The Hong Kong market, like many global markets, is navigating a complex landscape influenced by broader economic conditions and regional developments. Despite a recent decline in the Hang Seng Index, opportunities remain for discerning investors seeking potential growth in under-the-radar stocks. In this environment, identifying stocks with robust fundamentals and strategic positioning can be key to uncovering hidden gems that may thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

ZONQING Environmental (SEHK:1855)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ZONQING Environmental Limited, along with its subsidiaries, offers construction and maintenance services focused on landscaping, ecological restoration, and public work projects in the People’s Republic of China, with a market cap of HK$5.55 billion.

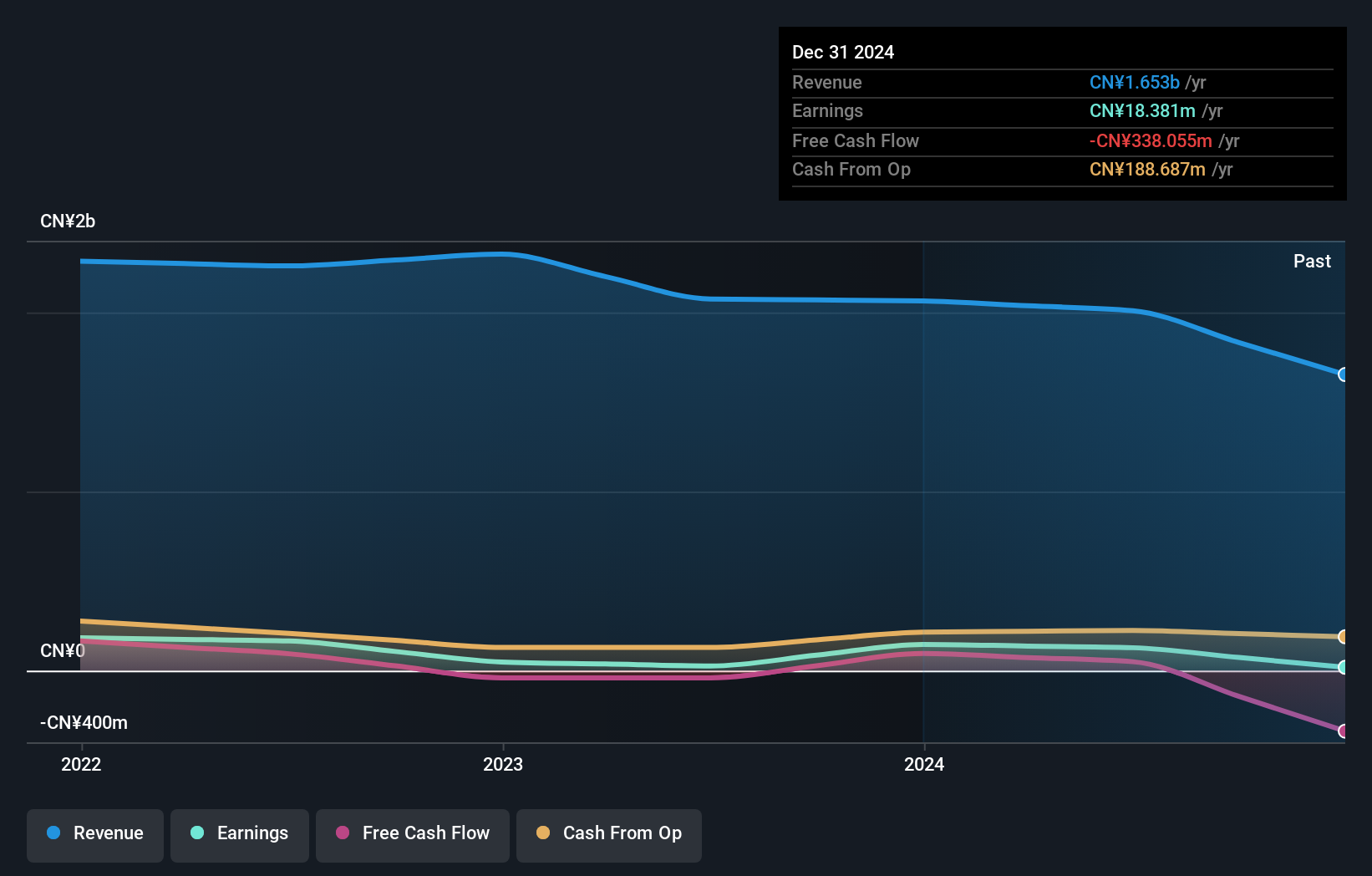

Operations: The company's primary revenue streams include city renewal construction services generating CN¥1.85 billion and city operation and maintenance services contributing CN¥280.90 million, with design and consultancy services adding CN¥86.75 million.

