It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Greentown Management Holdings (HKG:9979). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Greentown Management Holdings

How Quickly Is Greentown Management Holdings Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Impressively, Greentown Management Holdings has grown EPS by 20% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

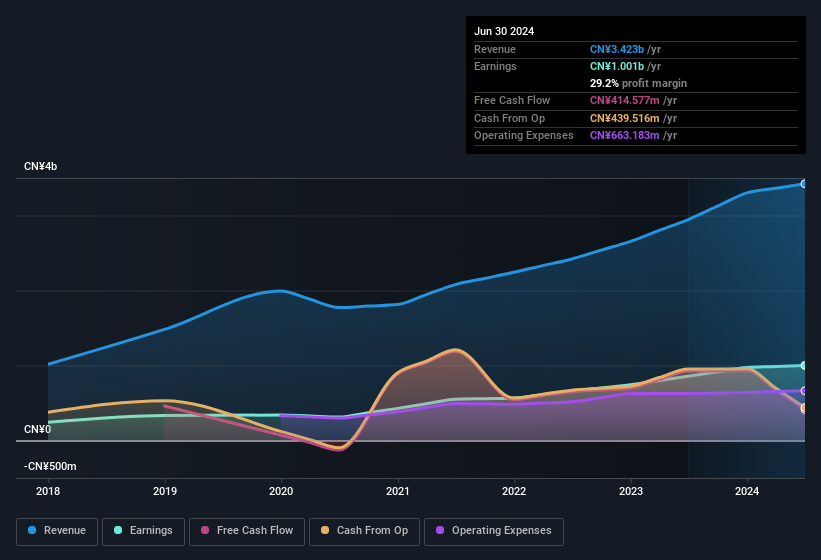

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Greentown Management Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to CN¥3.4b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Greentown Management Holdings' future EPS 100% free.

Are Greentown Management Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Greentown Management Holdings insiders spent a whopping CN¥33m on stock in just one year, without so much as a single sale. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Co-Chairman of the Board, Jiafeng Guo, who made the biggest single acquisition, paying HK$13m for shares at about HK$2.85 each.

Does Greentown Management Holdings Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Greentown Management Holdings' strong EPS growth. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. In essence, your time will not be wasted checking out Greentown Management Holdings in more detail. Still, you should learn about the 2 warning signs we've spotted with Greentown Management Holdings (including 1 which is concerning).

Keen growth investors love to see insider activity. Thankfully, Greentown Management Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.