Worldgate Global Logistics Ltd (HKG:8292) shareholders won't be pleased to see that the share price has had a very rough month, dropping 50% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

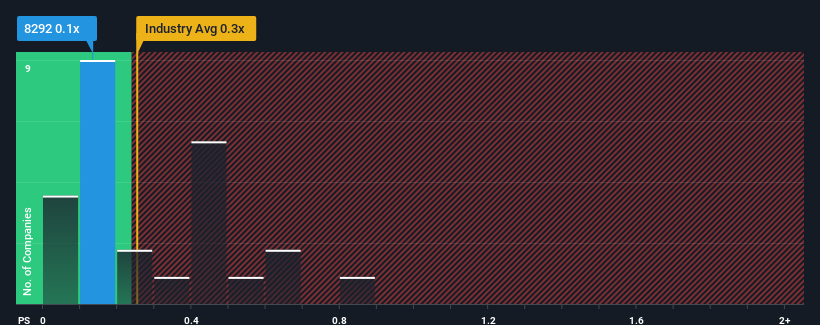

Although its price has dipped substantially, it's still not a stretch to say that Worldgate Global Logistics' price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Logistics industry in Hong Kong, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Worldgate Global Logistics

How Worldgate Global Logistics Has Been Performing

For example, consider that Worldgate Global Logistics' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Worldgate Global Logistics' earnings, revenue and cash flow.How Is Worldgate Global Logistics' Revenue Growth Trending?

In order to justify its P/S ratio, Worldgate Global Logistics would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.6% shows it's about the same on an annualised basis.

In light of this, it's understandable that Worldgate Global Logistics' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Following Worldgate Global Logistics' share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Worldgate Global Logistics maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You always need to take note of risks, for example - Worldgate Global Logistics has 3 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.