As global markets grapple with a mix of economic signals, including subdued manufacturing activity and fluctuating job data, small-cap stocks have shown resilience compared to their larger counterparts. With the S&P MidCap 400 and Russell 2000 indices reflecting this relative strength amidst broader market volatility, investors may find opportunities in lesser-known stocks that exhibit strong fundamentals and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 44.92% | 51.98% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Harbin Electric (SEHK:1133)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harbin Electric Company Limited, along with its subsidiaries, is engaged in the manufacturing and sale of power plant equipment across various regions including the People’s Republic of China, Asia, Africa, Europe, and the United States, with a market capitalization of approximately HK$6.22 billion.

Operations: Harbin Electric generates revenue primarily from its New Power System with New Energy as the Main Body segment, contributing CN¥22.56 billion, followed by Clean and Efficient Industrial Systems at CN¥7.05 billion. The Green and Low-carbon Drive System adds CN¥732.15 million, while Other businesses account for CN¥781.68 million in revenue.

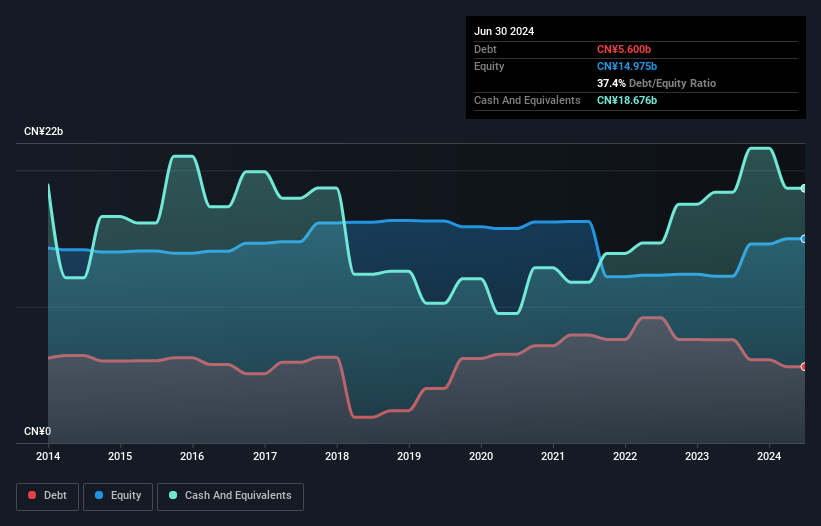

Harbin Electric, a player in the electrical sector, has shown impressive performance with earnings growth of 668.9% over the past year, outpacing the industry's 15.1%. The company reported revenue of CNY 17.26 billion for the first half of 2024, up from CNY 13.76 billion a year earlier, and net income surged to CNY 522.67 million from CNY 84.89 million last year. Despite an increased debt-to-equity ratio from 24.6% to 37.4% over five years, Harbin seems well-positioned with more cash than total debt and trading at a favorable price-to-earnings ratio of 5.7x compared to peers in Hong Kong's market at 9.9x.

- Click to explore a detailed breakdown of our findings in Harbin Electric's health report.

Explore historical data to track Harbin Electric's performance over time in our Past section.

Tibet GaoZheng Explosive (SZSE:002827)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tibet GaoZheng Explosive Co., Ltd. is engaged in the production and sale of civil explosives in China, with a market capitalization of CN¥8.45 billion.

Operations: Tibet GaoZheng Explosive generates revenue primarily from the production and sale of civil explosives. The company has a market capitalization of CN¥8.45 billion, reflecting its position in the industry.

