As global markets navigate a complex landscape of economic shifts, Hong Kong's Hang Seng Index has recently experienced a decline amidst broader market movements. In this context, identifying promising stocks requires a keen eye for companies with strong fundamentals and resilience, particularly those poised to benefit from potential economic recovery and supportive policy measures.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

China Shineway Pharmaceutical Group (SEHK:2877)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Shineway Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and trade of Chinese medicines in the People’s Republic of China and Hong Kong, with a market cap of HK$7.36 billion.

Operations: The company's primary revenue stream is from Chinese pharmaceutical products, generating CN¥4.20 billion.

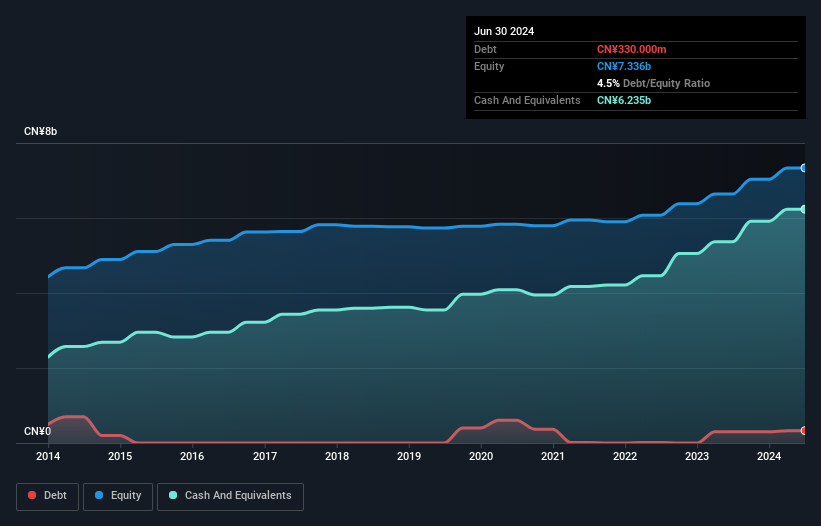

China Shineway Pharmaceutical Group seems to be an intriguing prospect, with earnings growth of 25.1% over the past year, outpacing the broader Pharmaceuticals industry’s 6.4%. The company's net income for the first half of 2024 was CNY 626 million, up from CNY 491 million a year ago, indicating strong operational performance. Despite a slight dip in sales from CNY 2.39 billion to CNY 2.09 billion, Shineway remains free cash flow positive and has more cash than its total debt. Trading at an estimated value significantly below its fair market price suggests potential undervaluation opportunities for investors seeking growth prospects in Hong Kong's market landscape.

Asia Financial Holdings (SEHK:662)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Financial Holdings Limited is an investment holding company that underwrites general and life insurance in Hong Kong, Macau, and Mainland China, with a market cap of HK$3.61 billion.

Operations: The primary revenue stream for Asia Financial Holdings comes from its insurance segment, generating HK$3.09 billion. Corporate activities contribute an additional HK$214.71 million to the total revenue.

