As global markets navigate the complexities of rising U.S. Treasury yields and shifting monetary policies, Hong Kong's Hang Seng Index has recently experienced a decline amidst broader economic adjustments in China. In this environment, identifying stocks that may be trading below their estimated value can present potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Plover Bay Technologies (SEHK:1523) | HK$5.56 | HK$10.14 | 45.2% |

| Giant Biogene Holding (SEHK:2367) | HK$53.50 | HK$98.89 | 45.9% |

| MicroPort NeuroScientific (SEHK:2172) | HK$10.04 | HK$18.81 | 46.6% |

| Kuaishou Technology (SEHK:1024) | HK$47.30 | HK$88.39 | 46.5% |

| Alibaba Pictures Group (SEHK:1060) | HK$0.48 | HK$0.95 | 49.6% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.04 | HK$19.44 | 48.3% |

| Semiconductor Manufacturing International (SEHK:981) | HK$28.80 | HK$54.36 | 47% |

| CSC Financial (SEHK:6066) | HK$9.43 | HK$17.20 | 45.2% |

| DPC Dash (SEHK:1405) | HK$65.30 | HK$130.54 | 50% |

| Sands China (SEHK:1928) | HK$20.45 | HK$38.92 | 47.5% |

Here we highlight a subset of our preferred stocks from the screener.

Alibaba Pictures Group (SEHK:1060)

Overview: Alibaba Pictures Group Limited, an investment holding company with a market cap of HK$14.26 billion, operates in the content, technology, and IP merchandising and commercialization sectors in Hong Kong and the People's Republic of China.

Operations: The company's revenue segments include CN¥394.28 million from Damai, CN¥596.12 million from Drama Series Production, CN¥920.22 million from Film Ticketing and Technology Platform, CN¥1.05 billion from IP Merchandising and Commercialization, and CN¥2.07 billion from Film Investment, Production, Promotion and Distribution.

