As global markets react to the recent Federal Reserve rate cut, Hong Kong's Hang Seng Index has seen a notable gain of 5.12%, suggesting renewed investor confidence despite broader economic concerns. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on market opportunities. In this article, we will explore three undiscovered gems in Hong Kong that exhibit robust potential and could benefit from the current favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited (SEHK:1277) is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$12.05 billion.

Operations: Kinetic Development Group Limited generates revenue primarily from the extraction and sale of coal products in the People’s Republic of China. The company reported a market cap of HK$12.05 billion.

Kinetic Development Group, a notable player in Hong Kong's market, has shown impressive performance. The company reported earnings of CNY 1.10 billion for the first half of 2024, up from CNY 570 million last year. Its net debt to equity ratio stands at a satisfactory 4.7%, and interest payments are well covered by EBIT at 163x coverage. Additionally, Kinetic's earnings growth of 39% outpaced the Oil and Gas industry’s average growth rate of just under 5%.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly and networking cable products across various international markets, with a market cap of HK$8.29 billion.

Operations: Time Interconnect Technology generates revenue primarily from its Server (HK$2.98 billion), Digital Cable (HK$1.18 billion), and Cable Assembly (HK$2.31 billion) segments, with minor eliminations (-HK$25.44 million). The company’s revenue streams are diversified across several international markets including the United States, China, and Hong Kong.

Time Interconnect Technology, a smaller player in the cable assembly sector, reported sales of HK$2.67 billion for the first half of 2024, up from HK$2.63 billion last year. Net income rose to HK$202.6 million compared to HK$151.11 million previously, with basic earnings per share increasing to HK$0.1041 from HK$0.0777 a year ago. The company announced an interim dividend of HKD 0.01 per share totaling HKD 19,470,000 payable on October 9th, reflecting its solid financial performance and shareholder returns.

- Take a closer look at Time Interconnect Technology's potential here in our health report.

Gain insights into Time Interconnect Technology's past trends and performance with our Past report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.78 billion.

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily from retail sales through grocery stores, amounting to CN¥5.99 billion. The company has a market cap of HK$7.78 billion.