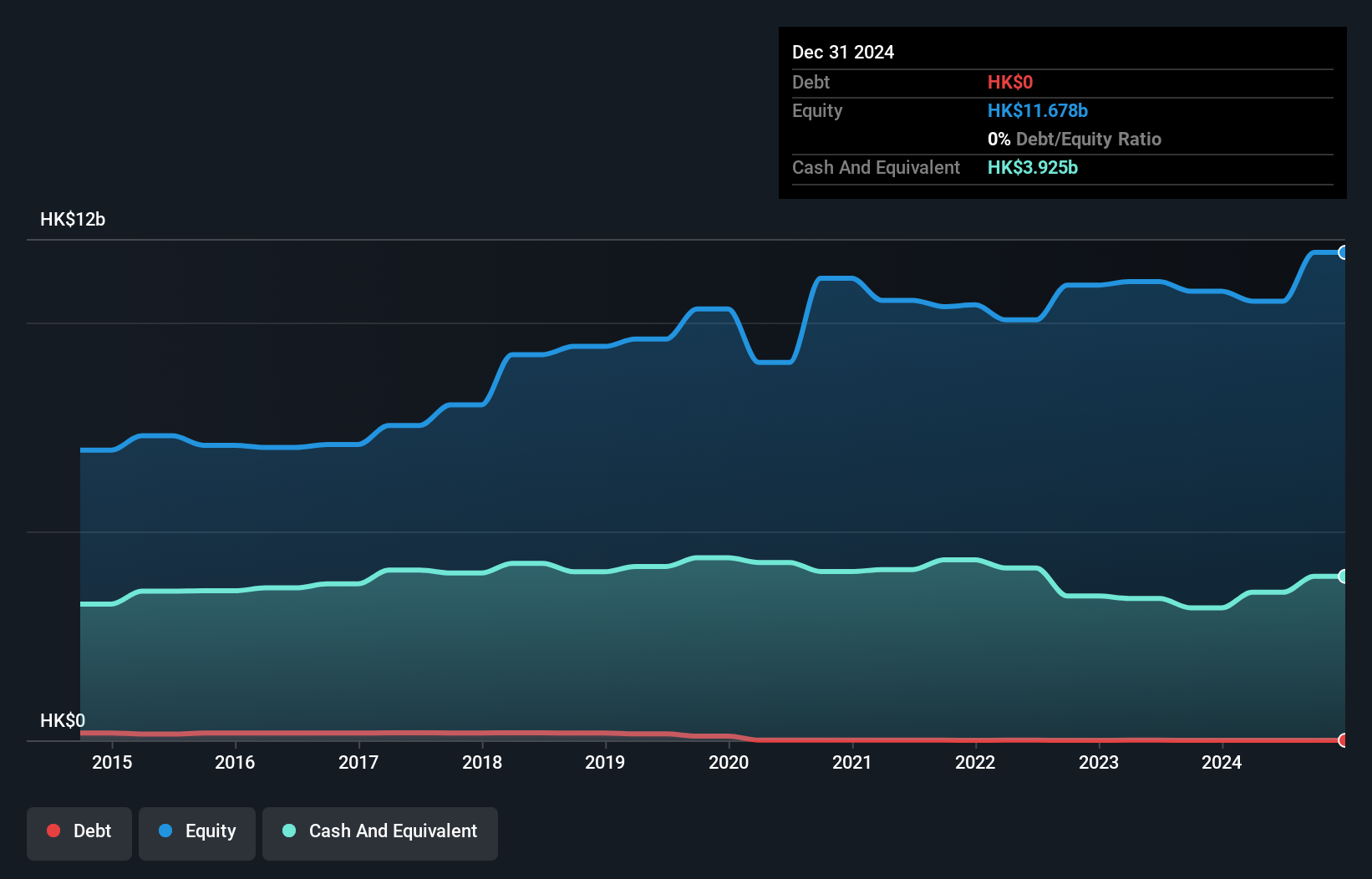

Asia Financial Holdings, a nimble player in Hong Kong's financial landscape, has been making waves with its recent performance. The company reported a net income of HK$361 million for the first half of 2024, up from HK$300 million the previous year. Its basic earnings per share rose to HK$0.39 from HK$0.32, reflecting solid growth. With a Price-To-Earnings ratio of 8.8x, it offers better value than the broader market's 10x benchmark. Notably debt-free now compared to five years ago when its debt-to-equity ratio was 1.6%, this firm seems well-positioned in its industry as it outpaces sector growth rates with high-quality earnings and no interest coverage concerns due to lack of debt obligations.

- Click here and access our complete health analysis report to understand the dynamics of Asia Financial Holdings.

Gain insights into Asia Financial Holdings' past trends and performance with our Past report.

Kangji Medical Holdings (SEHK:9997)

Simply Wall St Value Rating: ★★★★★★

Overview: Kangji Medical Holdings Limited is an investment holding company that designs, develops, manufactures, and sells minimally invasive surgical instruments and accessories in Mainland China and internationally, with a market cap of HK$7.08 billion.

Operations: Kangji Medical generates revenue primarily from the sale of surgical and medical equipment, amounting to CN¥980.85 million. The company has a market capitalization of HK$7.08 billion.

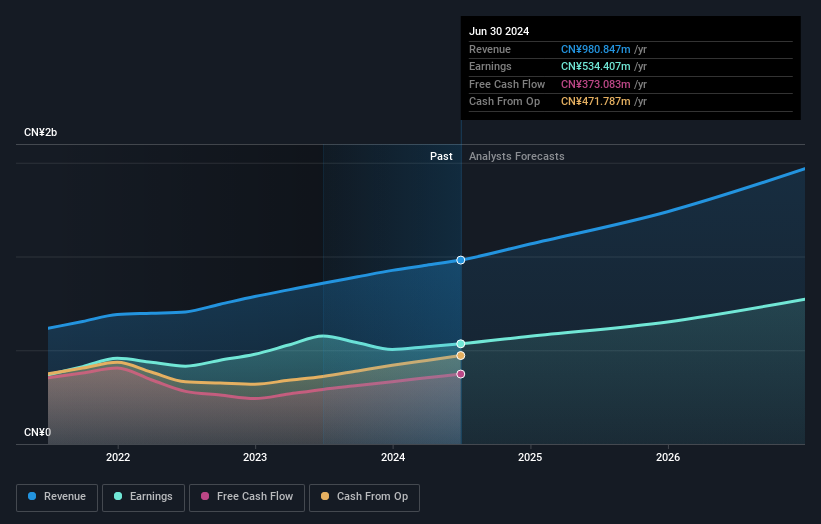

Kangji Medical Holdings, a player in the medical equipment sector, is trading at 45.2% below its estimated fair value, suggesting potential undervaluation. Despite experiencing negative earnings growth of -7.3% last year compared to the industry's -4.3%, Kangji remains debt-free for five years, enhancing its financial stability and eliminating concerns over interest payments. The company's recent half-year results show sales climbing to CNY 458 million from CNY 404 million and net income reaching CNY 286 million from CNY 255 million year-on-year. With earnings per share rising to CNY 0.2439, Kangji's future growth prospects appear promising with forecasts predicting a yearly increase of 14%.

- Dive into the specifics of Kangji Medical Holdings here with our thorough health report.

Explore historical data to track Kangji Medical Holdings' performance over time in our Past section.

Where To Now?

- Click this link to deep-dive into the 165 companies within our SEHK Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com