As global markets react to the recent Federal Reserve rate cut, Hong Kong's Hang Seng Index has shown a notable gain of 5.12%, reflecting renewed investor optimism. This positive sentiment provides a fertile ground for uncovering promising small-cap stocks that could benefit from the evolving economic landscape. In this context, identifying stocks with strong fundamentals and growth potential becomes crucial, especially as market conditions shift in response to macroeconomic changes.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$12.31 billion.

Operations: Kinetic Development Group generates revenue from the extraction and sale of coal products in the People’s Republic of China. The company has a market cap of HK$12.31 billion.

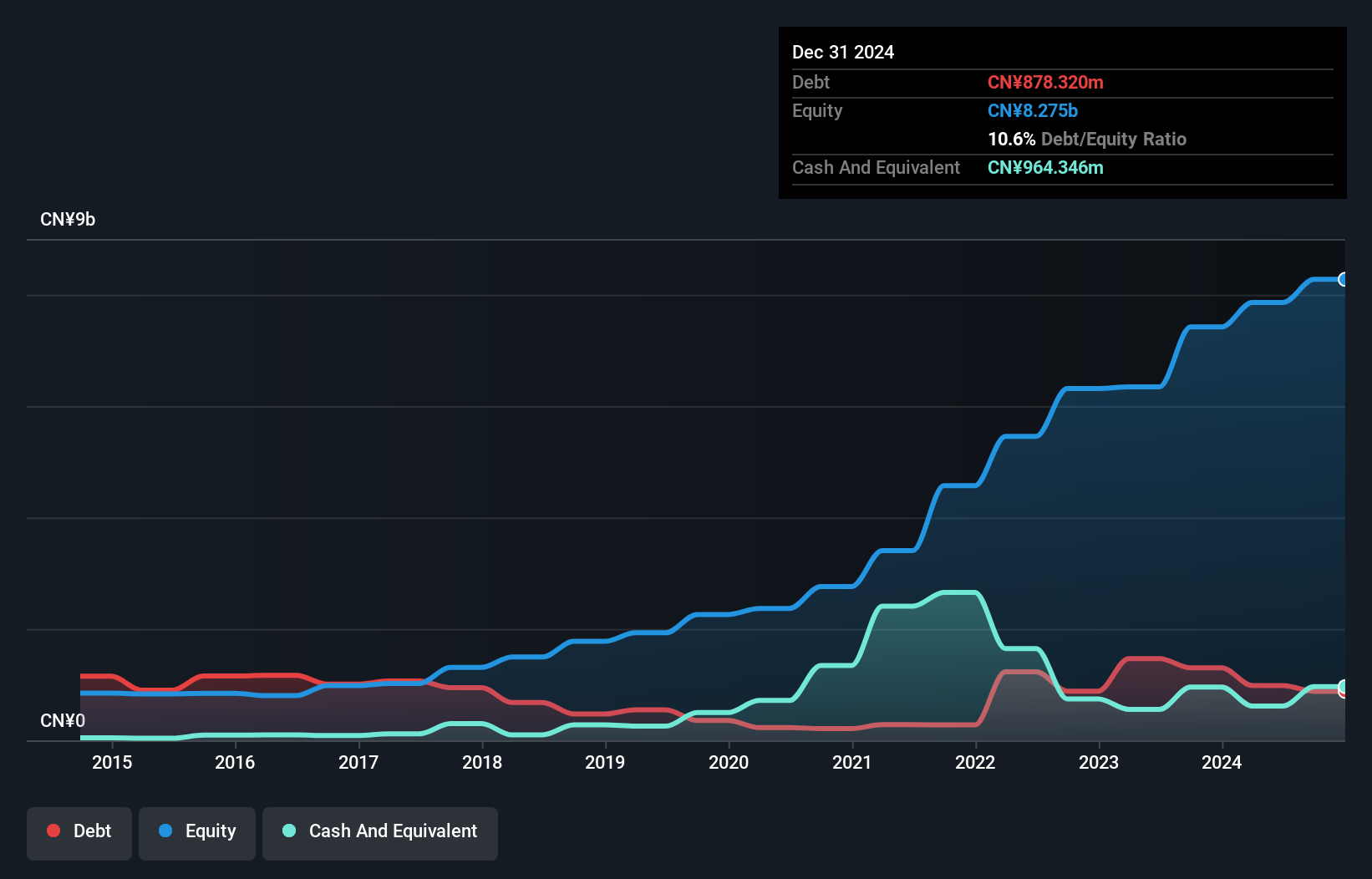

Kinetic Development Group has demonstrated strong performance with earnings growing by 39.2% over the past year, surpassing the Oil and Gas industry's 4.6%. The company's net debt to equity ratio stands at a satisfactory 4.7%, down from 28.4% five years ago, showcasing prudent financial management. Recent earnings for the half-year ended June 30, 2024, reported sales of CNY 2.53 billion and net income of CNY 1.10 billion, reflecting significant growth from last year’s figures of CNY 1.49 billion in sales and CNY 570 million in net income.

