As global markets navigate a complex landscape marked by mixed economic signals and cautious earnings reports, investors are increasingly turning their attention to dividend stocks for stability and income. In this environment, selecting stocks that offer reliable dividends can be a prudent strategy, providing potential income while weathering market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.85% | ★★★★★★ |

| Globeride (TSE:7990) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.42% | ★★★★★★ |

| Innotech (TSE:9880) | 4.73% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.13% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

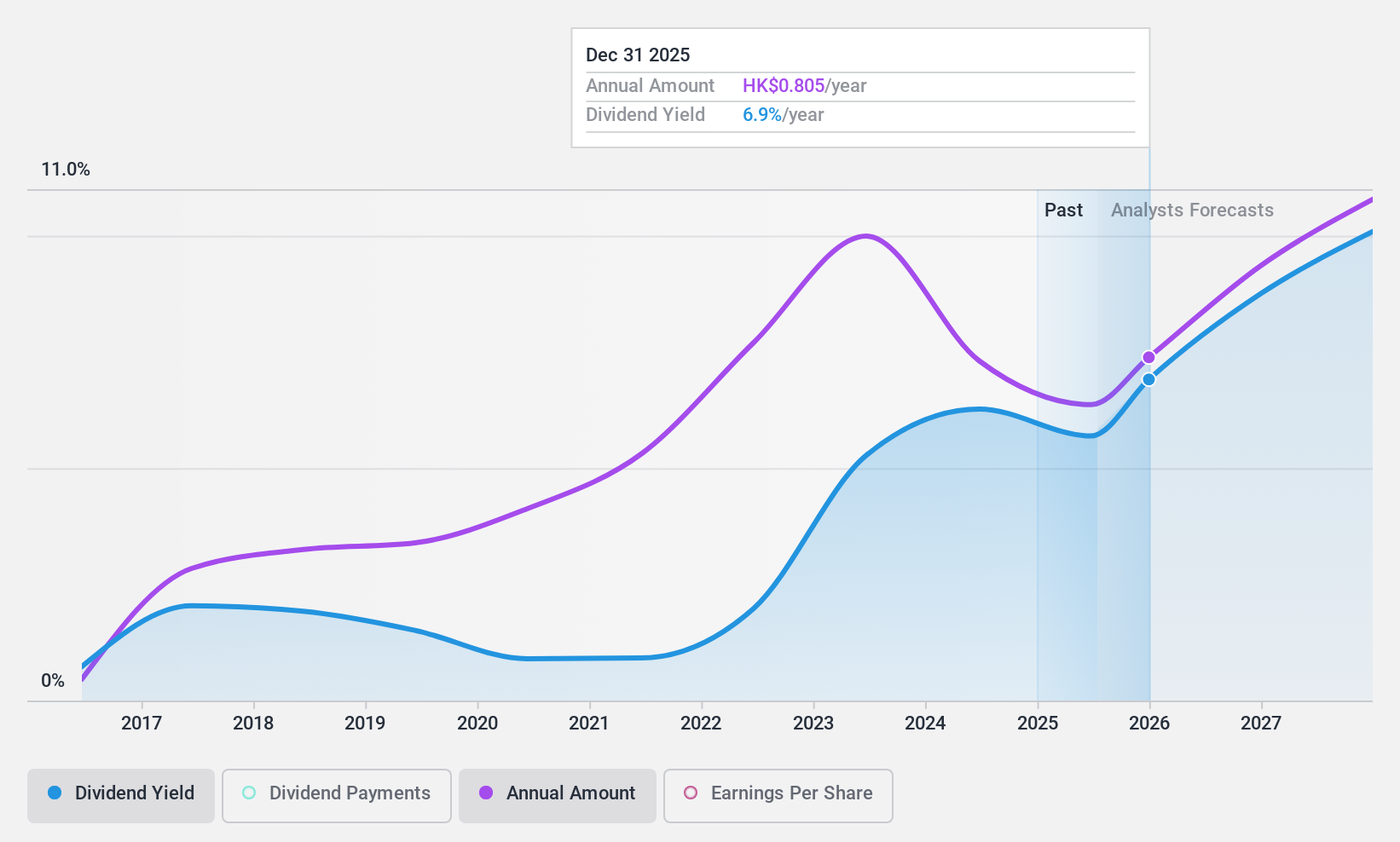

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics, with a market cap of HK$1.82 billion.