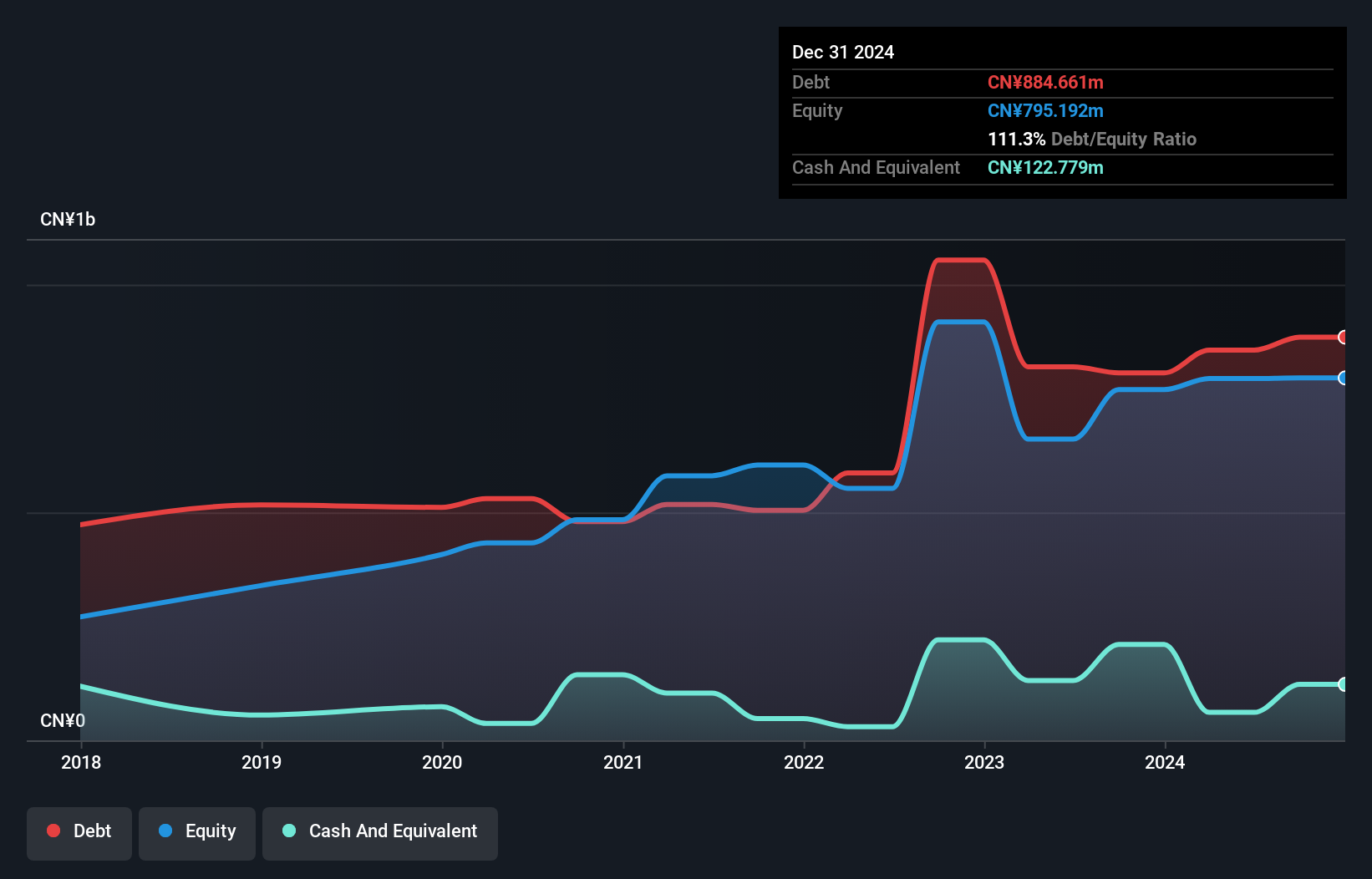

ZONQING Environmental, a smaller player in its sector, has shown notable financial dynamics. Over the past year, earnings surged by an impressive 2,106%, outpacing the Commercial Services industry average of -8.5%. Despite this growth, sales for the first half of 2024 were CNY 775.65 million compared to CNY 909.82 million a year earlier, with net income slightly down from CNY 37.1 million to CNY 34.26 million. The company boasts high-quality earnings and reduced its debt-to-equity ratio from 137.7% to 107.9% over five years but still holds a high net debt-to-equity ratio at 100%.

China Boton Group (SEHK:3318)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Boton Group Company Limited, along with its subsidiaries, engages in the production and sale of flavors, fragrances, and e-cigarette products across China and various international markets with a market capitalization of HK$2.01 billion.

Operations: The company's primary revenue streams include e-cigarette products (CN¥831.16 million) and flavor enhancers (CN¥776.68 million), with additional contributions from food flavors, fine fragrances, and investment properties.

China Boton Group, a smaller player in the market, recently reported a net income of CNY 44.33M for the first half of 2024, showing a decrease from CNY 65.36M in the previous year due to economic challenges. Despite this dip, their earnings grew by an impressive 396% over the past year, significantly outpacing the industry average. The company's debt management has improved with its debt-to-equity ratio dropping from 63.5% to 45.7% over five years, indicating stronger financial health. However, interest payments are not fully covered by EBIT at just 2.8x coverage, suggesting room for improvement in operational efficiency.