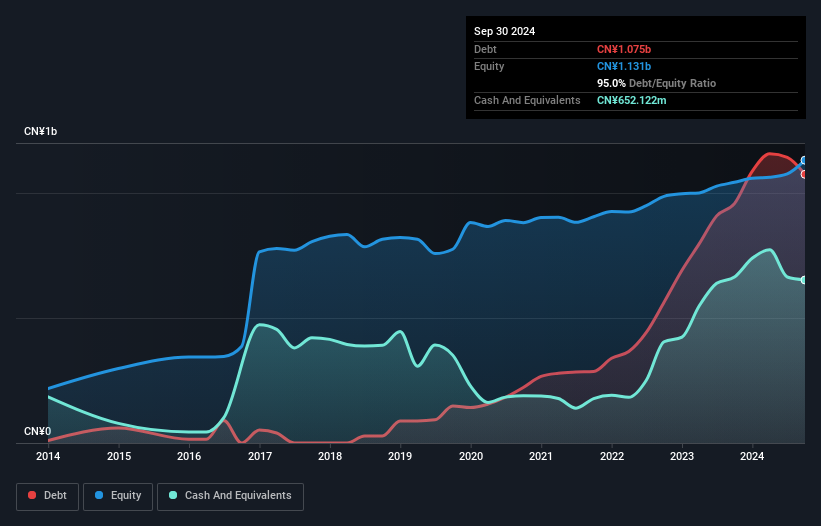

Tibet GaoZheng Explosive, a smaller player in the industry, showcases promising financial health with its interest payments being well-covered by EBIT at 9.8 times. Over the past year, earnings grew by 30%, outpacing the chemicals sector's -4% performance. The company's net debt to equity ratio stands satisfactorily at 37%, although it has risen from 19% to 95% over five years. Recent results highlight a revenue increase to CNY 1.17 billion for nine months ending September, with net income climbing to CNY 110 million compared to last year's CNY 83 million, reflecting solid growth and potential future prospects.

Juroku Financial GroupInc (TSE:7380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Juroku Financial Group, Inc. offers banking and leasing products and services in Japan, with a market capitalization of ¥155.83 billion.

Operations: The financial group generates revenue primarily through its banking and leasing operations in Japan. It has a market capitalization of ¥155.83 billion, reflecting its scale within the financial sector.

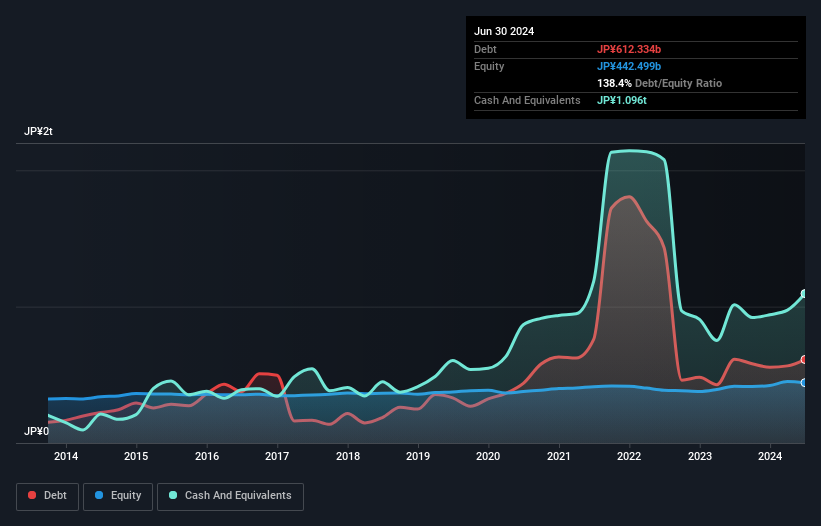

Juroku Financial Group Inc. offers a compelling picture with total assets of ¥7,691.9 billion and equity at ¥442.5 billion, reflecting a robust financial position. The company has maintained an appropriate level of bad loans at 1.3%, though its allowance for these loans is relatively low at 37%. While earnings have grown by nearly 10% annually over the last five years, recent growth trails behind the broader banking industry’s pace. Trading below estimated fair value by 20%, Juroku appears undervalued despite its net interest margin being modest at 0.8%. Recent buybacks indicate strategic capital management efforts, enhancing shareholder value through repurchasing shares worth ¥2,747 million.

- Get an in-depth perspective on Juroku Financial GroupInc's performance by reading our health report here.

Learn about Juroku Financial GroupInc's historical performance.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4702 more companies for you to explore.Click here to unveil our expertly curated list of 4705 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com