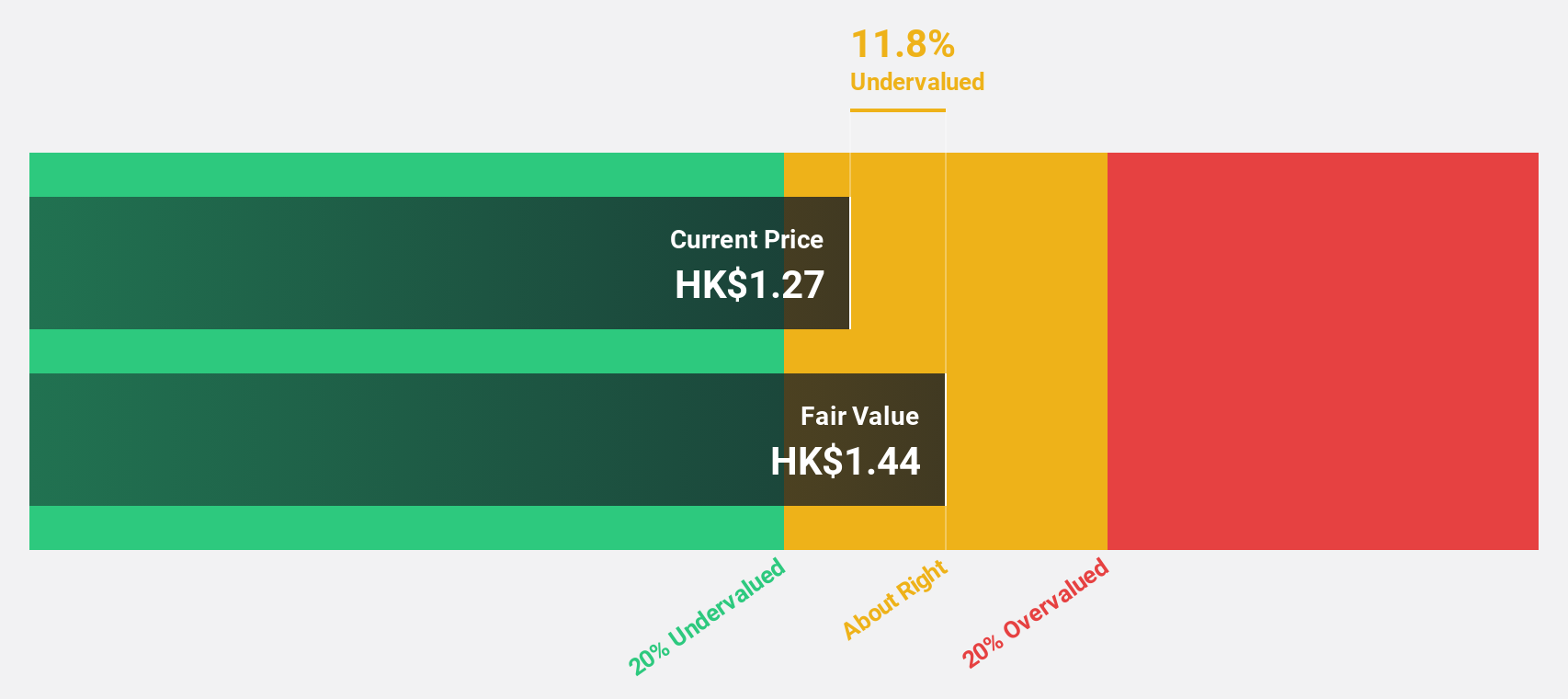

Estimated Discount To Fair Value: 49.6%

Alibaba Pictures Group is trading at HK$0.48, significantly below its estimated fair value of HK$0.95, suggesting it may be undervalued based on cash flows. The company has become profitable this year, with earnings expected to grow substantially by 35.5% annually over the next three years, outpacing the Hong Kong market average of 12.2%. However, shareholders experienced dilution in the past year and recent bylaw amendments were approved in August 2024.

- According our earnings growth report, there's an indication that Alibaba Pictures Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Alibaba Pictures Group's balance sheet health report.

AK Medical Holdings (SEHK:1789)

Overview: AK Medical Holdings Limited is an investment holding company that designs, develops, produces, and markets orthopedic joint implants and related products in China and internationally, with a market cap of HK$5.49 billion.

Operations: The company's revenue segments include CN¥989.17 million from orthopedic implants in China and CN¥159.06 million from orthopedic implants in the United Kingdom.

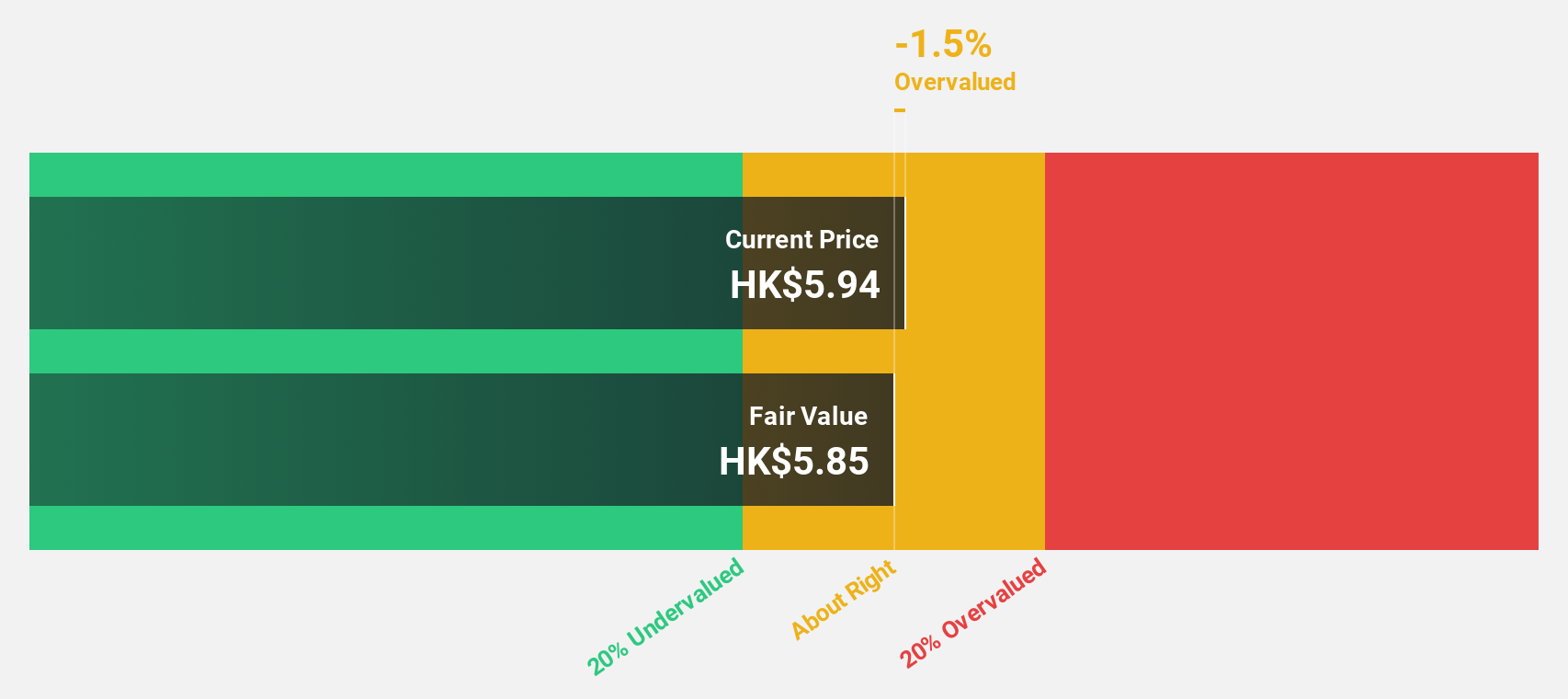

Estimated Discount To Fair Value: 41%

AK Medical Holdings is trading at HK$4.89, well below its estimated fair value of HK$8.29, highlighting potential undervaluation based on cash flows. The company's revenue and earnings are forecast to grow significantly, outpacing the Hong Kong market averages. Recent earnings showed modest growth with sales reaching CNY 657.1 million for the half-year ending June 2024. A change in company secretary occurred recently without impacting operations or investor relations negatively.