Operations: The company generates revenue of HK$9.94 billion from the design, manufacturing, and trading of electronics and PC parts and accessories.

Dividend Yield: 7.9%

PC Partner Group's dividends have grown over the past decade, supported by a reasonable payout ratio of 66.1% and a low cash payout ratio of 7.8%, indicating coverage by earnings and cash flows. However, its dividend history has been volatile, with fluctuations over 20%. Recent board changes could impact future governance and strategy. Despite trading below estimated fair value, PC Partner's dividend yield is slightly lower than top-tier Hong Kong payers at 7.86%.

- Dive into the specifics of PC Partner Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of PC Partner Group shares in the market.

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongsheng Group Holdings Limited is an investment holding company that focuses on the sale and service of motor vehicles in the People's Republic of China, with a market cap of HK$29.35 billion.

Operations: Zhongsheng Group Holdings Limited generates its revenue primarily from the sale of motor vehicles and the provision of related services, amounting to CN¥179.81 billion.

Dividend Yield: 5%

Zhongsheng Group Holdings offers a dividend yield lower than the top 25% in Hong Kong, but its payout ratio of 49% suggests dividends are well covered by earnings and cash flows. Despite a history of volatility with over 20% annual drops, dividends have grown over the past decade. Trading at significant value below estimated fair value, recent earnings showed decreased net income to CNY 1.58 billion from CNY 3 billion year-on-year.

- Click here to discover the nuances of Zhongsheng Group Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Zhongsheng Group Holdings' shares may be trading at a discount.

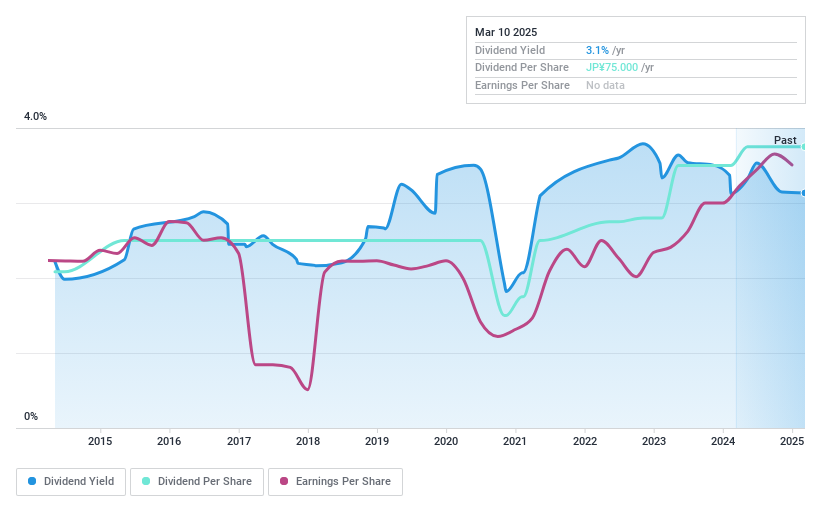

Oiles (TSE:6282)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oiles Corporation manufactures and sells bearings, structural equipment, and construction equipment both in Japan and internationally, with a market cap of ¥61.58 billion.

Operations: Oiles Corporation's revenue segments include bearings, structural equipment, and construction equipment.

Dividend Yield: 3.5%

Oiles Corporation's dividend yield of 3.48% is below the top tier in Japan, yet its payout ratios of 39.5% for earnings and 44.4% for cash flow indicate strong coverage. Despite a volatile dividend history over the past decade, payments have increased overall. Trading at a significant discount to fair value, Oiles has announced a share buyback program worth ¥2 billion to enhance shareholder returns and improve capital efficiency by April 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Oiles.

- Our valuation report here indicates Oiles may be undervalued.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1937 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com