As global markets navigate a landscape of fluctuating indices and economic indicators, Hong Kong's small-cap sector presents intriguing opportunities amid broader market sentiment shifts. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals, innovative approaches, and resilience to economic changes—qualities that can transform them into undiscovered gems within the bustling Hong Kong market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

MicroPort NeuroScientific (SEHK:2172)

Simply Wall St Value Rating: ★★★★★★

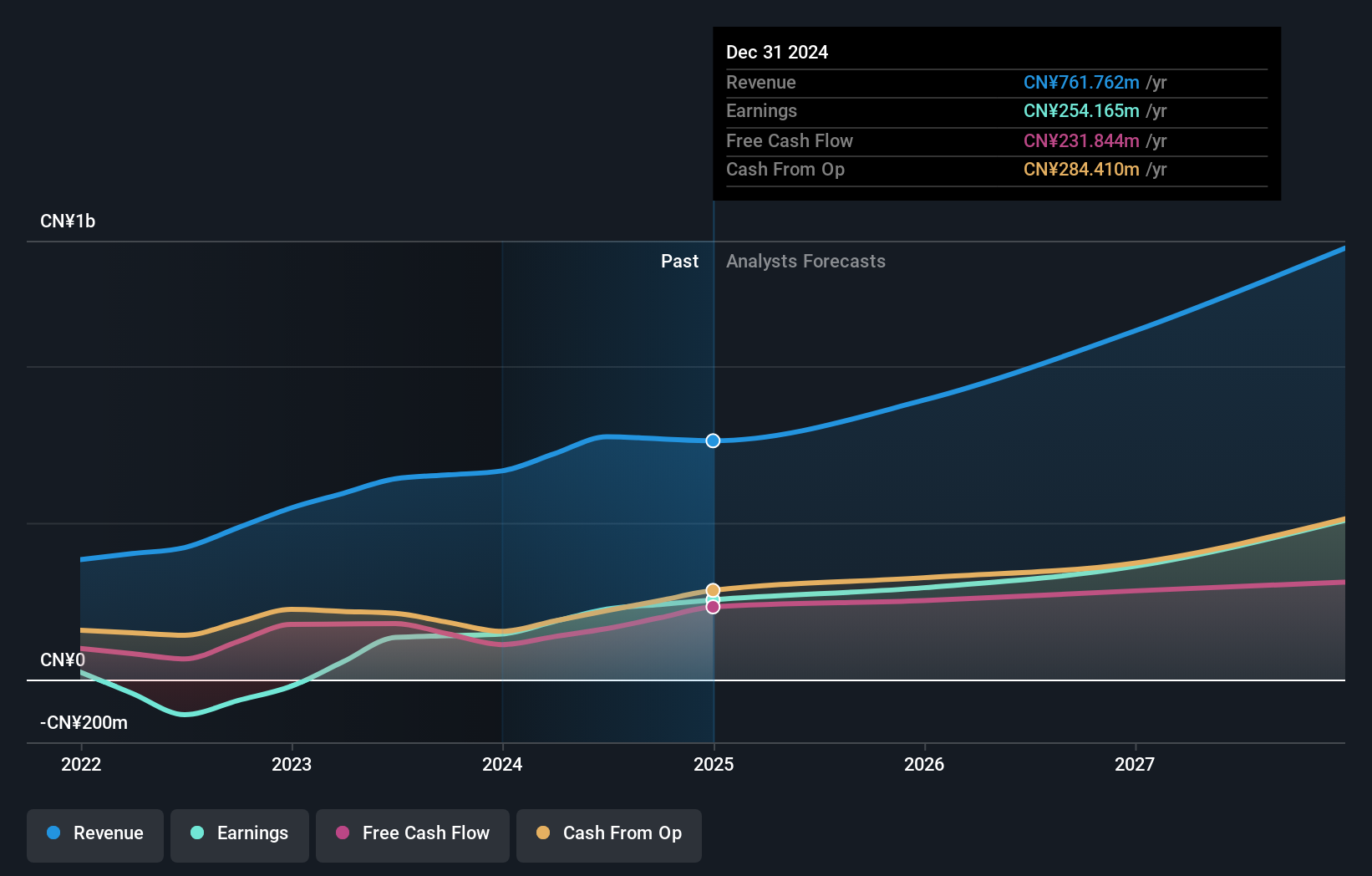

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally with a market cap of HK$5.64 billion.

Operations: The company generates revenue primarily from the sale of surgical and medical equipment, amounting to CN¥774.66 million.

MicroPort NeuroScientific, a dynamic player in the medical equipment space, has showcased impressive growth with earnings surging 67% over the past year. The company is debt-free and trades at nearly half its estimated fair value, indicating potential undervaluation. Recent financials reveal a net income of CNY 143 million for the first half of 2024, up from CNY 64 million last year. Additionally, MicroPort initiated a share repurchase program worth HKD 200 million to potentially enhance shareholder value. These factors highlight its robust financial health and strategic initiatives aimed at boosting investor confidence.

