Digital China Holdings Limited (HKG:861) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 24% in the last year.

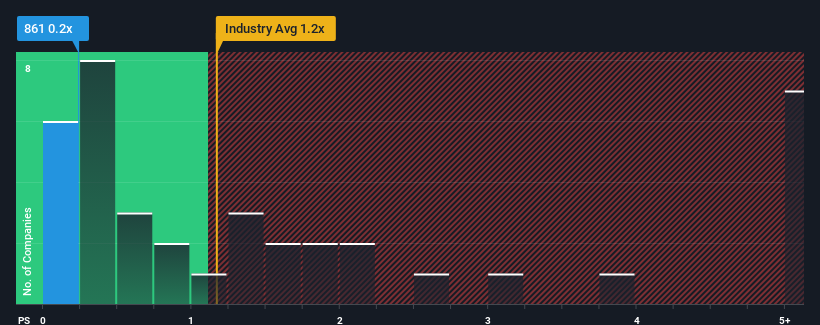

Following the heavy fall in price, given about half the companies operating in Hong Kong's IT industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Digital China Holdings as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Digital China Holdings

What Does Digital China Holdings' P/S Mean For Shareholders?

Digital China Holdings' revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Digital China Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Digital China Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.4%. Revenue has also lifted 11% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 10% per annum during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 8.8% each year growth forecast for the broader industry.

In light of this, it's peculiar that Digital China Holdings' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Digital China Holdings' P/S

Digital China Holdings' recently weak share price has pulled its P/S back below other IT companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Digital China Holdings remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Digital China Holdings with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.