C&D International Investment Group Limited (HKG:1908) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

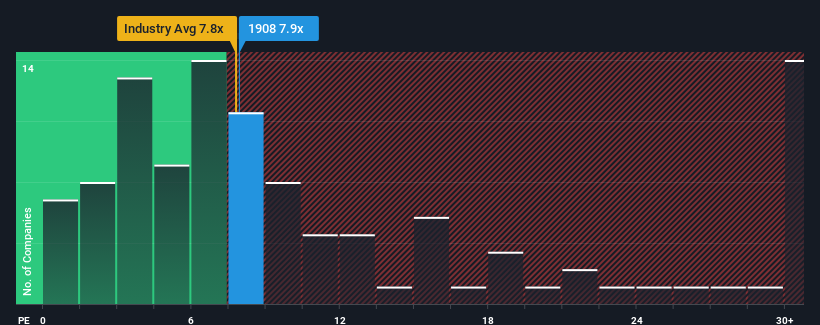

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about C&D International Investment Group's P/E ratio of 7.9x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

C&D International Investment Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for C&D International Investment Group

How Is C&D International Investment Group's Growth Trending?

C&D International Investment Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 9.8% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 5.7% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 12% each year, which is noticeably more attractive.

In light of this, it's curious that C&D International Investment Group's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On C&D International Investment Group's P/E

Its shares have lifted substantially and now C&D International Investment Group's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of C&D International Investment Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware C&D International Investment Group is showing 4 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on C&D International Investment Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.