- Delve into the full analysis health report here for a deeper understanding of Kinetic Development Group.

Learn about Kinetic Development Group's historical performance.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.28 billion.

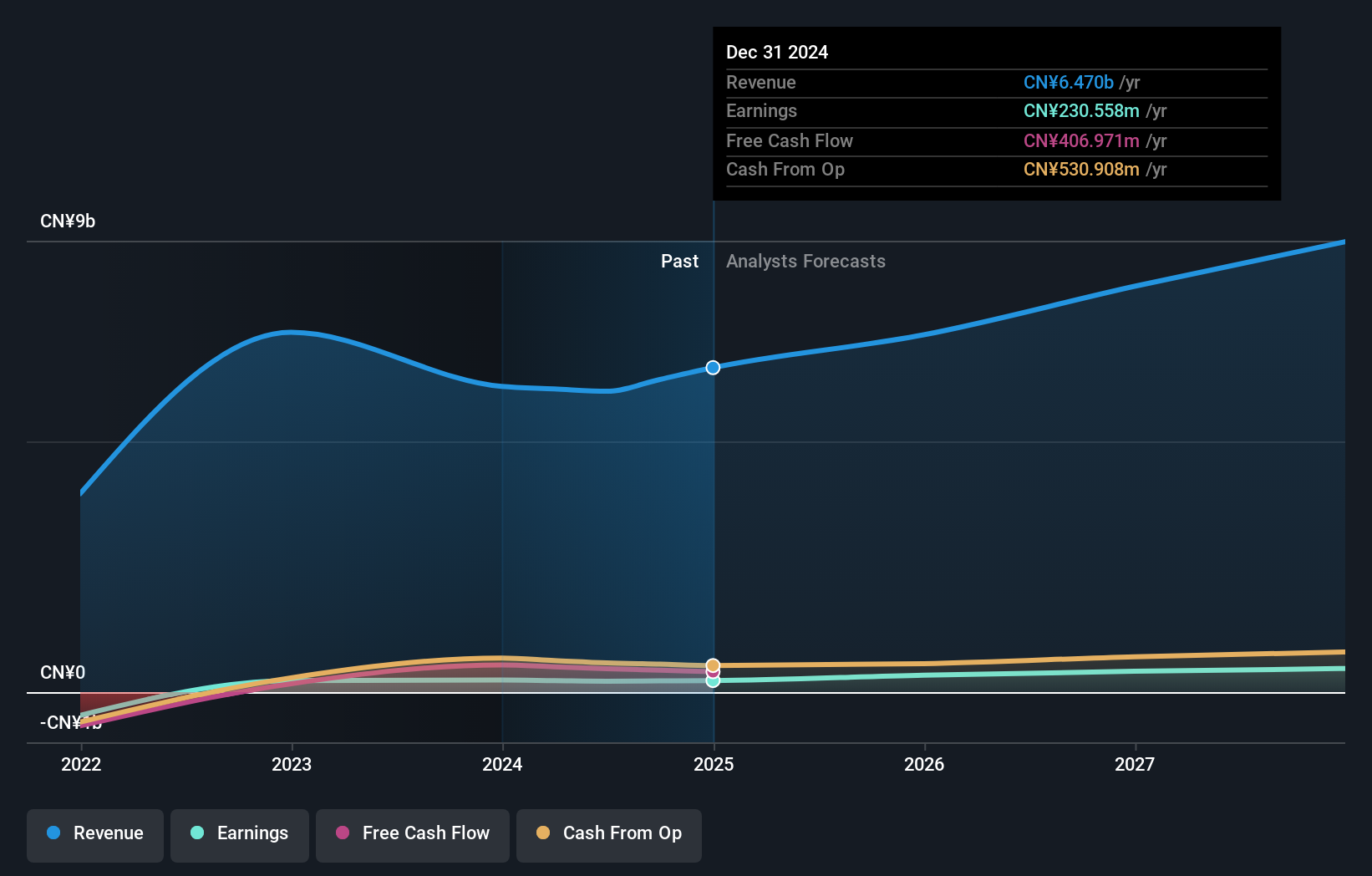

Operations: The company generates revenue primarily from retail sales through grocery stores, amounting to CN¥5.998 billion.

Guoquan Food (Shanghai) has seen a turbulent year, with sales for the first half of 2024 at CNY 2.67 billion, down from CNY 2.76 billion the previous year. Net income also dropped to CNY 86 million from CNY 108 million. Basic earnings per share fell to CNY 0.0313 compared to last year's CNY 0.0403. Despite these challenges, the company remains profitable and free cash flow positive with a levered free cash flow of US$467 million as of June this year.

- Take a closer look at Guoquan Food (Shanghai)'s potential here in our health report.

Evaluate Guoquan Food (Shanghai)'s historical performance by accessing our past performance report.