Lee & Man Chemical (SEHK:746)

Simply Wall St Value Rating: ★★★★★★

Overview: Lee & Man Chemical Company Limited is an investment holding company that manufactures and sells chemical products in the People’s Republic of China, with a market capitalization of HK$3.14 billion.

Operations: Lee & Man Chemical derives the majority of its revenue from its chemical segment, amounting to HK$4.01 billion, with a smaller contribution from property at HK$32.71 million.

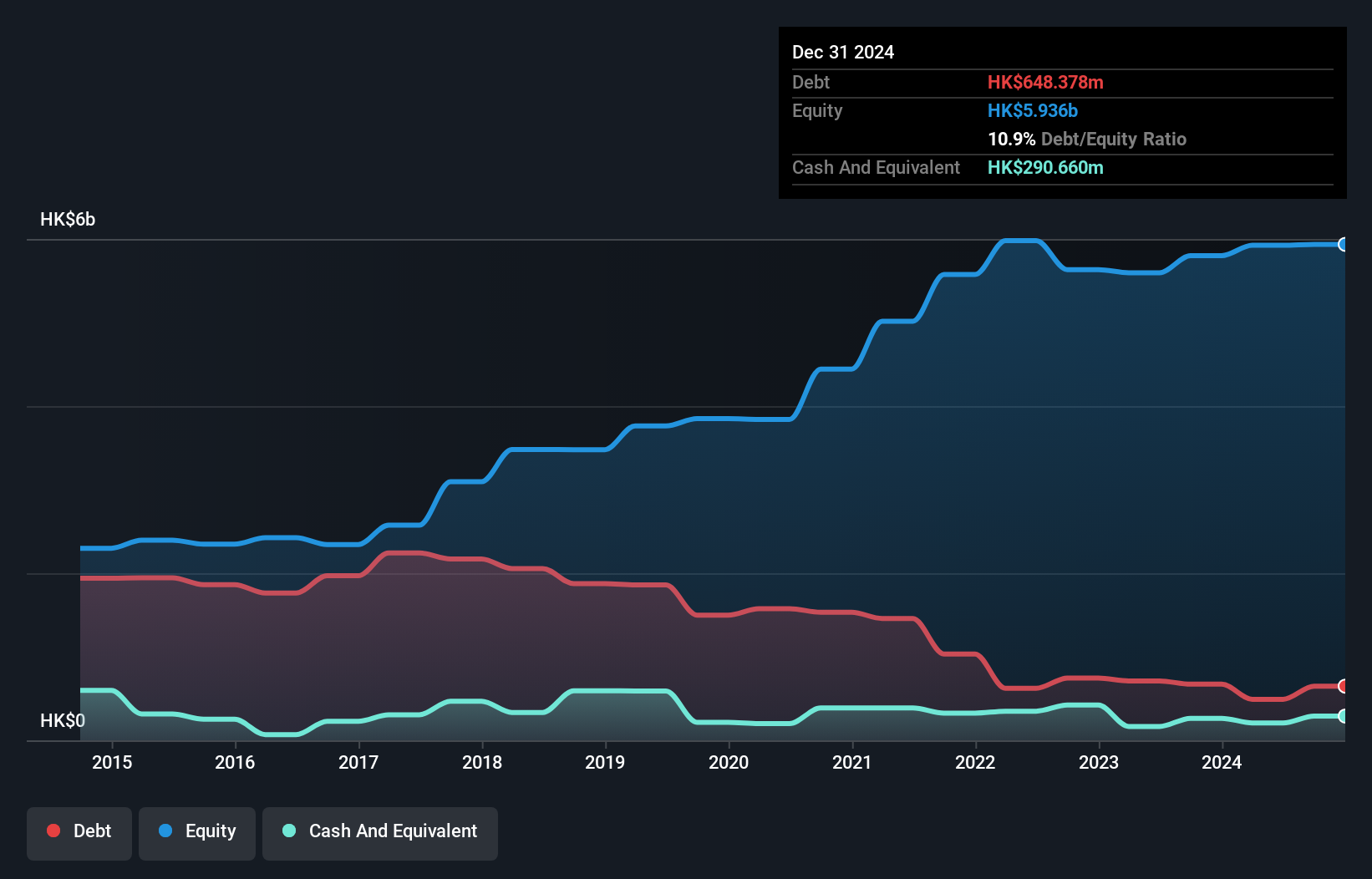

Lee & Man Chemical, a relatively small player in Hong Kong's chemical industry, has shown robust financial health with a net debt to equity ratio of 8.3%, significantly down from 49.4% over the past five years. The company posted impressive earnings growth of 44.9% last year, outpacing the broader chemicals sector which saw a -29.6%. Despite being dropped from the S&P Global BMI Index recently, its stock trades at 52.3% below estimated fair value, indicating potential undervaluation. Recent leadership changes and an interim dividend announcement highlight ongoing strategic adjustments aimed at strengthening its market position further.

- Delve into the full analysis health report here for a deeper understanding of Lee & Man Chemical.

Gain insights into Lee & Man Chemical's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 163 SEHK Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com