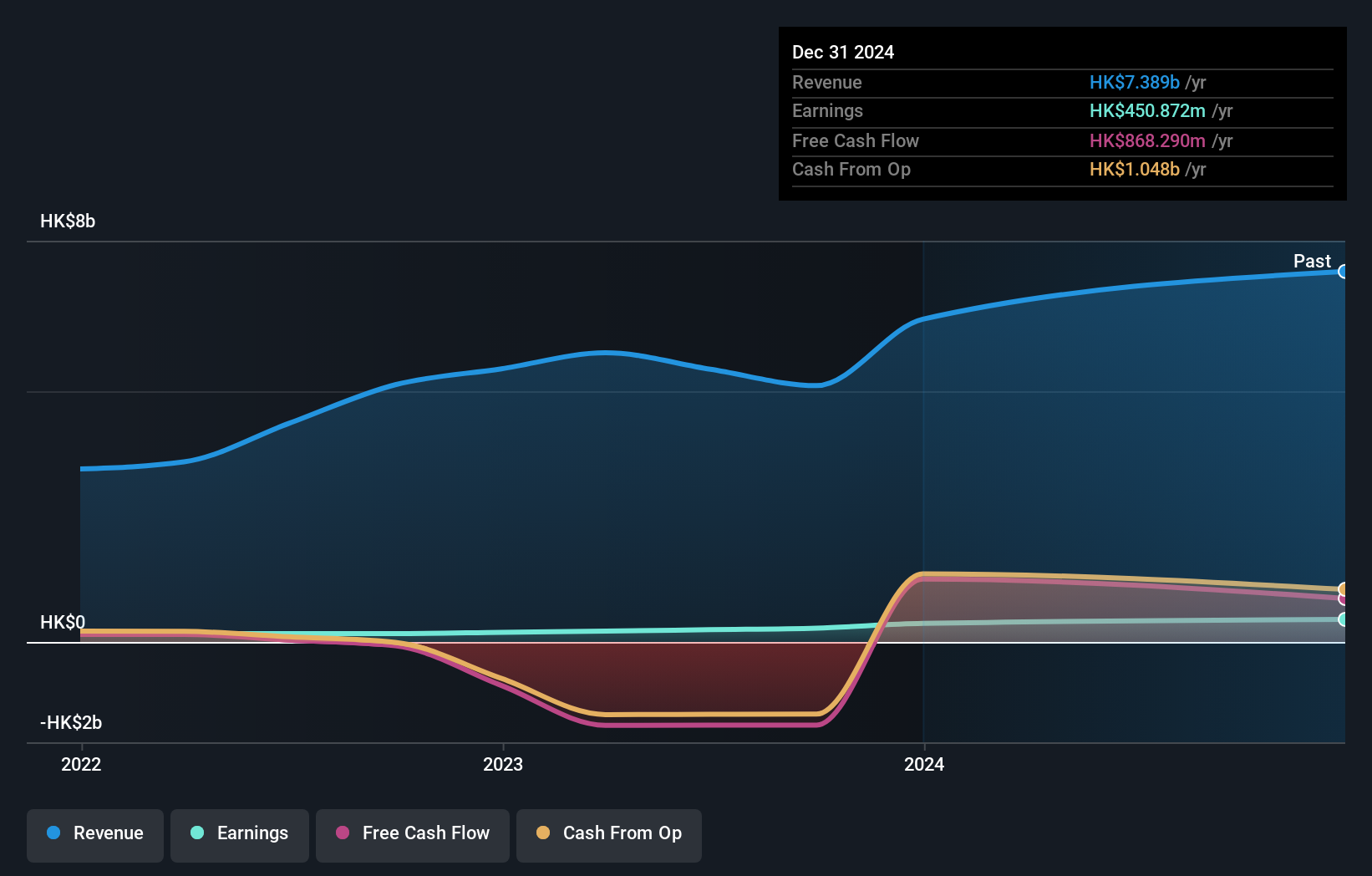

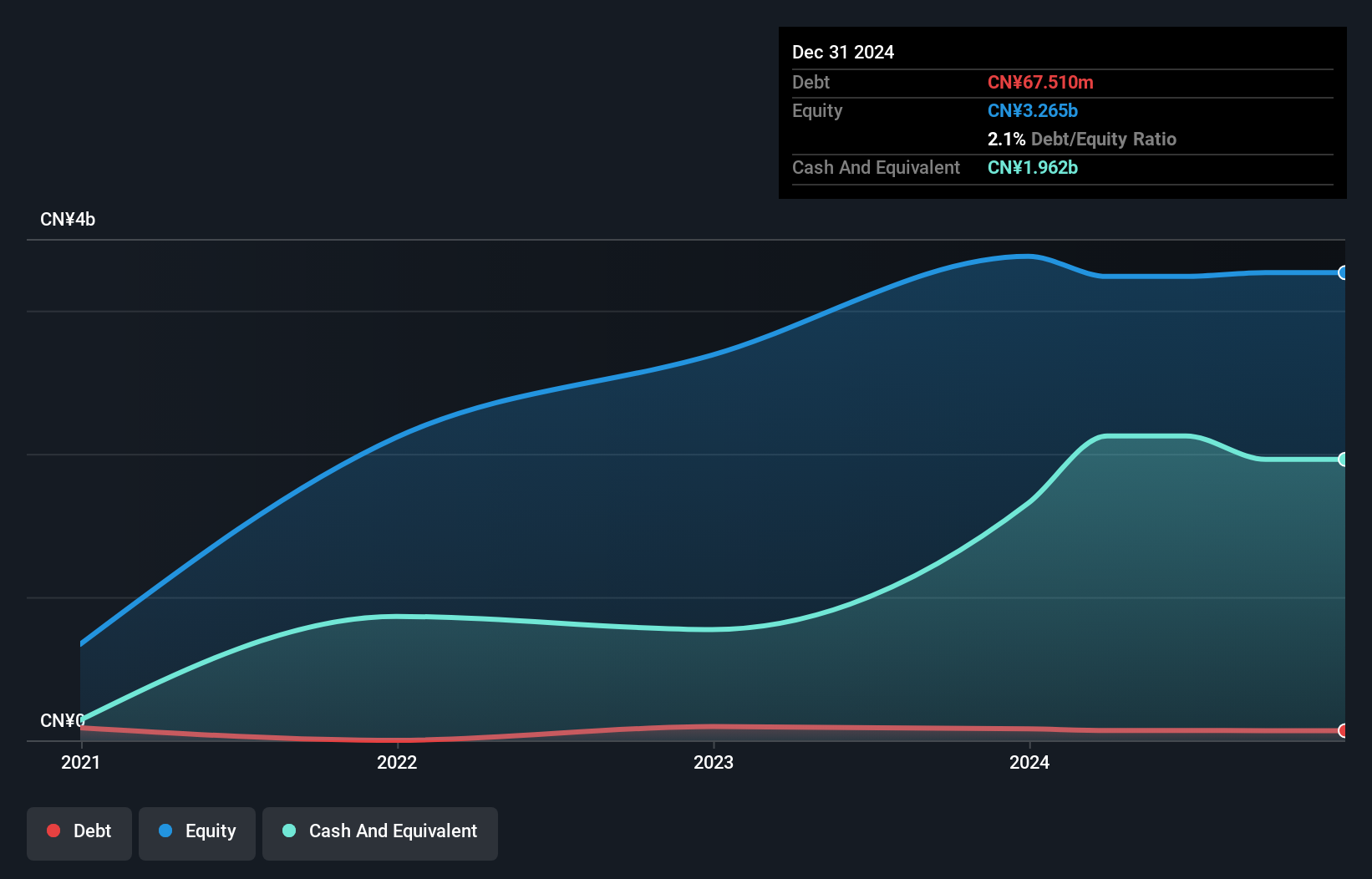

Guoquan Food (Shanghai) has demonstrated robust financial health, with free cash flow turning positive to CNY 543.34 million in 2023 from negative figures in previous years. Despite a net income drop to CNY 85.98 million for the first half of 2024, it remains profitable and covers its interest payments effectively. Trading at 63.5% below estimated fair value, Guoquan's volatile share price and recent board changes add complexity but also potential for future growth within the consumer retailing sector.

- Click here and access our complete health analysis report to understand the dynamics of Guoquan Food (Shanghai).

Evaluate Guoquan Food (Shanghai)'s historical performance by accessing our past performance report.

Seize The Opportunity

- Explore the 172 names from our SEHK Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com