Vtech Holdings (SEHK:303)

Simply Wall St Value Rating: ★★★★★★

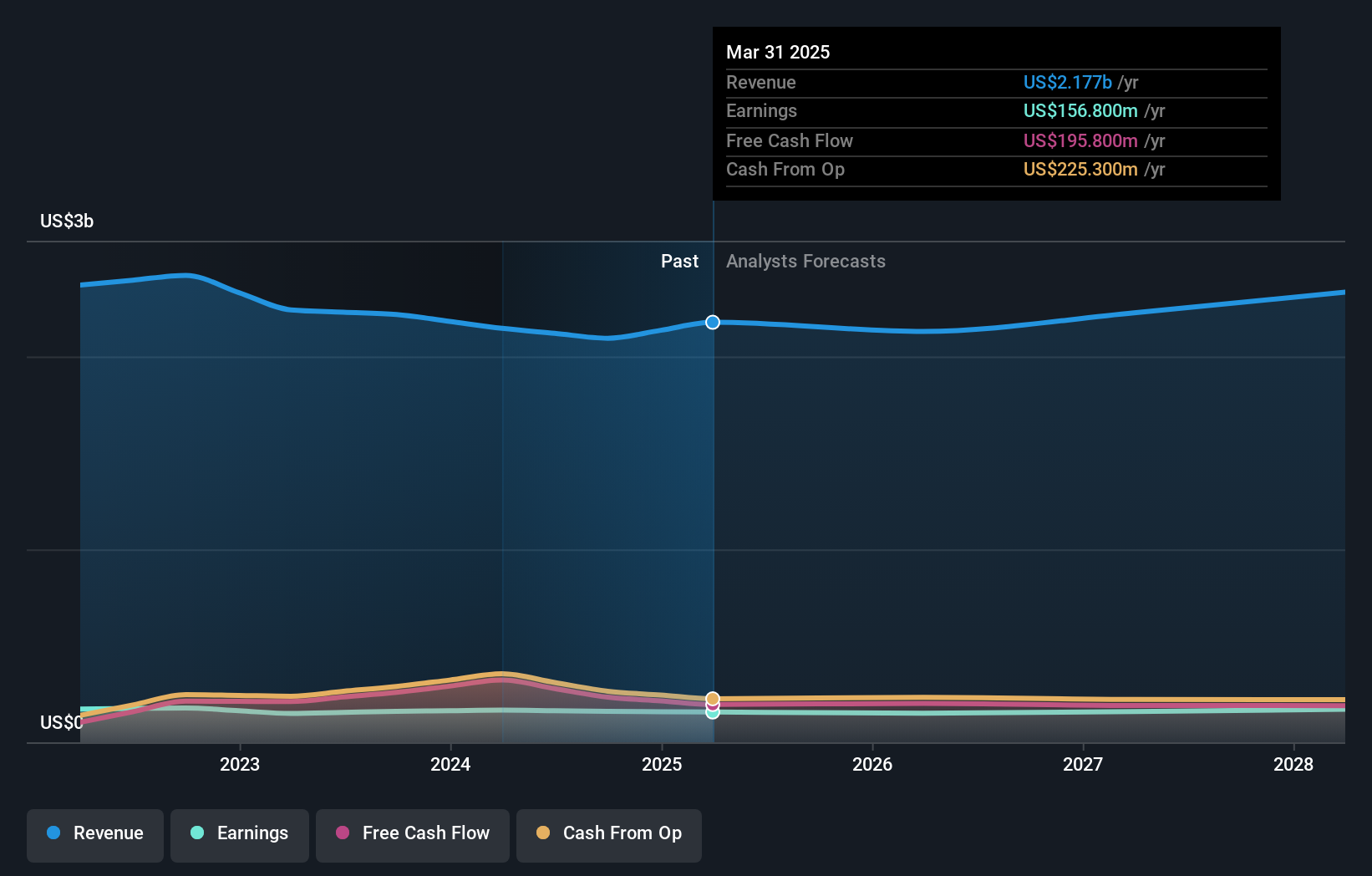

Overview: Vtech Holdings Limited, along with its subsidiaries, engages in the design, manufacture, and distribution of electronic products across Hong Kong, North America, Europe, the Asia Pacific, and other international markets with a market cap of approximately HK$14.53 billion.

Operations: The primary revenue stream for Vtech Holdings is the design, manufacture, and distribution of consumer electronic products, generating approximately $2.15 billion.

Vtech Holdings, a notable player in the tech industry, has been making waves with its recent performance. Over the past year, earnings grew by 11.7%, outpacing the broader Communications sector's -14.5% trend. The company is trading at a significant discount of 87.4% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Furthermore, Vtech remains debt-free and boasts high-quality earnings—a testament to its robust financial health. Recently, it approved a final dividend of US$0.48 per share for March 2024, reflecting confidence in its cash flow capabilities and shareholder returns strategy.

- Click here and access our complete health analysis report to understand the dynamics of Vtech Holdings.

