Hong Kong's stock market has been buoyed by the recent U.S. Federal Reserve rate cut, with the Hang Seng Index gaining 5.12% in a holiday-shortened week. This positive sentiment creates an opportune environment to explore lesser-known stocks that could benefit from broader market optimism and favorable economic conditions. In this context, identifying promising stocks involves looking for companies with strong fundamentals, growth potential, and resilience in fluctuating markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, with a market cap of HK$11.89 billion, is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group Limited generates revenue primarily from the extraction and sale of coal products in the People’s Republic of China. The company has a market cap of HK$11.89 billion.

Kinetic Development Group's earnings surged by 39.2% over the past year, outpacing the Oil and Gas industry’s 4.6%. The company repurchased shares in 2024, reflecting confidence in its valuation. Recent half-year results show sales at CNY 2.53 billion, significantly up from CNY 1.49 billion a year earlier, with net income rising to CNY 1.10 billion from CNY 570 million. Additionally, Kinetic declared both interim and special dividends of HKD 0.04 per share each for August and November payments respectively.

Morimatsu International Holdings (SEHK:2155)

Simply Wall St Value Rating: ★★★★★★

Overview: Morimatsu International Holdings Company Limited designs, manufactures, installs, operates, and maintains process equipment and systems primarily for chemical, polymerization, and bio-reactions in China and internationally with a market cap of approximately HK$5.78 billion.

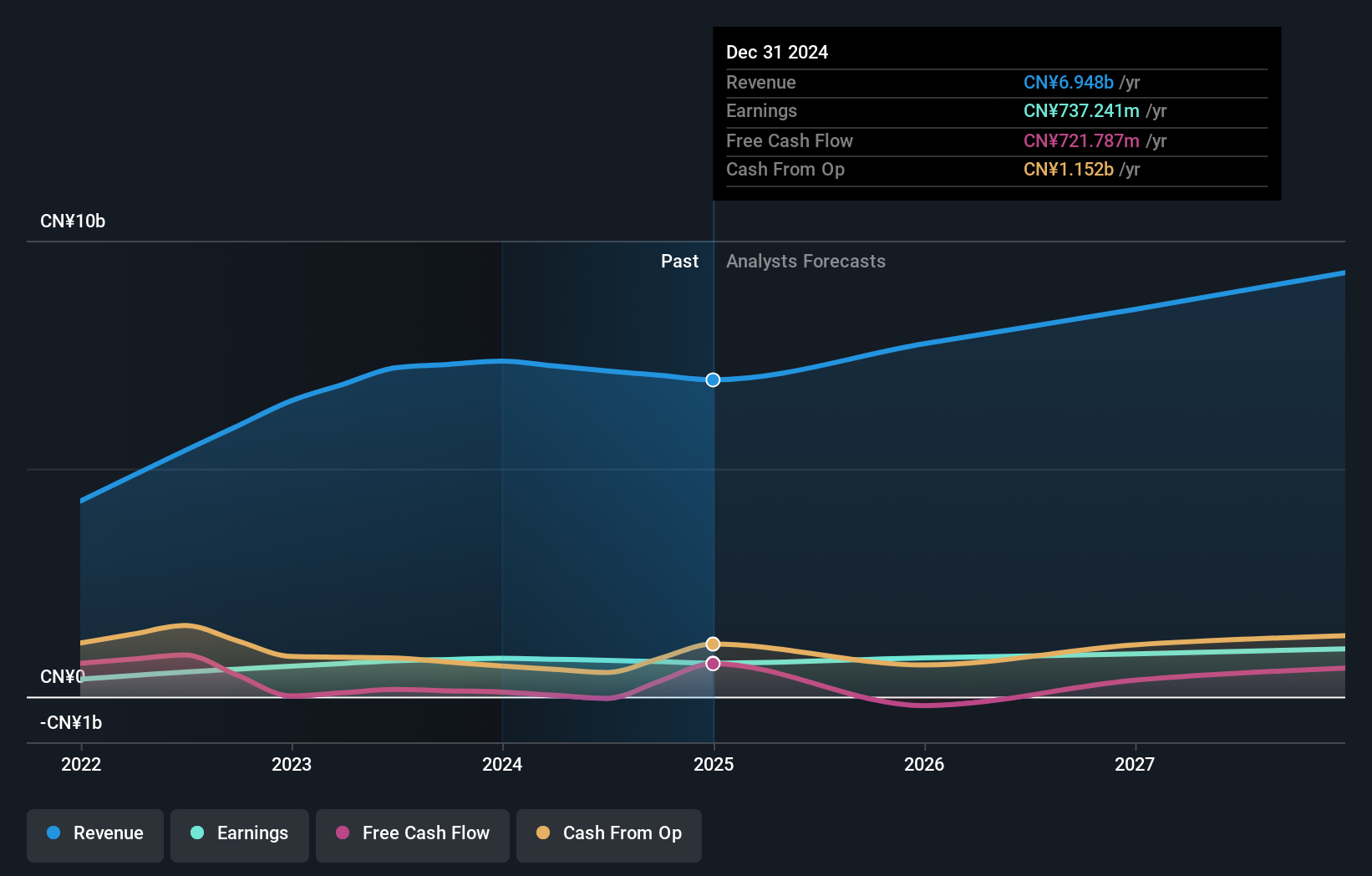

Operations: Morimatsu International Holdings generates revenue primarily from the production and sales of various pressure equipment, amounting to CN¥7.15 billion. The company has a market cap of approximately HK$5.78 billion.