- Upon reviewing our latest growth report, AK Medical Holdings' projected financial performance appears quite optimistic.

- Get an in-depth perspective on AK Medical Holdings' balance sheet by reading our health report here.

Shenzhou International Group Holdings (SEHK:2313)

Overview: Shenzhou International Group Holdings Limited is an investment holding company involved in the manufacture, printing, and sale of knitwear products across Mainland China, the European Union, the United States, Japan, and other international markets with a market cap of approximately HK$92.45 billion.

Operations: The company's revenue from the manufacture and sale of knitwear products is CN¥26.38 billion.

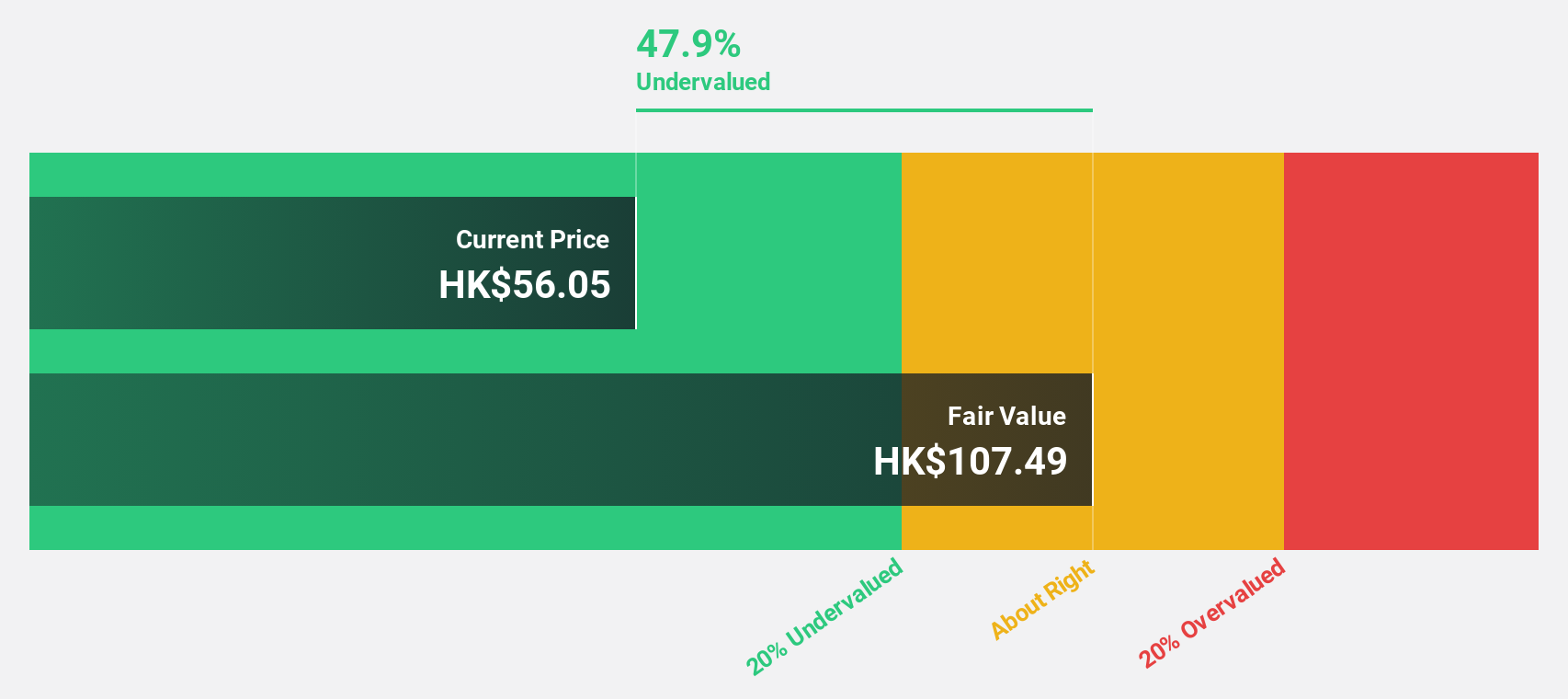

Estimated Discount To Fair Value: 35.5%

Shenzhou International Group Holdings is trading at HK$61.5, significantly below its estimated fair value of HK$95.3, suggesting potential undervaluation based on cash flows. The company's earnings grew by 24% last year and are forecast to grow at 12.89% annually, outpacing the Hong Kong market average. Recent financials show net income rising to CNY 2.93 billion for the half-year ending June 2024, reflecting strong operational performance despite an unstable dividend history.

- The growth report we've compiled suggests that Shenzhou International Group Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Shenzhou International Group Holdings.

Make It Happen

- Click this link to deep-dive into the 37 companies within our Undervalued SEHK Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com