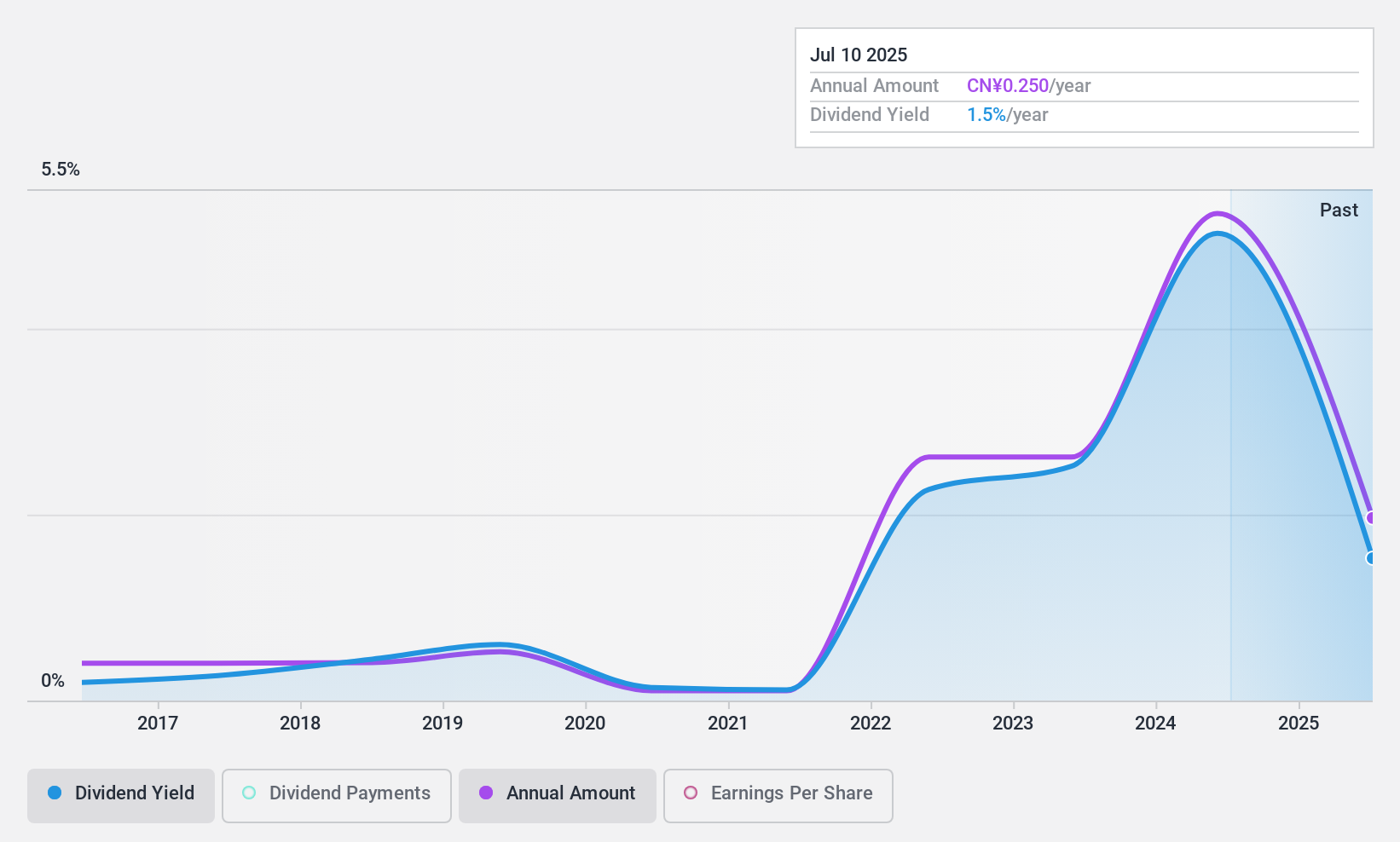

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both in China and internationally, with a market capitalization of CN¥7.43 billion.

Operations: Boai NKY Medical Holdings Ltd. generates revenue through its operations in the fine chemical and medical care sectors, serving both domestic and international markets.

Dividend Yield: 4.4%

Boai NKY Medical Holdings' dividend yield of 4.35% ranks in the top 25% within the CN market, yet its dividends have been volatile and unreliable over the past decade. The company’s payout ratio of 77% suggests earnings cover dividends, but a high cash payout ratio of 258.4% indicates insufficient free cash flow support. Despite this, its price-to-earnings ratio of 18.6x presents a valuation advantage compared to the broader CN market average of 35.3x.

- Get an in-depth perspective on Boai NKY Medical Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Boai NKY Medical Holdings is priced higher than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 1976 companies within our Top Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com