The Hong Kong market has seen a significant boost recently, driven by China's robust stimulus measures aimed at revitalizing its economy. This positive sentiment has also lifted the Hang Seng Index, which gained 13% in response to these developments. In this favorable economic climate, dividend stocks can offer a stable income stream and potential for capital appreciation. Here are three SEHK dividend stocks yielding up to 5.5% that might be worth considering for their steady returns and resilience amid current market conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.93% | ★★★★★★ |

| Consun Pharmaceutical Group (SEHK:1681) | 8.42% | ★★★★★☆ |

| China Hongqiao Group (SEHK:1378) | 9.09% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.29% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.42% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.46% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 7.28% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.59% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.47% | ★★★★★☆ |

Click here to see the full list of 87 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells bio-pharmaceutical products in the People’s Republic of China, Hong Kong, and internationally with a market cap of HK$1.53 billion.

Operations: Essex Bio-Technology Limited generates revenue primarily from its surgical segment (HK$871.44 million) and ophthalmology segment (HK$747.39 million).

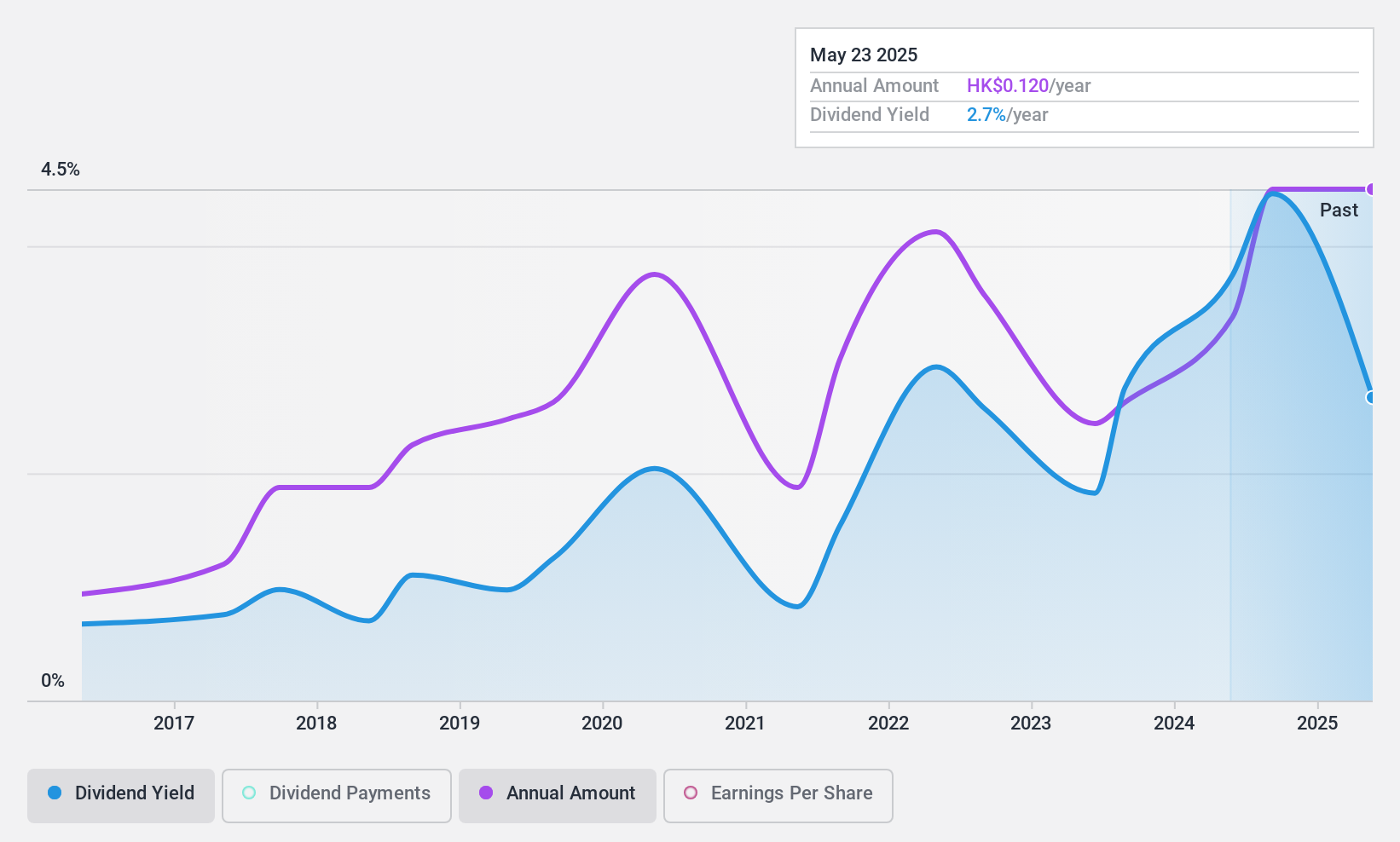

Dividend Yield: 4.4%

Essex Bio-Technology's recent share repurchase program, authorized to buy back up to 56.75 million shares, is expected to enhance net asset value and earnings per share. The company declared an interim dividend of HK$0.06 per share for the first half of 2024 despite a slight decline in sales and net income compared to last year. With a payout ratio of 22.7% and cash payout ratio of 32.3%, dividends are well-covered by earnings and cash flows, though historical dividend payments have been volatile and lower than top-tier payers in Hong Kong.