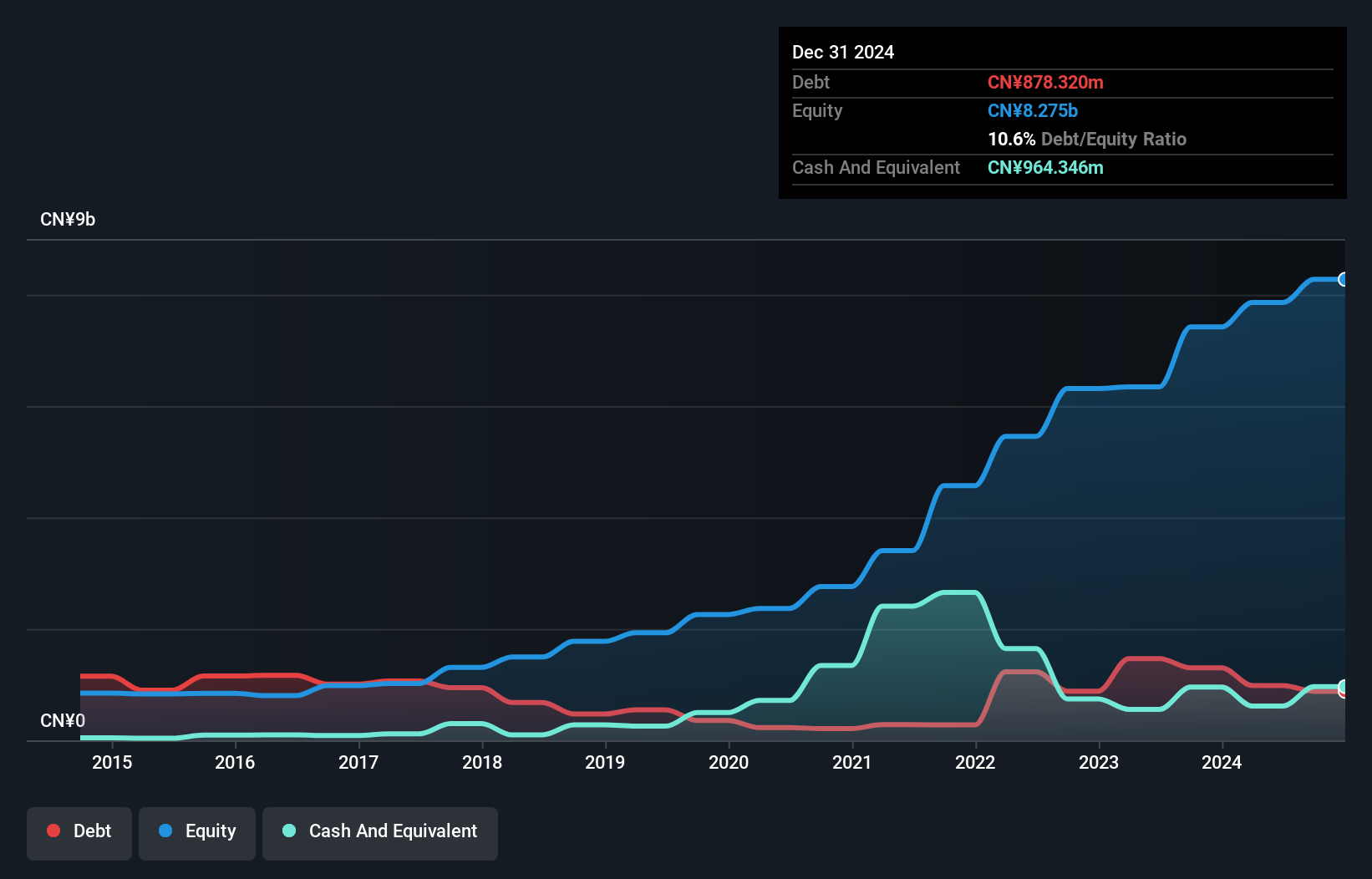

Morimatsu International Holdings has shown robust performance despite recent challenges. Over the past five years, earnings have grown annually by 35.1%, though last year’s growth of 1.2% lagged behind the Machinery industry at 7.2%. The company is trading at a significant discount, estimated to be 66.1% below fair value, and it has more cash than total debt. Recent share repurchases authorized up to 121 million shares aim to enhance net asset value per share and earnings per share.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.94 billion.

