In October 2024, the Hong Kong market has been influenced by global economic developments, with rising oil prices and geopolitical tensions in the Middle East impacting investor sentiment. Despite these challenges, small-cap stocks in Hong Kong have shown resilience, presenting potential opportunities for investors looking to capitalize on insider activity and attractive valuations. Identifying promising small-cap stocks often involves assessing their financial health and strategic positioning within the current market landscape.

Top 5 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.6x | 41.47% | ★★★★★☆ |

| Vesync | 7.2x | 1.1x | -3.50% | ★★★★☆☆ |

| Ferretti | 10.8x | 0.7x | 47.27% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.2x | 44.29% | ★★★★☆☆ |

| China Lesso Group Holdings | 6.0x | 0.4x | -524.17% | ★★★☆☆☆ |

| Skyworth Group | 5.8x | 0.1x | -308.71% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 7.2x | 0.4x | -48.07% | ★★★☆☆☆ |

| Guangdong Kanghua Healthcare Group | 13.7x | 0.3x | 5.54% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Vesync (SEHK:2148)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the design, development, and sale of smart home appliances and tools, with a market capitalization of approximately HK$3.5 billion.

Operations: The company generates revenue primarily from its Appliance & Tool segment, with recent figures reaching $604.75 million. Over time, its gross profit margin has shown an upward trend, peaking at 48.46% as of the latest data. Operating expenses are a significant component of costs, with sales and marketing being the largest expense within this category.