- Click here and access our complete dividend analysis report to understand the dynamics of Essex Bio-Technology.

- Our expertly prepared valuation report Essex Bio-Technology implies its share price may be too high.

Shandong Weigao Group Medical Polymer (SEHK:1066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Weigao Group Medical Polymer Company Limited focuses on the research, development, production, wholesale, and sale of medical devices in China and has a market cap of HK$25.69 billion.

Operations: Shandong Weigao Group Medical Polymer Company Limited generates revenue from Orthopaedic Products (CN¥1.22 billion), Interventional Products (CN¥1.99 billion), Medical Device Products (CN¥6.74 billion), Blood Management Products (CN¥936.84 million), and Pharma Packaging Products (CN¥2.13 billion).

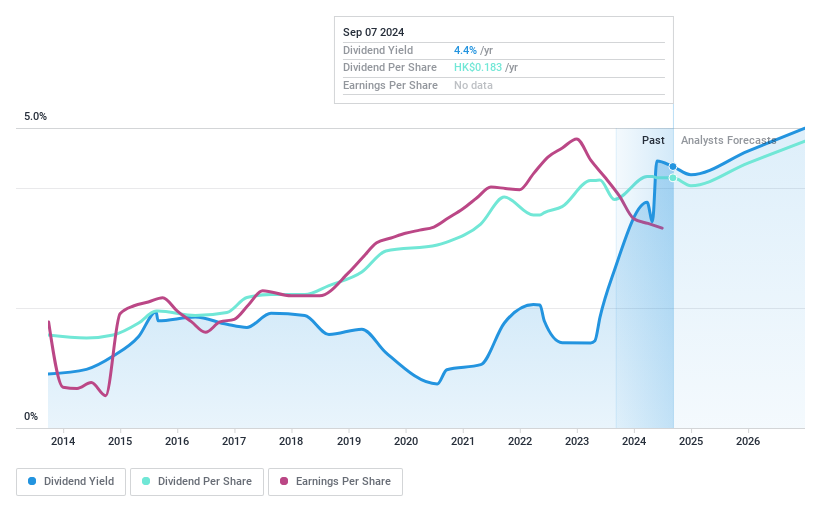

Dividend Yield: 3.3%

Shandong Weigao Group Medical Polymer's dividend payments have been volatile over the past decade, though recent increases suggest some improvement. The company proposed an interim dividend of RMB 0.0919 per share for H1 2024, up from RMB 0.0734 a year ago, pending shareholder approval. Despite a drop in sales and net income for H1 2024 compared to last year, dividends are well-covered by earnings (payout ratio: 43.9%) and cash flows (cash payout ratio: 37.5%).

- Click here to discover the nuances of Shandong Weigao Group Medical Polymer with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Shandong Weigao Group Medical Polymer is trading behind its estimated value.

EVA Precision Industrial Holdings (SEHK:838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EVA Precision Industrial Holdings Limited, with a market cap of HK$1.31 billion, offers precision manufacturing services in the People's Republic of China, Vietnam, and Mexico.

Operations: EVA Precision Industrial Holdings Limited generates revenue from two main segments: Automotive Components (HK$1.98 billion) and Office Automation Equipment (HK$4.34 billion).

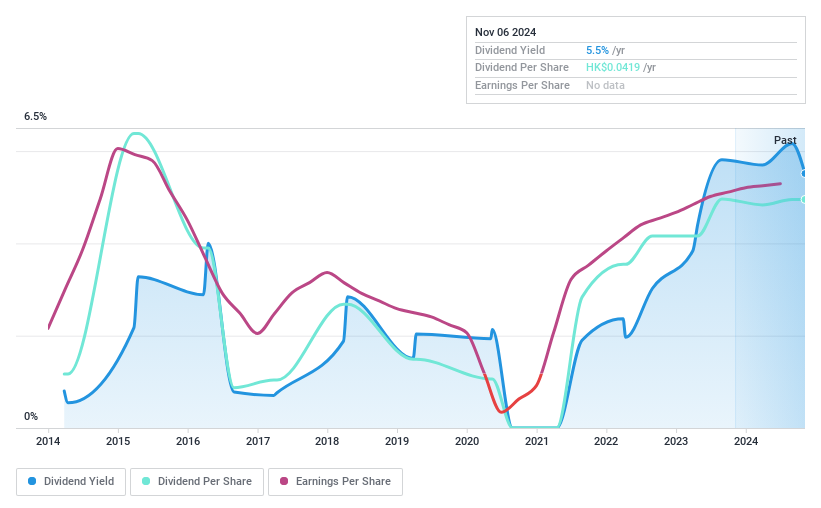

Dividend Yield: 5.6%

EVA Precision Industrial Holdings recently declared an interim dividend of HKD 0.022 per share for H1 2024, reflecting a modest increase. The company's earnings for the same period rose slightly to HKD 127.81 million from HKD 122.62 million last year, with basic EPS at HKD 0.073. While dividends are well-covered by both earnings (payout ratio: 30.1%) and cash flows (cash payout ratio: 34%), the dividend history has been volatile over the past decade.

- Take a closer look at EVA Precision Industrial Holdings' potential here in our dividend report.

- The valuation report we've compiled suggests that EVA Precision Industrial Holdings' current price could be quite moderate.

Next Steps

- Get an in-depth perspective on all 87 Top SEHK Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com