Tomson Group (SEHK:258)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomson Group Limited is an investment holding company involved in property development and investment, hospitality and leisure, securities trading, and media and entertainment operations across Hong Kong, Macau, and Mainland China with a market cap of HK$4.90 billion.

Operations: Tomson Group Limited generates revenue primarily from property investment (HK$217.63 million), hospitality and leisure (HK$49.69 million), and securities trading (HK$20.19 million). The company's net profit margin is a key financial metric to consider in evaluating its profitability.

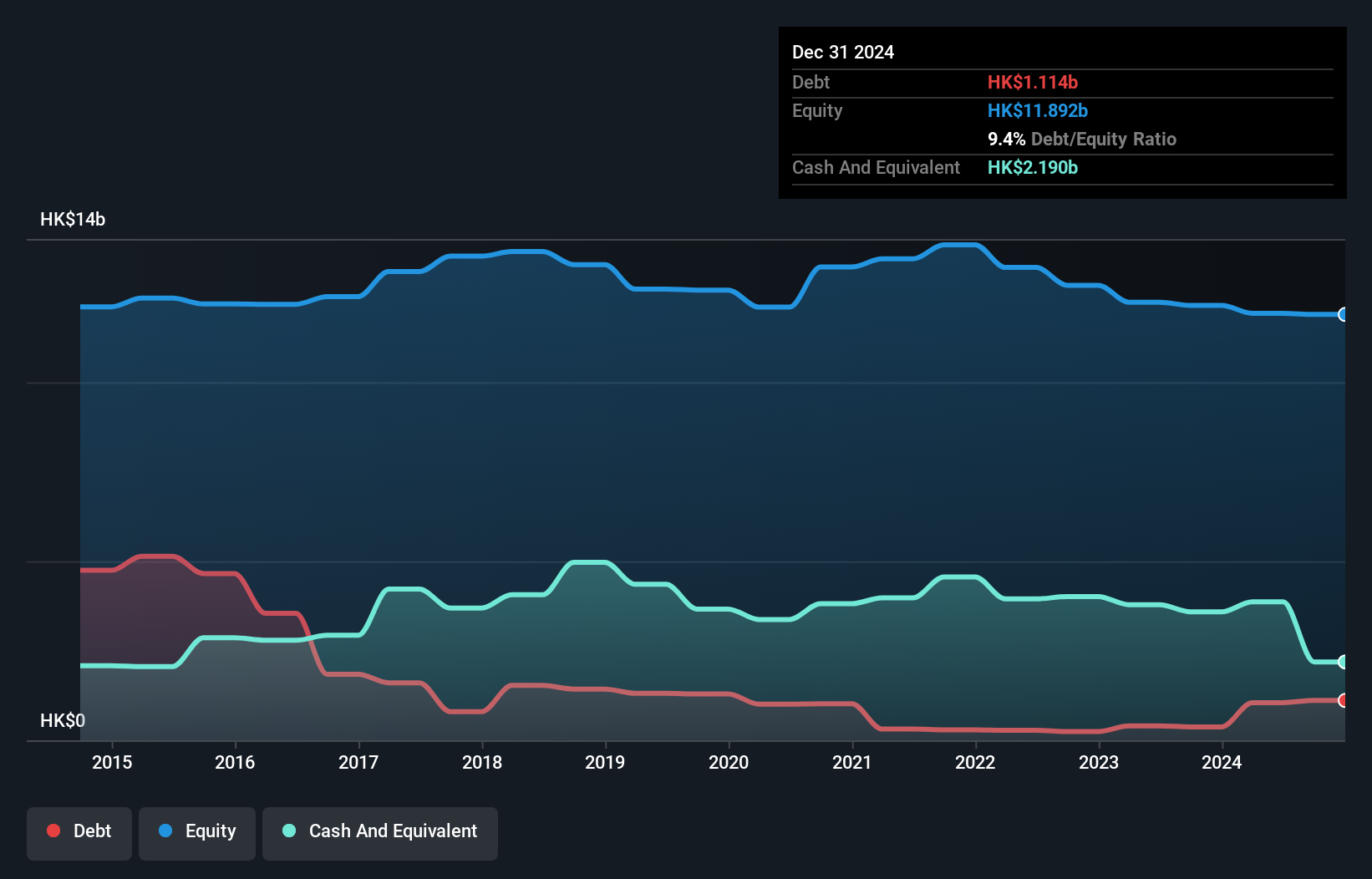

Tomson Group's recent performance has been marked by a mix of highs and lows. The company reported a significant earnings growth of 2337% over the past year, driven largely by a one-off forfeiture of deposit upon terminating an agreement. Despite this, its revenue for the half-year ended June 2024 was HK$129.57 million, down from HK$304.29 million in the previous year. Notably, Tomson Group's debt-to-equity ratio improved from 10.4% to 8.8% over five years, indicating better financial health despite shareholders facing dilution recently.

- Unlock comprehensive insights into our analysis of Tomson Group stock in this health report.

Review our historical performance report to gain insights into Tomson Group's's past performance.

Next Steps

- Reveal the 170 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com