Gain insights into Vtech Holdings' past trends and performance with our Past report.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

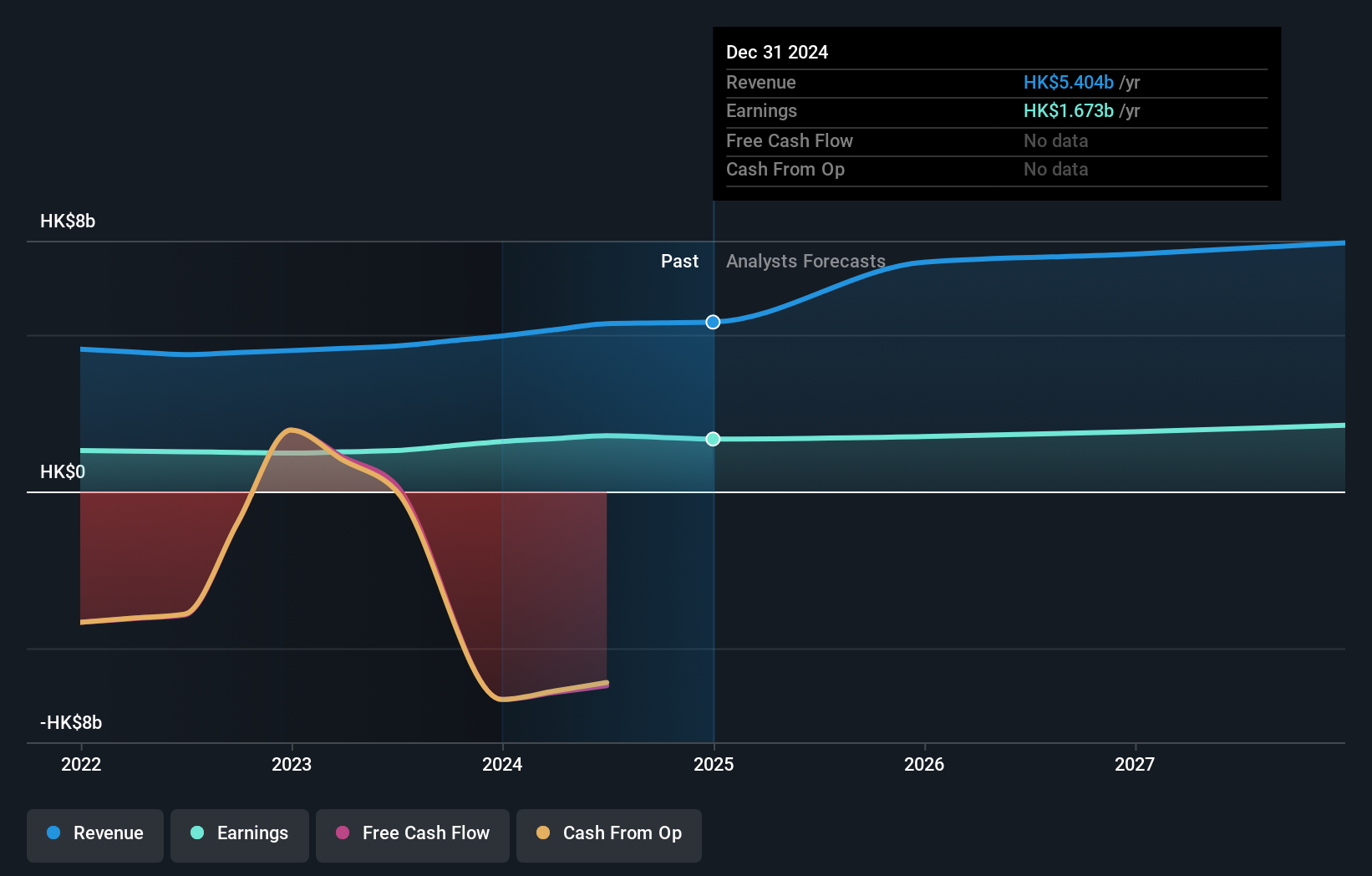

Overview: Dah Sing Financial Holdings Limited is an investment holding company offering banking, insurance, and financial services in Hong Kong, Macau, and the People’s Republic of China with a market cap of approximately HK$8.39 billion.

Operations: Revenue primarily stems from Personal Banking at HK$2.68 billion, followed by Treasury and Global Markets generating HK$1.34 billion. Corporate Banking contributes HK$853.60 million, while the Insurance Business adds HK$246.25 million to the revenue stream.

Dah Sing Financial Holdings, a relatively smaller player in the Hong Kong financial scene, is trading at 36.2% below its estimated fair value. The company has total assets of HK$272.4 billion and equity of HK$42.4 billion, with deposits amounting to HK$214.2 billion and loans at HK$141.9 billion. Notably, earnings surged by 36.7% over the past year, outpacing industry growth of 3.2%. Dah Sing maintains a low bad loans ratio of 1.9%, supported by an allowance for bad loans at 43%. Recent leadership changes include Derek Wong's appointment as vice chairman in August 2024.

Turning Ideas Into Actions

- Click here to access our complete index of 166 SEHK Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com