Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Asia Standard International Group Limited (HKG:129) for five years would be nursing their metaphorical wounds since the share price dropped 73% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 29% over the last twelve months. Unfortunately the share price momentum is still quite negative, with prices down 20% in thirty days.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Asia Standard International Group

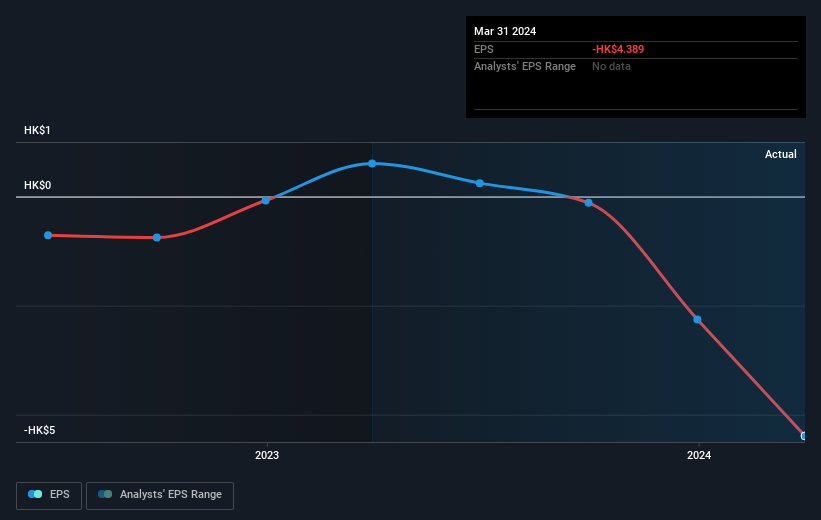

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over five years Asia Standard International Group's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Asia Standard International Group's key metrics by checking this interactive graph of Asia Standard International Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 17% in the last year, Asia Standard International Group shareholders lost 29%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Asia Standard International Group better, we need to consider many other factors. For instance, we've identified 4 warning signs for Asia Standard International Group (2 are potentially serious) that you should be aware of.

But note: Asia Standard International Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.