Operations: The company's primary revenue stream comes from retail sales through grocery stores, amounting to CN¥5.998 billion.

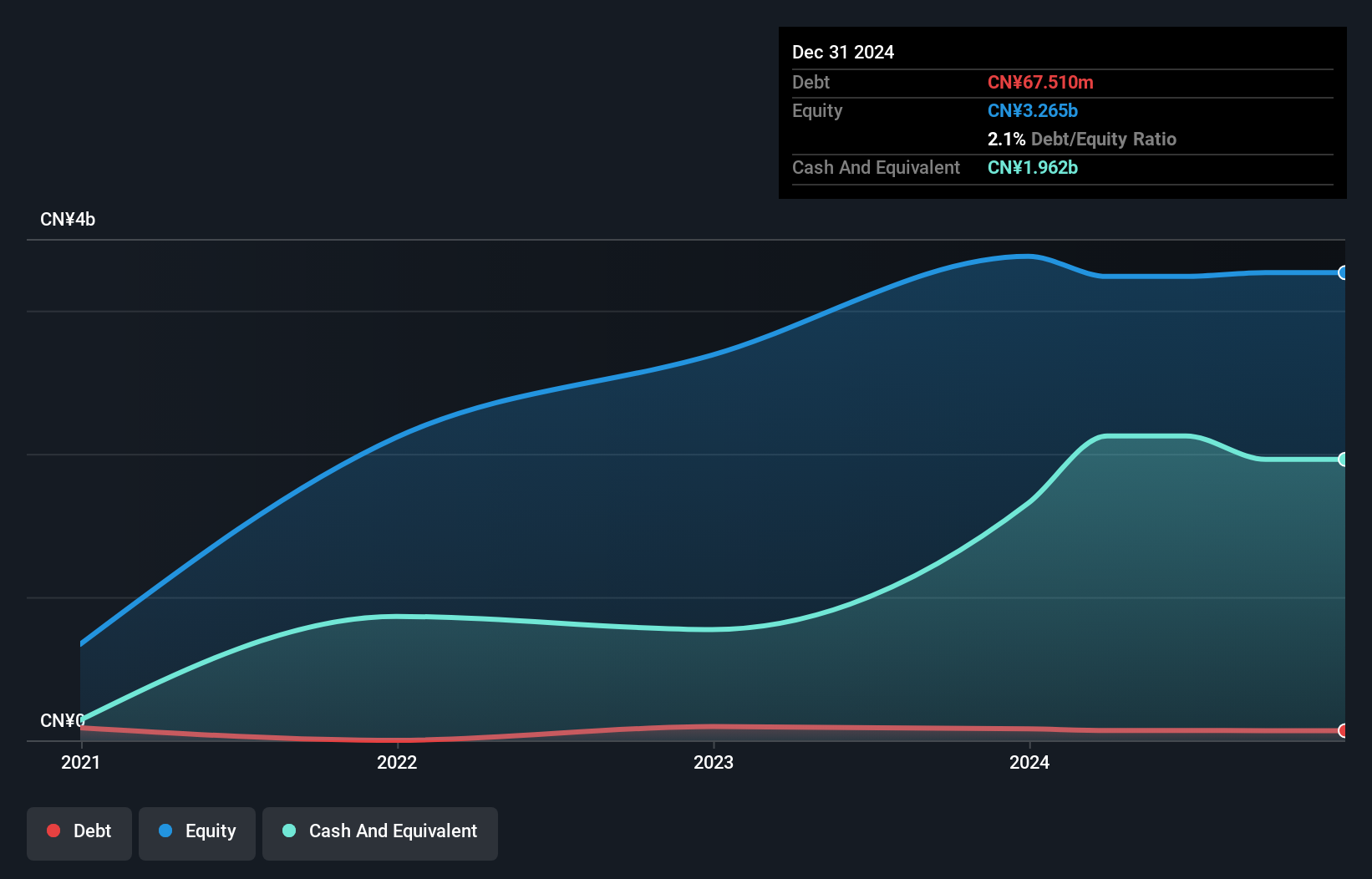

Guoquan Food (Shanghai) has been trading at 62.7% below its estimated fair value, making it an intriguing option for investors. The company reported sales of CNY 2.67 billion for the first half of 2024, down from CNY 2.76 billion a year earlier, with net income also decreasing to CNY 86 million from CNY 108 million. Despite this, Guoquan remains profitable and free cash flow positive at CNY 467.84 million as of June 30, 2024.

Turning Ideas Into Actions

- Take a closer look at our SEHK Undiscovered Gems With Strong Fundamentals list of 172 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com