Nexteer Automotive Group Limited (HKG:1316) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

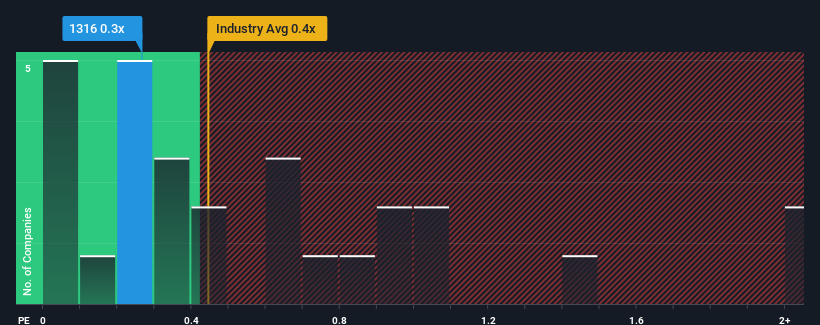

Although its price has surged higher, there still wouldn't be many who think Nexteer Automotive Group's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Auto Components industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nexteer Automotive Group

What Does Nexteer Automotive Group's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Nexteer Automotive Group has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Nexteer Automotive Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Nexteer Automotive Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nexteer Automotive Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.7% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 17% per annum, which is noticeably more attractive.

In light of this, it's curious that Nexteer Automotive Group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Nexteer Automotive Group's P/S Mean For Investors?

Nexteer Automotive Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at the analysts forecasts of Nexteer Automotive Group's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Nexteer Automotive Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.