PE: 7.2x

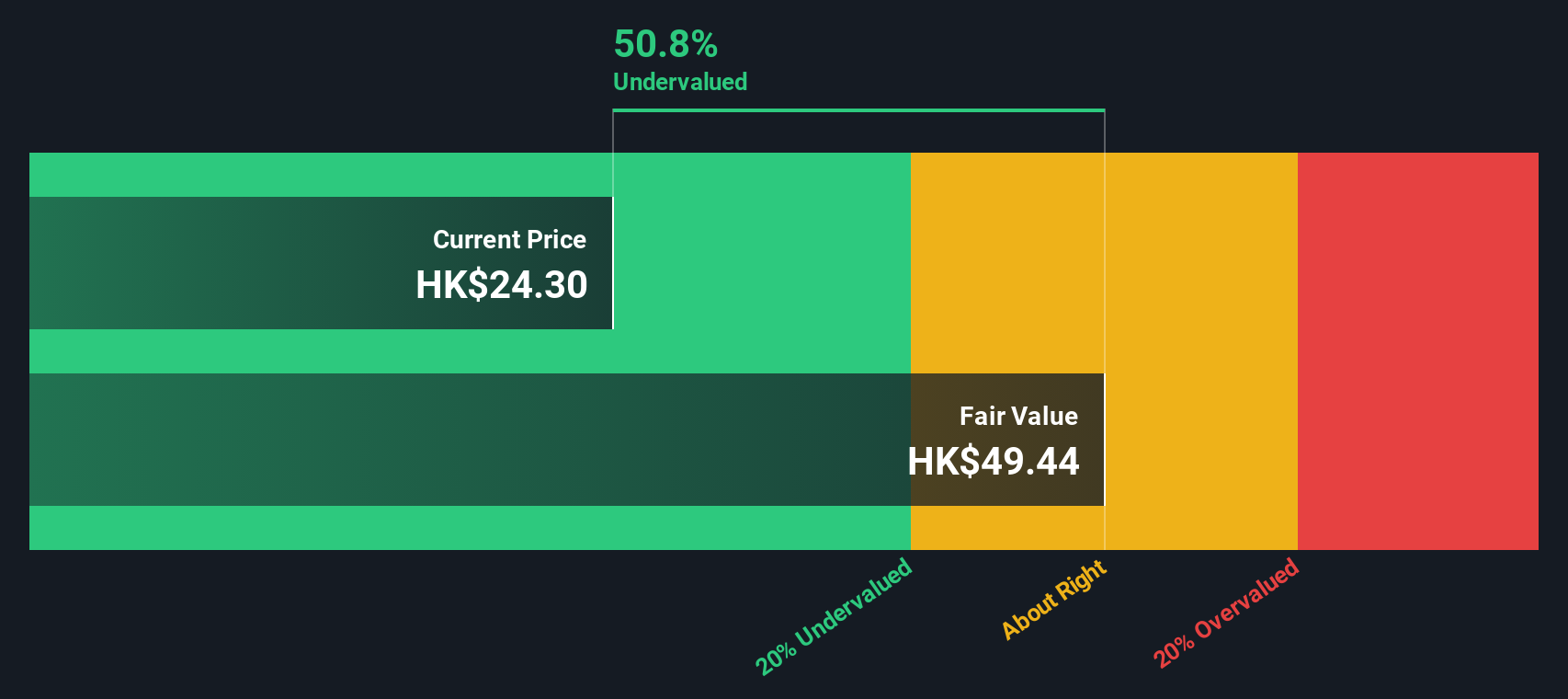

Vesync, a Hong Kong-based company, has recently been added to the S&P Global BMI Index, reflecting its growing recognition. Its financial performance for the first half of 2024 showed sales of US$296.19 million and net income of US$44.86 million, marking significant growth from the previous year. Insider confidence is evident with Zhaojun Chen purchasing 200,000 shares valued at approximately HK$828,979 in August 2024. Despite relying on higher-risk external borrowing for funding, Vesync's earnings are projected to grow by 6.61% annually.

- Navigate through the intricacies of Vesync with our comprehensive valuation report here.

Assess Vesync's past performance with our detailed historical performance reports.

Skyworth Group (SEHK:751)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Skyworth Group is a diversified technology company engaged in the production and sale of smart household appliances, smart systems technology, modern services, and new energy solutions.

Operations: The Smart Household Appliances Business is the largest revenue contributor, followed by the New Energy Business and Smart Systems Technology Business. The gross profit margin has varied over time, reaching 21.23% in December 2015 before declining to 13.76% by June 2023. Operating expenses primarily include sales and marketing, research and development, and general administrative costs.

PE: 5.8x

Skyworth Group, a player in Hong Kong's small company sector, recently reported a rise in net income to CNY 384 million for the first half of 2024, up from CNY 302 million the previous year. Despite lower revenue at CNY 30.15 billion compared to CNY 32.3 billion previously, insider confidence is evident with Chi Shi purchasing over two million shares valued at approximately CNY 6.3 million between August and September. The company's strategic expansion into Russia aims to leverage its innovative product line and advanced technology like the BM series developed with BMW's Designworks studio. However, Skyworth faces challenges due to reliance on external borrowing for funding rather than customer deposits but remains focused on growth through technological innovation and market adaptation strategies in Russia.

- Click here to discover the nuances of Skyworth Group with our detailed analytical valuation report.

Gain insights into Skyworth Group's past trends and performance with our Past report.

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is a company involved in the design, construction, and marketing of yachts and recreational boats with a market capitalization of approximately HK$8.52 billion.

Operations: Ferretti generates revenue primarily from the design, construction, and marketing of yachts and recreational boats, with recent figures reaching €1.30 billion. The company's gross profit margin was 36.04% as of the latest period, indicating efficiency in managing production costs relative to sales. Operating expenses are a significant component of its cost structure, including general and administrative expenses which recently amounted to €263.40 million.

PE: 10.8x

Ferretti, a smaller company in Hong Kong's market, has been making waves with insider confidence shown through recent share purchases. Despite being dropped from the S&P Global BMI Index in September 2024, they reported strong earnings for the first half of 2024 with sales reaching €695.1 million and net income at €43.86 million. Leadership changes include Mr. Jiang Kui stepping in as Chairman on August 29, 2024, ensuring strategic continuity and potential growth ahead despite higher-risk funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Ferretti.

Examine Ferretti's past performance report to understand how it has performed in the past.

Key Takeaways

- Click here to access our complete index of 8 Undervalued SEHK Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com